Decommissioning Barings’ Hartford Office

In the first in the series looking at how we lead by example in our operational sustainability, Anita Benton, Barings’ U.S. Head of Corporate Properties, speaks about how we saved 46 tons of material from landfill in the sustainable decommission of our Hartford office.

Tell us about the Hartford office decommission:

We decided to relocate our Hartford office at the end of our lease in 2022 and were responsible for disposing of approximately 24,000 square feet of very outdated furniture. Luckily, through negotiations with the landlord, we were able to leave the external office and conference furniture for a future tenant—that left 90 workstations and task chairs, 78 storage and file cabinets, and numerous miscellaneous items and ancillary furniture that needed to be removed. And on a deadline.

Why did you decide to do this so sustainably?

In line with our overarching sustainability goals, I’m always looking to find innovative ways to reduce our impact on the environment and our societies through our operations.

Through our global furniture partner, Teknion, I found out about two other organizations: Divert, who help clients achieve their goal of zero waste, and Green Standards, who partner with organizations on sustainable office decommissions.

As we’re looking to achieve net zero in our global operations, I jumped at the chance to work with them to contribute to our firm-wide sustainability ambitions.

What was the process, and what happened?

To begin the project, we assessed the site, then had a walk-through with Divert. We created a complete inventory of items to be removed, as well as a list of “specialty projects”. These included services that must be provided by a certified vendor, such as removing power and cabling from furniture before dismantling.

Divert recommended we partner with Green Standards for the project. A formal proposal was prepared and accepted, and work began.

Furniture including tables, chairs and filing cabinets were disposed of in the decommission of Barings’ Hartford office

Furniture including tables, chairs and filing cabinets were disposed of in the decommission of Barings’ Hartford office

What was the highlight of the project for you?

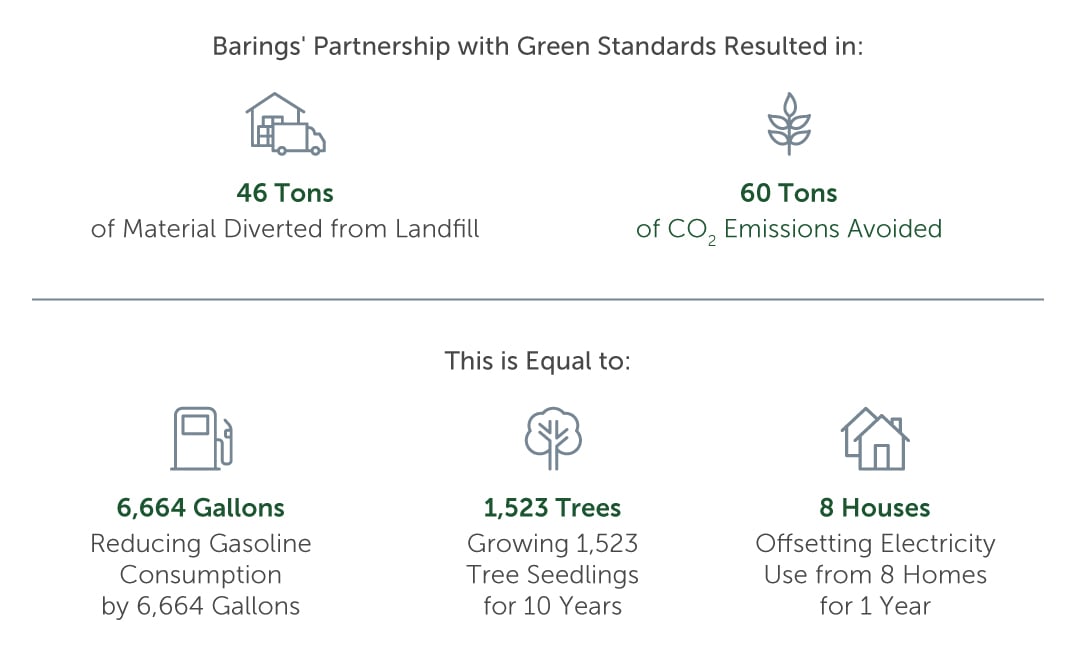

The highlight of the partnership with Green Standards was that 100% (46 tons) of the items removed were diverted from landfill, with 90% recycled and 10% donated. This led to:

- 60 tons of CO2 emissions avoided.

- 90% of materials recycled.

- $9,340 worth of furniture donations made to support three local charities.

How important is it that some of the furniture was sent to local charities?

10% of the furniture was donated to good causes. Knowing that it wasn’t just needlessly sent to landfill, but that it is breathing new life into local community organizations, is a very rewarding feeling.

Non-profit organization Auxil Tech Foundation were one of the beneficiaries of Barings furniture, including filing cabinets, tables and chairs.

Non-profit organization Auxil Tech Foundation were one of the beneficiaries of Barings furniture, including filing cabinets, tables and chairs.

How does it make you feel to have driven such an impactful project?

I am very proud to have introduced Divert and Green Standards to Barings, and to have played my part in moving us one step closer to our net zero goals. I always strive and push for innovative thinking in all my projects – for example, in the decommission of our Boston office, we diverted over 12 tons from landfill after leaving furniture for the new subtenant.

I’m excited that we identified a partner with a highly successful and trackable process to help us move one step closer to our sustainability aims.