Three Reasons Why the Fixed Income Environment May Be Better Than You Think

While there are a number of risks creating volatility and unease across the market, there are also reasons to believe that today’s fixed income markets offer a range of compelling opportunities.

Recession worries, inflation and tighter credit conditions are impacting fixed income investors, stoking fears of wider credit spreads and an imminent wave of defaults. While the volatility and general unease cannot be dismissed, investors in public debt markets may benefit from taking a step back and assessing the overall level of risk-reward on offer. In our view, and despite the prevailing negativity, investors are likely to find that fixed income currently offers a range of compelling opportunities. Here are three reasons why that is the case:

1. The Long-Anticipated Downturn

Starting in late 2021 as inflationary pressures mounted and major central banks’ rate hiking cycles subsequently began, consensus has seen a recession as imminent. While certain countries such as Germany have technically already entered a recession, other major economies such as the U.S. may not follow until later in 2023 or early 2024—arguably making it one of the most widely anticipated downturns in recent history. That has given companies considerable time to prepare and there is little sense of foreboding among corporate management, who are managing costs closely and keeping inventory levels low. Many companies have also reduced leverage levels and proactively increased the maturity profile of their debt. For example, U.S. high yield companies’ net leverage declined to 3.4x at the end of last year, from 3.7x a year ago, while interest coverage ratios increased to 5.9x from 4.8x during the same period.1

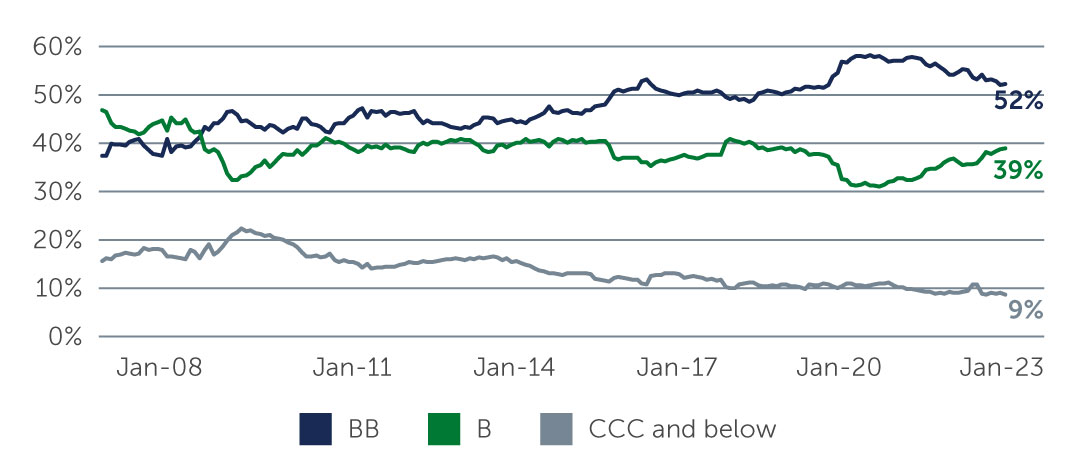

As a result, any earnings decline that occurs as growth slows is likely to be orderly, while default rates could be lower than in previous downturns. Indeed, high yield issuers are in a stronger financial position to ride out a challenging period than they were pre-pandemic, while the credit quality of the global high yield bond market has also improved considerably since the global financial crisis—BB issuers now comprise 52% of developed markets high yield, while single-B companies make up 39% (Figure 1).

Figure 1: A Higher-Quality Market

Source: Bank of America. As of March 31, 2023.

Source: Bank of America. As of March 31, 2023.

While a recession will undoubtedly trigger some decline in credit quality, unemployment remains at record low levels and hundreds of thousands of jobs remain unfilled. If consumers stay employed, strong demand could continue in many sectors of the economy—which suggests that a downturn may be less severe than some forecasters expect.

2. Dislocations Create Opportunities

While the recent spate of banking problems is more a result of declining market values for high-quality bank assets than of lax lending standards, banks will undoubtedly move more cautiously going forward by making credit less available and more expensive. This is causing concern among public fixed income investors because a lower propensity by banks to lend could trigger liquidity problems for borrowers in public markets. But those fears may be overblown.

Perhaps counterintuitively, an environment where credit is less available could work in favor of investors in credit markets—both public and private. Opportunities to finance healthy companies that would otherwise have tapped banks are likely to increase and with the supply/demand dynamics moving in favor of lenders, investors can expect to earn not only attractive yields but do so with added structural protections. In essence, providing capital when capital is scarce can be an attractive source of returns for investors willing to take smart credit risk—even into a downturn.

3. Yields Offer a Considerable “Margin of Safety”

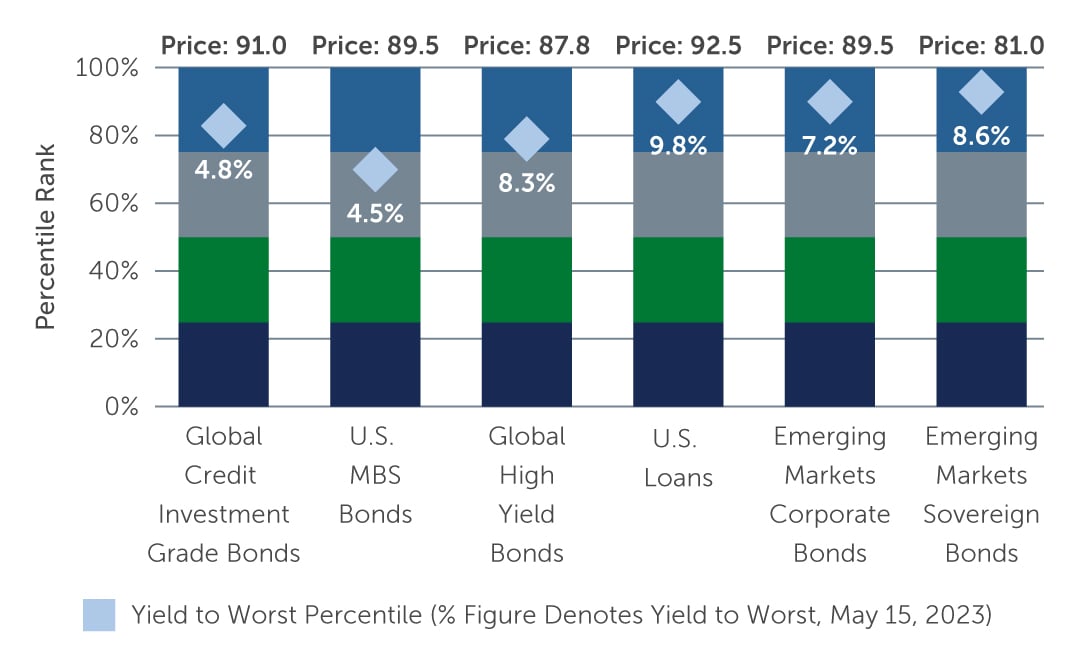

While we acknowledge that uncertainty will persist and volatility is likely to remain high, a lot is already reflected in the price. Outside the depths of the pandemic, yields across most fixed income assets are at levels not seen since the global financial crisis and at which investors have historically generated attractive total returns (Figure 2). Trying to precisely time the right entry and exit points is extremely difficult, but fixed income offers the potential for higher and more dependable absolute returns than many other asset classes.

Figure 2: Yields Across Most Fixed Income Asset Classes Are in the 80th-90th Percentile Vs. the Last 20 Years

Source: Bank of America Merrill Lynch, Credit Suisse, Bloomberg, J.P. Morgan. As of May 15, 2023. ICE BofA Non-Financial Developed Markets High Yield Constrained Index (HNDC), Credit Suisse Leveraged Loan Index, Bloomberg Global Aggregate Credit Total Return Index, Bloomberg US MBS Fixed Rate Total Return Index, JP Morgan CEMBI Broad Diversified Index and JP Morgan EMBI Global Diversified Index. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

Source: Bank of America Merrill Lynch, Credit Suisse, Bloomberg, J.P. Morgan. As of May 15, 2023. ICE BofA Non-Financial Developed Markets High Yield Constrained Index (HNDC), Credit Suisse Leveraged Loan Index, Bloomberg Global Aggregate Credit Total Return Index, Bloomberg US MBS Fixed Rate Total Return Index, JP Morgan CEMBI Broad Diversified Index and JP Morgan EMBI Global Diversified Index. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

At Barings, we advocate for patient investing and diversification in helping our clients solve for challenges ranging from income generation to liability matching. Fortunately, there are more choices today than ever before to help achieve this—from corporate and sovereign bonds (both high yield and investment grade) across developed and emerging markets, to floating-rate loans, collateralized loan obligations (CLOs) and various flavors of asset-backed securities. Indeed, the investment universe is broad and deep.

In managing fixed income portfolios through the ups and downs of many past economic cycles, our team has found that markets generally overreact both to the upside and downside. For savvy investors, intent on finding both absolute and relative value through deep credit analysis, environments like the one we face today can therefore offer some of the best long-term opportunities for total returns.

1. Source: J.P. Morgan. As of December 31, 2022.