The Still-Compelling Opportunity in U.S./Mexico Border Industrial Markets

Despite the looming headwinds that could impact global trade, there are still reasons for optimism on the outlook for U.S./Mexico trade—which suggests the opportunity in border port industrial markets remains attractive.

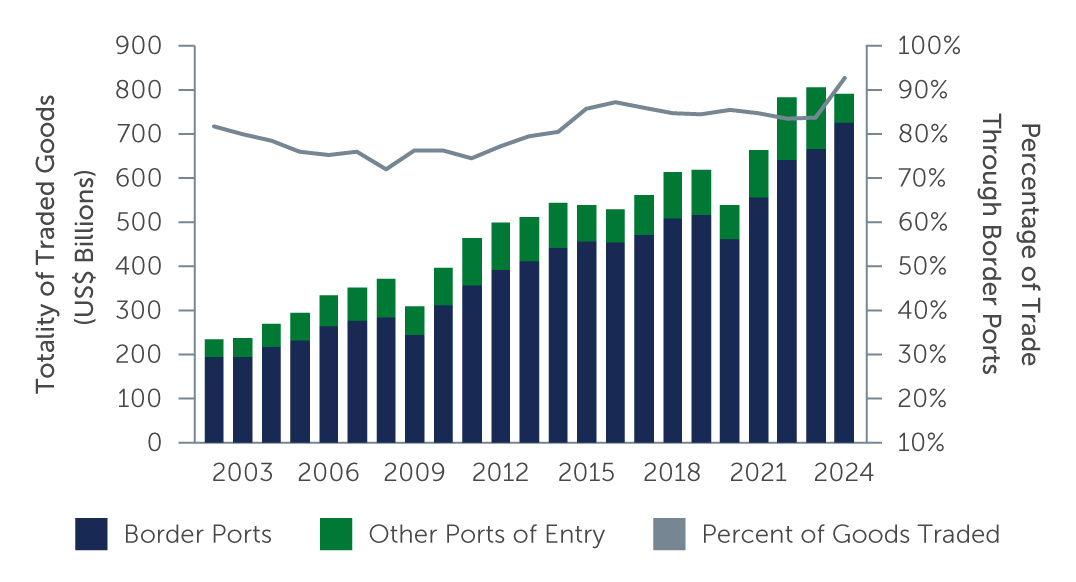

The combined value of goods traded between the U.S. and Mexico reached $794 billion in 2024 (Figure 1). This is nearly 2.5 times more than the value of aggregate goods traded between the two countries in 2002. And in 2019, Mexico surpassed both Canada and China in terms of goods imported, becoming the largest U.S. trade partner.

Figure 1: Aggregate Value of Goods Traded Through U.S./Mexico Land Ports

Sources: Bureau of Economic Analysis; Census Bureau. As of October 2024. Data for 2024 is annualized based upon figures through October 2024.

Sources: Bureau of Economic Analysis; Census Bureau. As of October 2024. Data for 2024 is annualized based upon figures through October 2024.

Even as protectionist rhetoric between the two nations has ramped up since the November 2024 elections, we believe Mexico’s status as the largest and most important trading partner to the U.S. is unlikely to change given the mutually beneficial relationship. With the return of President Donald Trump to the White House and his vociferous endorsement of tariffs to correct the perceived injustices created through global trade, investors and businesses are becoming increasingly concerned that the Administration will tip the scales toward self-inflicted and self-defeating economic wounds.

The concept of “reshoring” is an extension of this same logic. Reshoring, also known as on-shoring or near-shoring, references the (re)location of manufacturing and production activities to a firm’s country of domicile. Trump’s first presidency resulted in increased reshoring investment and activity that continues to the present. In practice, reshoring can take on different manifestations. As it concerns U.S. industry, currency, wages, power, and business costs make the prospect of fully repatriating manufacturing operations for domestic firms cost-prohibitive over the near term, while aging demographics create long-term headwinds. In many instances, firms have moved higher value-add segments of their supply chains back to the U.S. while keeping or moving other segments to foreign countries like Vietnam, Malaysia, China, Canada, and Mexico. Trump has explicitly targeted these half-measures.