Infrastructure CLOs: 101

Infrastructure CLOs are reshaping how institutional investors access essential, income-generating assets—offering a scalable, risk-adjusted entry point into the infrastructure debt market.

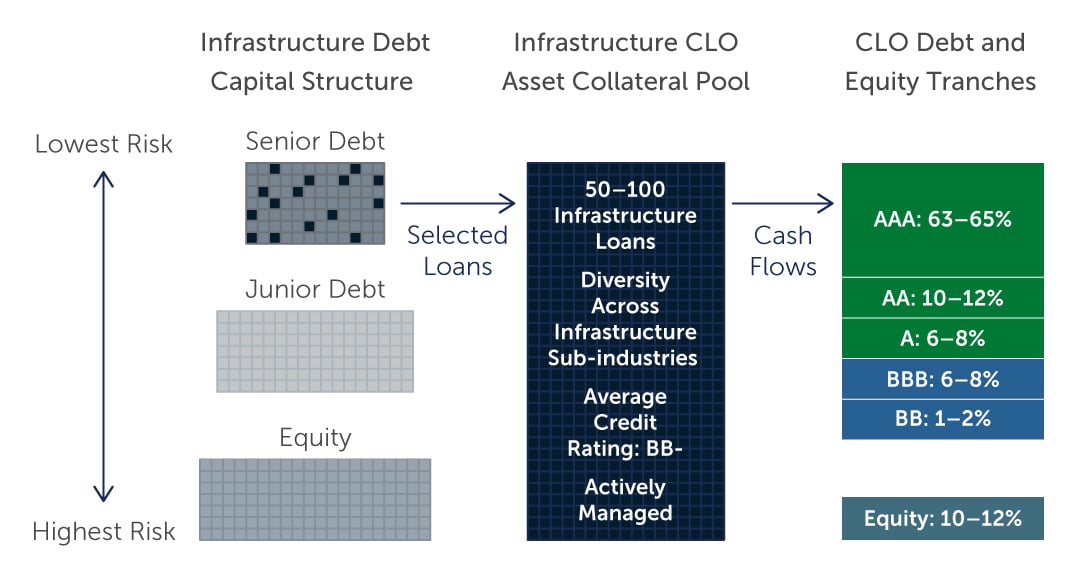

An infrastructure collateralized loan obligation (CLO) is a securitized investment vehicle that pools together a diversified portfolio of infrastructure loans. The underlying loans are typically senior secured in nature and often used to finance assets like renewable energy projects, digital infrastructure, and transportation systems. Portfolios are tranched, or layered, into varying levels of risk and return, offering investors access to infrastructure debt through a familiar and scalable structure: the CLO.

Infrastructure CLOs vs. BSL CLOs

While CLOs have traditionally been backed by diversified pools of broadly syndicated corporate loans (BSLs), the same structuring technology is increasingly being applied to other asset classes—including infrastructure debt. The core mechanics remain consistent:

- Senior tranches sit at the top of the payment waterfall and receive priority, offering the lowest risk/return profile

- Equity tranches provide leveraged exposure and the highest return potential, but also bear first-loss risk

- Self-healing mechanisms redirect cash flows to senior tranches if a portfolio begins to show signs of stress

- Active management during reinvestment periods allows managers to dynamically shape the portfolio

Figure 1: Typical Infrastructure CLO

Source: Barings.

Source: Barings.