High Yield: Keep Calm & “Carry” On

High yield bonds and loans continue to offer attractive income in a world where uncertainty remains a constant—and in today’s highly uncertain environment, a balanced approach that looks across fixed and floating-rate assets can help mitigate volatility while preserving upside potential.

The global economic landscape remains in flux as investors navigate a complex mix of resilient data, policy uncertainty, and geopolitical tension. In the U.S., recession probabilities have receded but not disappeared. While hard data—such as employment and consumption—has held up, soft indicators continue to flash caution. Inflation remains sticky in places, and the full impact of recently introduced tariffs has yet to be felt. Meanwhile, the Federal Reserve appears content to remain on hold, awaiting further clarity before adjusting policy. In Europe, the macro picture has shown relative improvement. Economic data has surprised to the upside, and the European Central Bank has already begun its easing cycle. This divergence in policy has supported flows into European credit markets, where investors are increasingly viewing the region as a more stable alternative to the U.S.

Despite the uncertain backdrop, risk assets have rallied since the April selloff. Equity markets have largely looked through geopolitical shocks and policy risks, while credit spreads have compressed meaningfully. In high yield, both bonds and loans have retraced much of the widening seen earlier in the year, with spreads now sitting through pre-volatility levels. This tightening reflects strong investor demand and ample liquidity, but it also leaves less room for error. Looking ahead, while the market appears to be pricing in a soft landing and eventual rate cuts, the path forward is unlikely to be linear. For high yield investors, this calls for a measured approach—one that balances the appeal of elevated yields with the reality of tighter valuations and latent risks.

Resilient Fundamentals

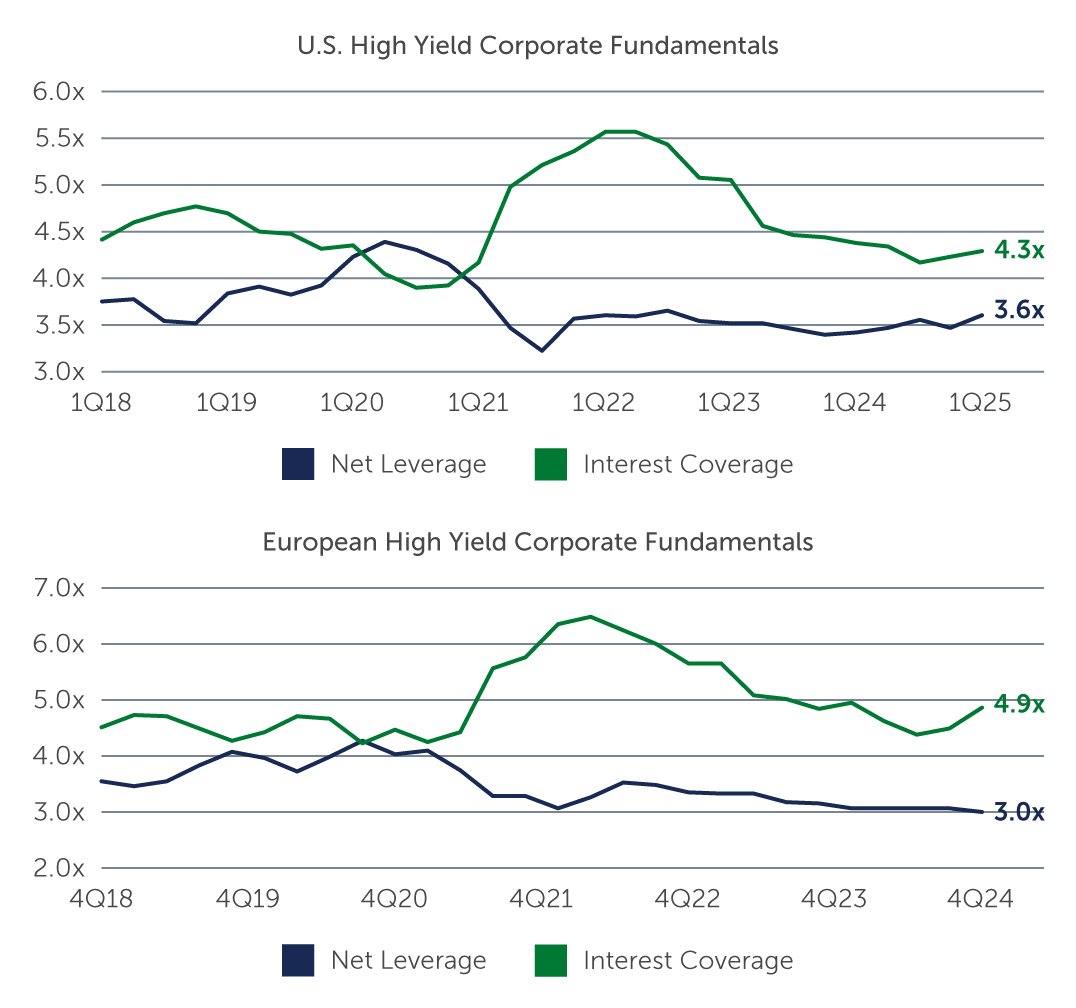

Corporate fundamentals in the high yield market remain broadly stable, with first-quarter earnings generally meeting expectations. While the initial impact of tariffs appears less severe than feared, uncertainty around their longer-term effects continues to cloud visibility. Companies are beginning to reassess capital expenditure plans, and signs of demand softening are emerging, particularly in sectors sensitive to consumer and geopolitical trends. Issuers, for their part, have largely maintained discipline, with leverage and interest coverage metrics holding steady (Figure 1). However, the risk of downward revisions in earnings guidance during the upcoming second-quarter season could expose vulnerabilities, especially in more cyclical sectors. The automotive industry, for example, has seen notable volatility tied to tariff developments.

Figure 1: High Yield Fundamentals Remain Supportive

Source: CreditSights. As of March 31, 2025.

Source: CreditSights. As of March 31, 2025.

Given the resilient fundamental backdrop, defaults remain contained, with no signs of a broad-based acceleration. In fact, the outlook for loan defaults appears to be improving, and bond defaults remain well below historical averages. That said, while the market is not pricing in a significant uptick in distress, the potential for downside surprises reinforces the need for selectivity.

Robust Technicals

The technical backdrop for high yield is robust. In Europe, investor demand has surged, driven by both dedicated inflows and increased allocations from global managers. This has coincided with a sharp rise in issuance, with recent weeks setting records for new supply. Despite the volume, demand has kept pace, preventing oversupply and supporting pricing. With regard to loans specifically, the CLO market continues to be a powerful force behind demand in both the U.S. and Europe. Managers are actively building portfolios, and the pipeline for new CLOs remains strong. Issuers are responding, with a pickup in new deals, particularly in higher-quality segments. However, M&A activity remains subdued, limiting the diversity of issuance and keeping the market reliant on refinancing and opportunistic transactions.

Importantly, while technicals are supportive, they are not indiscriminate. Riskier deals—particularly those with weaker credit profiles—are facing more scrutiny and, in some cases, trading below par. There is a clear preference for quality, and the market is rewarding discipline.

Opportunities in Focus

In today’s environment, the most compelling opportunities in high yield generally lie in areas that offer a balance of income, resilience, and liquidity. With yields elevated across both bonds and loans, investors are being compensated for staying higher in quality—without needing to stretch for risk.

Loans: Floating-Rate Income with Structural Strength

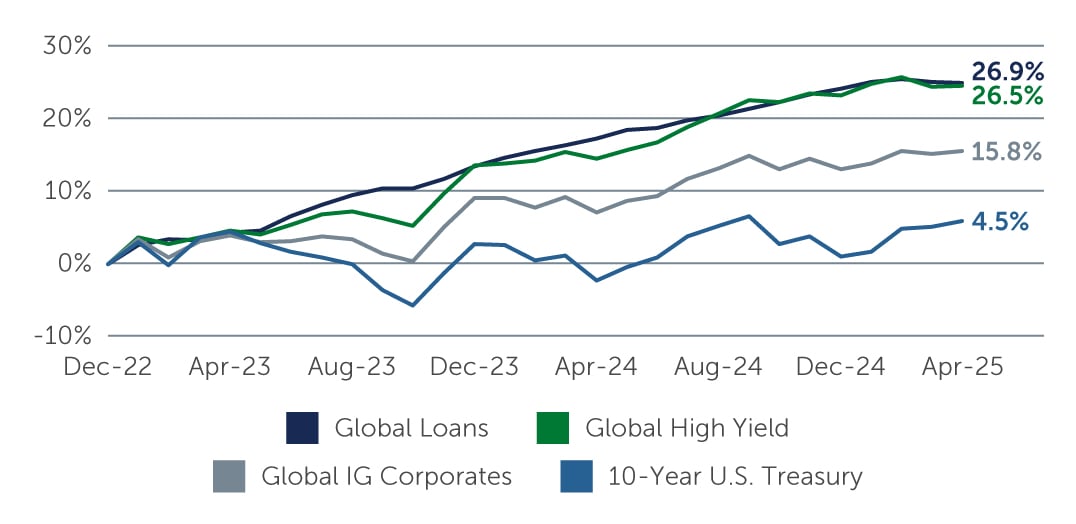

The case for loans lies largely in the asset class’s floating-rate nature and senior secured status, potentially attractive characteristics in a market still grappling with policy uncertainty and geopolitical risk. Elevated income continues to provide ample support for performance, which should help offset potential decreases in central banks' short-term rates—particularly given that rate cuts, at least in the U.S., will likely be measured. And notably, unlike other fixed income asset classes, the majority of the return on loans comes from contractual income that is being paid today rather than awaiting price recovery, which has resulted in a steadier return profile over time (Figure 2). All of this is to say—for investors seeking income with downside protection, loans offer a compelling proposition, particularly in portfolios where rate sensitivity is a concern.

Figure 2: Loans: Income Continues to Support Compelling Total Return Potential

Source: S&P; ICE BofA; J.P. Morgan; Bloomberg. As of May 30, 2025. Returns shown on hedged to USD basis. Cumulative return from January 1, 2023. Past Performance is not indicative of future results.

Source: S&P; ICE BofA; J.P. Morgan; Bloomberg. As of May 30, 2025. Returns shown on hedged to USD basis. Cumulative return from January 1, 2023. Past Performance is not indicative of future results.

Bonds: Low Duration, Downside Protection

High yield bonds also continue to present an attractive risk-reward profile, particularly higher-rated BB credits. With duration at historically low levels (less than three years), and coupons resetting higher through refinancing activity, the asset class is positioned to offer meaningful income with limited interest rate exposure.1 Select opportunities also remain in refinancing-driven new issues, where issuers are offering attractive terms to lock in capital. However, caution is warranted in the lower-rated credits, such as single-B and CCC, where investor appetite remains more selective and price discovery is less forgiving.

More broadly, while high yield bonds are often perceived as a riskier segment of the fixed income market, today’s environment tells a more nuanced story. With short duration, elevated yields, and a backdrop of low distress, the asset class currently offers a compelling downside profile. For 12-month forward returns to turn negative, spreads would need to widen materially—an unlikely scenario given historical norms. A yield-to-worst over duration calculation illustrates this point: spreads for global high yield bonds, where a significant majority of credits are rated BB and B, would need to reach approximately 550 bps, a level rarely seen outside of periods of acute stress.2

In other words, while spreads remain tight and valuations look somewhat stretched, the combination of attractive income, limited rate sensitivity, and resilient fundamentals suggests that risks are reasonably balanced against the opportunity.

What’s Next?

High yield bonds and loans continue to offer attractive income in a world where uncertainty remains a constant. While fundamentals are holding steady and technicals are broadly supportive, current spread levels suggest there is less margin for error. The outlook is constructive but cautious, with risks ranging from earnings disappointments to geopolitical flare-ups and policy missteps. In this environment, we believe the most compelling opportunities lie in higher-quality segments of the market, where investors can earn meaningful yield without taking on excessive risk. A balanced approach—across fixed and floating-rate assets, and across geographies—may also offer benefits, as it can help mitigate volatility while preserving upside potential and maintaining flexibility to respond to evolving conditions.

As the second half of the year unfolds, active management will be critical. Navigating a market shaped by shifting macro conditions and evolving credit dynamics requires a disciplined, quality-focused approach—and one that can capture the benefits of high yield while also managing the complexities ahead.

1. Source: Barings; ICE BofA Developed Markets Non-Financial High Yield Constrained Index. As of May 31, 2025.

2. Source: Barings; Bloomberg. As of May 31, 2025. Past performance is not necessarily indicative of future results.