Monthly Market Updates–August

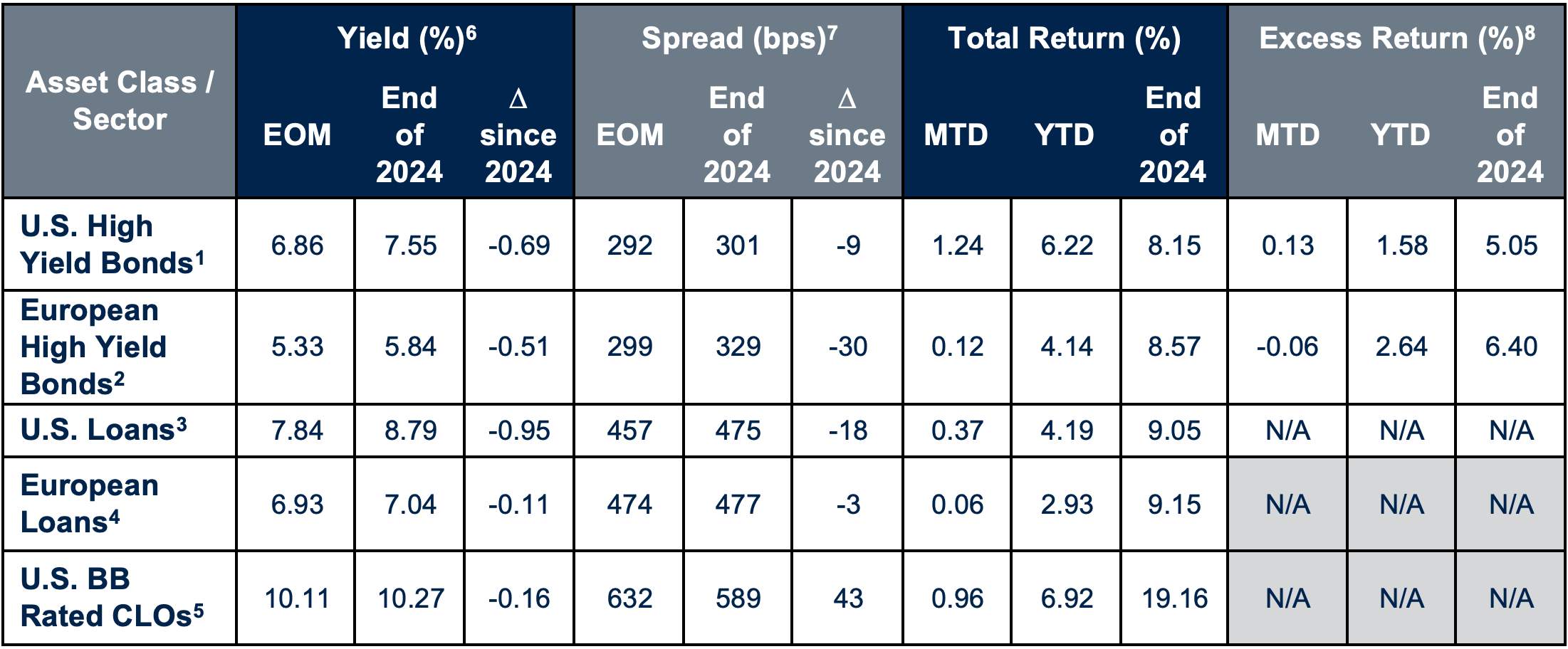

1. ICE BofA U.S. Non-Financial High Yield Index (HCNF).

1. ICE BofA U.S. Non-Financial High Yield Index (HCNF).

2. ICE BofA European Currency Non-Financial High Yield Index (HPID). Hedged to EUR.

3. S&P UBS Leveraged Loan Index.

4. S&P UBS Western European Leveraged Loan Index Non-U.S.D. Hedged to EUR.

5. JPM Post-Crisis CLOIE BB rating.

6. Yield shown is yield-to-worst for high yield bonds and CLOs and 3-year discount yield for loans.

7. Spread shown is option adjusted spread for high yield bonds, 3-year discount margin for loans and discount margin for CLOs.

8. Excess return is the total return minus the return of a duration-matched government security.

Sources: ICE BofA, S&P UBS, J.P. Morgan and Pitchbook LCD.

U.S. High Yield

Overview

- The U.S. high yield bond market generated a positive total return of +1.24% during August, as government bond yields ended the month lower.

- High-yield bonds provided their fifth consecutive monthly gain in August amid a more dovish trajectory for Fed policy in response to softening labor market conditions.

- The average secondary market price increased by 82 basis points to 97.36% of par and the yield-to-worst decreased, standing at 6.86%. The option-adjusted spread tightened marginally by 3 basis points to 292 basis points.

Notable Market Moves

- Performance was positive across rating categories, with triple-Cs outperforming the most (+1.77%), followed by double-Bs (+1.19%) and single-Bs (+1.16%).

- From a sector perspective, returns were positive across the board. The Healthcare sector outperformed the most (+1.66%), followed by Energy (+1.59%), and Telecommunications (+1.58%).

Trends

- Retail funds recorded their fourth consecutive inflow recouping the largest monthly outflow since March 2020. High yield funds saw a net inflow of $1.1 billion in August.

- The market saw a total of $25.7 billion of new deals priced in August, bringing year-to-date total issuance to $207.7 billion. Most of the transactions on a year-to-date basis have been for refinancing purposes.

European High Yield

Overview

- The European high yield bond market delivered modest positive returns during August (+0.12%), with coupon income offsetting wider spreads over the period.

- Option-adjusted spreads ended the month 12 basis points wider at 299 basis points. The yield-to-worst increased, standing at 5.33% and the average bond price decreased to end the month at 98.53% of par.

Notable Market Moves

- Across rating categories, single-Bs outperformed the most (+0.41%), followed by double-Bs (+0.23%), whilst triple-Cs underperformed (-1.66%).

- Returns were mixed from a sector perspective. The Automotive sector outperformed the most (+0.97%), followed by Media (+0.73%) and Real Estate (+0.68%).

Trends

- The market saw a total of €1.4 billion of new deals priced in August, the slowest monthly issuance year-to-date. On a year-to-date basis, new issuance activity increased compared with the year prior, bringing year-to-date total issuance to €80.5 billion. Most of the transactions on a year-to-date basis have been for refinancing purposes.

U.S. Loans

Overview

- The U.S. loan market finished August with a positive total return of +0.37%, with the positive impact from income offsetting a modest decline in trading prices.

- The average secondary market price declined by 24 basis points to end the month at 96.47% of par.

- As the average price decreased, the 3-year discount margin widened by 7 basis points to end the month at 457 basis points.

- The average coupon for the market finished the month at 7.82%, remaining well above the historical average.

Notable Market Moves

- Performance was positive across most industries during the month. The top performing sectors were Housing (+1.32%), Consumer Durables (+0.72%), and Manufacturing (+0.71%).

- Across ratings, higher rated loans outperformed the lower rating categories.

Trends

- CLO new issuance remained strong in August with $19.1 billion of new CLO deals during the month.

- There was a net inflow of $1.5 billion for loan-related retail funds during the month; however, this included an inflow of $1.8 billion for CLO ETFs that was partially offset by modest outflows from loan mutual funds and loan ETFs.

- Loan primary market activity declined in August, as $27.8 billion of new deals priced during the month, with refinancing related transactions accounting for about half of monthly issuance.

European Loans

Overview

- The European loan market finished August with a modestly positive total return of +0.06%, as the positive impact from interest income offset the decline in trading levels.

- The average secondary market price decreased by 45 basis points to finish the month at 96.90% of par.

- As the average price decreased, the 3-year discount margin widened by 11 basis points to finish the month at 474 basis points.

- The average coupon for the market finished the month at 5.83%, remaining above the historical average.

Notable Market Moves

- From a sector perspective, Consumer non-Durables (+0.80%), Consumer Durables (+0.74%), and Media/Telecom (+0.67%) were the top performers. Forest Prod/Containers (-2.02%), Chemicals (-0.73%), and Healthcare (-0.44%) were the worst performing sectors.

- Across ratings, double-B rated loans outperformed the most.

Trends

- CLO new issuance declined in August with €1.7 billion of new CLO deals during the month.

- Loan primary market activity was muted in August as only €0.1 billion of new deals priced during the month.

Structured Credit

Overview

- The U.S. CLO market posted positive returns across the capital stack for the month of August, with sub-ratings group posting the following performance: AAA (+0.46%), AA (+0.50%), A (+0.48%), BBB (+0.74%), BB (+0.96%).

Trends

- Overall primary activity was the highest volume we have seen year-to-date, primarily driven by elevated reset/refi volumes. There was $19.1 billion of new CLO issuance and $34.8 billion of reset/refi activity.

- European primary new CLO issuance was down substantially month-over-month, as is expected for the slower end of summer month. European new issuance came in at €1.7 billion

- Primary spreads tightened in the U.S. and widened slightly in Europe.

25-4797562