EM Debt: Opportunities in a Riskier World

Emerging market fundamentals remain strong and continue to provide opportunities despite risks in developed markets that raise cautionary flags.

To a large extent, emerging markets (EM) have remained untouched by banking problems that have roiled developed markets. But if U.S. inflation falls more slowly and recession comes sooner and more forcefully than was anticipated a few months ago, emerging markets could feel second-order effects in the form of credit repricing and greater risk aversion.

Sovereign & Local Debt: Recovery Continues but Risks Remain

We believe the outlook remains positive for most EM economies, for a number of reasons. For one, EM economic growth is expected to be at a faster pace than developed markets growth this year—with IMF projections suggesting an almost three percentage point growth differential between developed markets and EMs. Further, we believe the impact of banking stresses in developed markets will have little direct effect on EM countries, as there is little direct contagion impact from the troubled U.S. regional banks to broader EM economies. In addition, following the banking stresses, there is potential for a pause in tightening from developed market central banks, which suggests inflation in developed markets could stay stickier for longer. However, while we remain constructive on the outlook for EMs, the potential for inflation to fall later than expected in developed markets raises the risk that the global interest rate environment could stay “higher-for-longer”.

While this backdrop presents risks, it is also creating a number of opportunities on the sovereign and local debt side. In terms of local debt, with real rates in many EM countries now positive, we see select opportunities emerging. In fact, local markets performed well in U.S. dollar terms in the first quarter, returning 5.1%.1 Investors with existing EM exposure have the potential to generate currency alpha without taking significant market beta risk—especially in a number of Latin American and Asian countries. Brazil looks attractive from a local rates standpoint given that the economy is slowing and inflation is falling, and we also see value in Peru. In addition, concerns around China’s reopening and the impact it could have on commodity prices and exports is creating an opportunity in Asian countries, such as Korea and Malaysia. When it comes to Eastern European countries, however, the opportunity looks less compelling given that inflation in these countries remains quite high.

We are slightly more cautious from a hard currency credit perspective, given that the uncertainties around interest rates and inflation will likely keep the environment for credit volatile. However, we do see select opportunities where growth may surprise to the upside. We continue to focus on countries that have diversified, competitive and well-run economies that can withstand uncertainty and turbulence. In particular, we see value in investment grade sovereigns—where fundamentals remain strong, although growth may be slowing—such as a number of Asian countries. We also like Chile, which has largely avoided the tail risk. In the high yield space, while spreads remain wide relative to historical averages, we see very select opportunities emerging. More specifically, some BBs look potentially attractive. We also see value in Sri Lanka, which is making significant effort to improve its credit metrics.

Corporate Debt: A Nuanced Picture

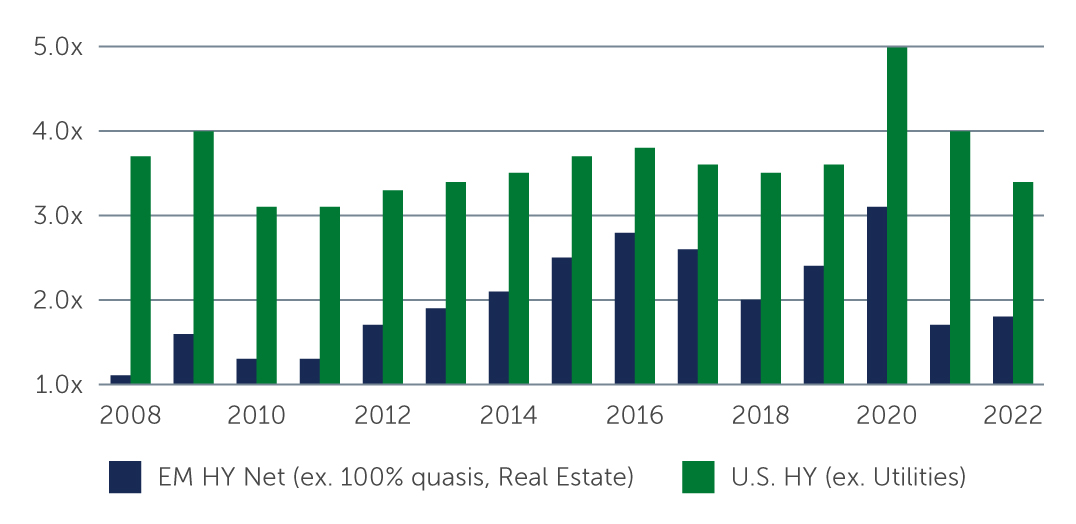

Following the events in the developed market banking sector in March, we are slightly more cautious on the outlook for credit due to the potential for tighter credit conditions in the aftermath, coupled with the first signs of softening in economic growth and the possibility of rates staying elevated for a period. Such a scenario will likely impact credit spreads generically including EM spreads, as the potential decrease in global credit supply and repricing of credit spreads in developed markets could cause some contagion to EM corporates. As a result, while EM corporate balance sheets remain healthy overall (Figure 1), and the growth outlook for EMs remains attractive relative to developed markets, the picture is more nuanced today.

Figure 1: EM vs U.S. High Yield Corporate Net Leverage

Source: J.P. Morgan. As of December 31, 2022.

Source: J.P. Morgan. As of December 31, 2022.

In particular, risks have increased on the lower end of the corporate rating spectrum, especially given the potential that these issuers could be cut off from access to capital in the coming months. In the first quarter, EM corporate issuance reached a lower-than-expected $75.7 billion (of the forecasted $304.2 billion for full-year 2023)—and $61.5 billion of this has been from investment grade issuers as many high yield issuers were unable to access the capital markets.2 So while some domestic capital markets may provide a source of relief to a number of corporate issuers, we remain cautious around the impact of a selective international capital markets on some high yield issuers. As a result, we could see an increase in corporate defaults—albeit we don’t expect to see a spike, with the default rate expectation for EM corporates at around 2% for 2023 (excluding Russia, Ukraine and Chinese real estate).3

In light of the banking stresses, it’s also worth noting how EM banking models differ from those in developed markets. Most EM countries have only a handful of champion banks which are considered D-SIBs, the majority of which tend to be fully or partially government owned. Governments also keep significant deposits at the banks, and other depositors tend to be widespread across the wider local economy. These EM banks tend to be more traditional commercial banks engaging in very broad, conventional commercial banking activities such as residential mortgages, issuing credit cards and making loans that are not specialized by industry. Therefore, the likelihood of seeing a deposit run on a niche bank like we observed for SVB or a Credit Suisse-like failure is low. Overall, the majority of EM banks are also stringently regulated and well-capitalized with capital levels well in excess of their Basel III requirements.

On the positive side, we do see bright spots across the corporate space. Within the investment grade segment, spreads have tightened notably, but we see value in some idiosyncratic opportunities in BBB credits. The high yield segment looks less attractive from a risk-reward perspective, but in our view, there are some very select opportunities in BBs. Across the market, sectors in India and in the Gulf Cooperation Council (GCC) states look interesting for corporates that are well-positioned to benefit from the economic growth, infrastructure projects and/or green transition themes taking place in those countries. In Latin America, corporates in Mexico continue to look attractive due to the broad impact of nearshoring, which over time will have a cascading effect through several sectors and is likely to continue for the foreseeable future. That said, we continue to believe staying up in quality makes sense—now more than ever.

Key Takeaway

Going forward, we are relatively optimistic about the role of rates and currencies as positive drivers of performance in the EM debt space. From a credit standpoint, we remain cautious given the potential for tighter global credit conditions and higher costs of funding. We continue to emphasize close attention to credit risk through rigorous issuer and country selection, especially in a volatile and uncertain global macro environment. We believe that managers focused on those drivers are best positioned to uncover opportunities and deliver superior results.

1. Source: J.P. Morgan. As of March 31, 2023.

2. Source: J.P. Morgan. As of March 31, 2023.

3. Source: J.P. Morgan. As of March 31, 2023.

23-2846935