International Equities: A Strengthening Investment Case

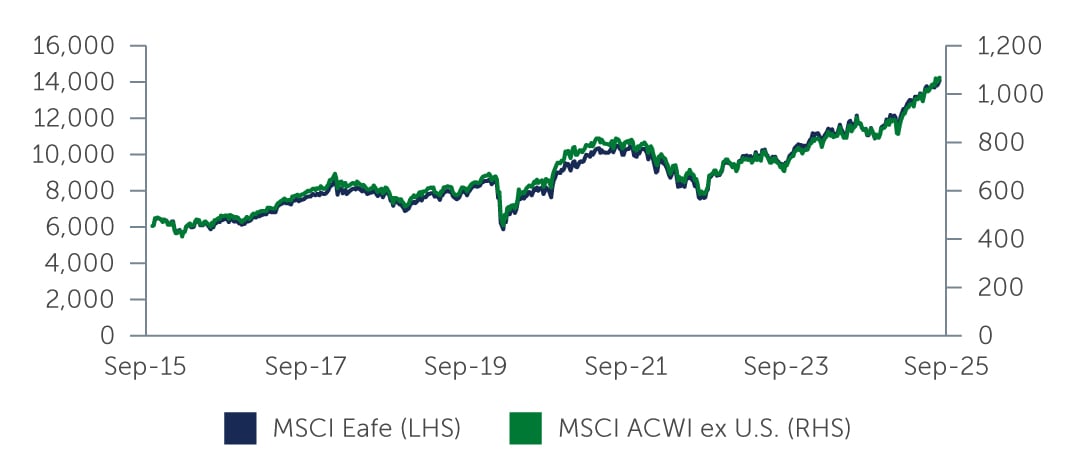

International equity markets have hit all-time highs over the past 18 months, benefiting from a number of positive developments. While they have shared some of the same tailwinds as U.S. equities, international markets are increasingly supported by distinct, structural drivers—offering both sustained upside potential and meaningful diversification benefits.

Figure 1: International Equity Performance

Source Bloomberg. As of October 2025.

Source Bloomberg. As of October 2025.

Europe: A New Fiscal Era

At the heart of Europe’s resurgence is a dramatic shift in German fiscal policy. Long known for its fiscal conservatism, Germany is now embracing expansionary spending—driven by rising infrastructure investment needs, sluggish growth, and political change. Friedrich Merz’s Christian Democratic Union of Germany and Christian Social Union in Bavaria alliance emerged from the February election with a clear mandate to pursue increased public investment.

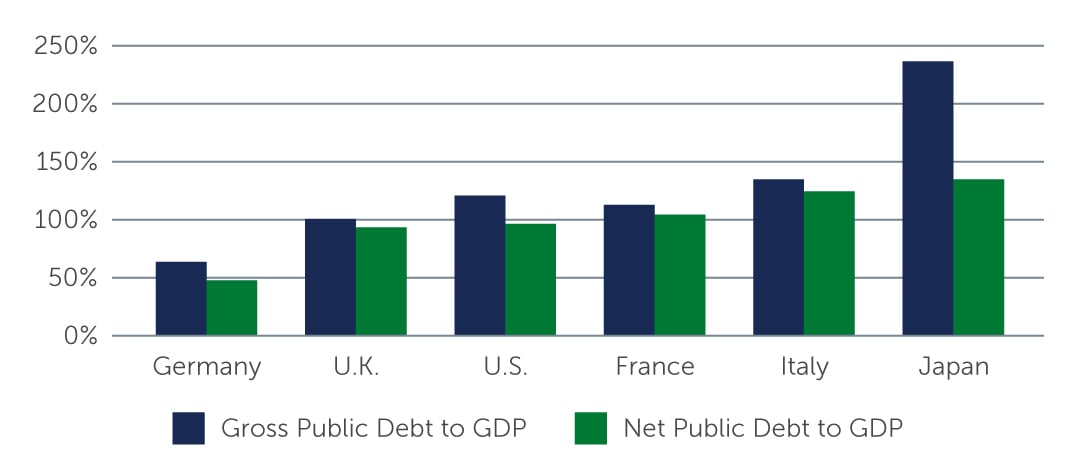

Figure 2: Government Debt as a Percentage of GDP

Source: IMF. As of December 2024.

Source: IMF. As of December 2024.

Germany’s long-standing “fiscal brake” (limiting the structural deficit borrowing to 0.35% of GDP) was effectively abandoned with the launch of a €500 B infrastructure fund in March. This move is expected to boost earnings across many sectors, both directly and through broader economic stimulus.

THREE KEY ACCELERATORS ARE AMPLIFYING THIS SHIFT

- Private Investment Surge: Companies like Siemens are advancing joint investment plans that could collectively rival government infrastructure spending, amplifying the impact of public initiatives.

- The E.U. Recovery & Resilience Fund is a €723 B financial instrument set up to help E.U. member states recover from Covid, with 60% of the fund yet to be spent.

- Defense Spending Boom: One clear outcome of the Russia-Ukraine conflict has been Europe’s renewed commitment to taking greater responsibility for its own defense. Many European nations have acknowledged that large parts of their defense infrastructure are no longer fit for purpose and are raising defense budgets to 2.5–3.5% of GDP. This shift has provided significant support to defense-related stocks and is expected to have a positive impact on the wider economy with associated gains for a broad range of companies.

25-4930989