Monthly Market Updates–August

EM Local Debt

EM Local Debt

Overview

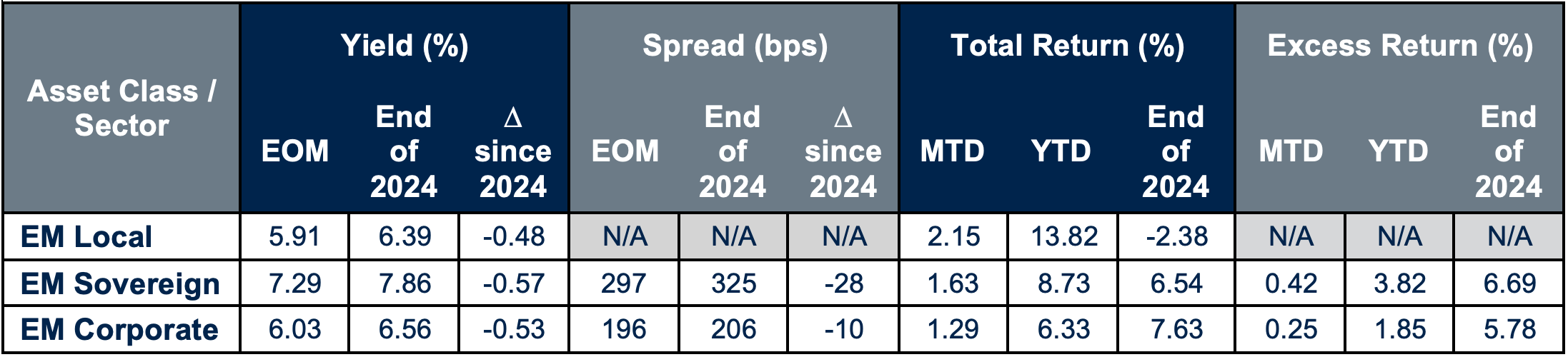

- The Emerging Markets Local Debt Index (J.P. Morgan GBI-EM Global Diversified) returned +2.15% in August.

- Positive returns came from both FX and rates. The dollar resumed the sell-off that has characterized most of 2025 in August, after a brief counter-trend rally in July, providing most of the positive contribution, +1.31%.

- Rates contributed a further +0.84% as yields dropped another -5 basis points, to end the month at 5.91%.

Notable Market Moves

- The best performers in the index over the month were Colombia, Brazil, Hungary, Czech Republic and Mexico. Our strategy is overweight all of this month’s top performers.

- Notable underperformers in the index were India, Dominican Republic, China, Malaysia and Indonesia. Our strategy is underweight all but Indonesia.

Trends

- Flows for Emerging Markets local debt mutual funds were positive for the fourth month in a row, a feat they had not accomplished since 2021, adding an additional $1.5 billion in August. For the first half of 2025, flows stand at positive $6.8 billion.

EM Sovereign Debt

Overview

- The Emerging Markets Sovereign Debt Index (J.P. Morgan EMBI Global Diversified) returned +1.63% in August.

- Both spreads and rates contributed positively to returns with the former delivering the greater part, providing +0.90% as they tightened a further -2 basis points, from 299 to 297.

- Rates tacked on an additional +0.73% as the 10 year treasury yield closed the month at 4.23%, -12 basis points lower than where they ended July and back exactly where they closed Q2.

Notable Market Moves

- High Yield issuers outperformed Investment Grade issuers (1.93% vs 1.34%). High yield has outperformed investment grade year-to-date, +10.26% to +7.15%.

- Once again, the top performers in the index came largely from High Yield issuers at the lower end of the quality spectrum including Venezuela, Lebanon, Ukraine and Bolivia as well as BB-rated Colombia. Collectively the lower rated High Yield names only make up 2.4% of the index, while Colombia is 2.8%. We are void Bolivia and Lebanon, underweight Venezuela and Ukraine and overweight Colombia.

- The largest detractors from the index’s performance during the month include Zambia, Argentina, Ethiopia, Gabon and Iraq. Our strategy is overweight Argentina and Zambia, while void Ethiopia, Gabon and Iraq.

Trends

- Emerging Markets Hard Currency debt had inflows in August of $2.5 billion, the fourth month in a row, a feat they had not accomplished since 2021. For the year, the asset class has still not turned positive as year-to-date net flows are -$0.7 billion, however, momentum appears to be turning.

- Overall sovereign monthly issuance ticked down in August compared to July. However, YoY the asset class is $20 billion ahead of last year’s year-to-date issuance.

EM Corporate Debt

Overview

- The Emerging Markets Corporate Bond Index (J.P. Morgan CEMBI Broad Diversified) returned +1.29% in August.

- Both rates and spreads contributed positively to returns with the former delivering the greater part, providing +0.72% as the 10 year treasury yield closed the month at 4.23%, -12 basis points lower than where they ended July and back exactly where they closed Q2.

- Spreads contributed a further +0.56%, although on net they ended exactly where they closed July, at 196 basis points.

Notable Market Moves

- High Yield issuers slightly outperformed Investment Grade issuers (+1.33% vs +1.22%), building on the marginal year-to-date outperformance by high yield after trailing investment grade through the first half of the year.

- Performance was positive across all sectors with the Transport, Real Estate and Oil & Gas sectors providing the most return.

- The best performing issuers on a country level were from Colombia, Lithuania, Morocco, Iraq and Mongolia.

- Ghana was home to the lone negative performer during the month of August going from first (in July to worst).

Trends

- Monthly issuance for EM Corporates was up substantially vs. its YoY monthly comparator in August, at $24 billion vs. $13 billion in August 2024. Year-to-date issuance has been meaningfully larger YTD vs 2024 at $328 billion compared to $251 billion.

- Emerging Markets Hard Currency debt had inflows in August of $2.5 billion, the fourth month in a row, a feat they had not accomplished since 2021. For the year, the asset class has still not turned positive as year-to-date net flows are -$0.7 billion, however, momentum appears to be turning.

25-4797562