Global Equity and Fixed Income Market Outlook

Learn how Barings sees global equity and fixed income markets in 2025.

Constructive on Global Markets, Selection Is Key

Continuous normalization of the global economy has led to a commencement of an interest rate-cutting cycle by most major central banks in 2024. However, the pace of rate cuts is expected to be slower than previously anticipated in the U.S. due to the strong resilience seen in the U.S. economy, while other economies, namely Europe, China, and most emerging markets, are opting to continue rate cuts to stimulate growth in 2025. There is also a structural shift toward multi-polarization of the global economy, as major trade blocs are reviewing strategic priorities on the back of potential disruptions to global trade and world order. With these structural considerations in mind, the team is optimistic about the prospects of global equity and bond markets while adopting a bottom-up approach within each asset class to identify potential strong performers and beneficiaries of these structural themes.

Equity Market Outlook

Major market trends in the last quarter of 2024 reversed in January 2025. Looking ahead, we could continue to see volatility in global equity markets given ongoing risk factors such as growth uncertainties, geopolitical tension, monetary policy expectations, and fiscal management. Despite areas of weakness, corporate earnings have proven resilient, allowing many equity markets to appreciate even under the assumption that there could be no rerating outside of the U.S. market.

Resilience in U.S. economic and corporate fundamentals has led to a rich valuation in U.S. equities, which could lead to vulnerabilities if the U.S. Federal Reserve interest rate is expected to remain higher-for-longer on the back of strong macro data. On the other hand, possible European Central Bank rate cuts and a potential resolution of the conflict in Ukraine are supporting a positive rerating in European equities. Within emerging markets, many central banks have begun cutting interest rates to support growth in their local markets, as elevated U.S. interest rates begin to weigh on domestic activities. China’s policy pivot since late 2024 combined with the recent rise of DeepSeek has revived investor interest and led to positive rerating of Chinese equities, but a sustained rally may require continuous support from fiscal policy and validated by a recovery in fundamentals. Elsewhere, Southeast Asia is well-positioned to be a net beneficiary of the global rebalancing of supply chains with its demographic advantage, combined with tariff-related uncertainties on China.

Policy speculation, particularly given the easing of monetary policy, will remain a hot topic in many regions. With most central banks claiming to be ‘data dependent’, we will likely see further sentiment swings, with our belief that inflation will prove more volatile rather than simply directional in coming years. Fiscal policy also remains an element of support in several areas, but potentially limited by the relative size of individual economies’ public debt.

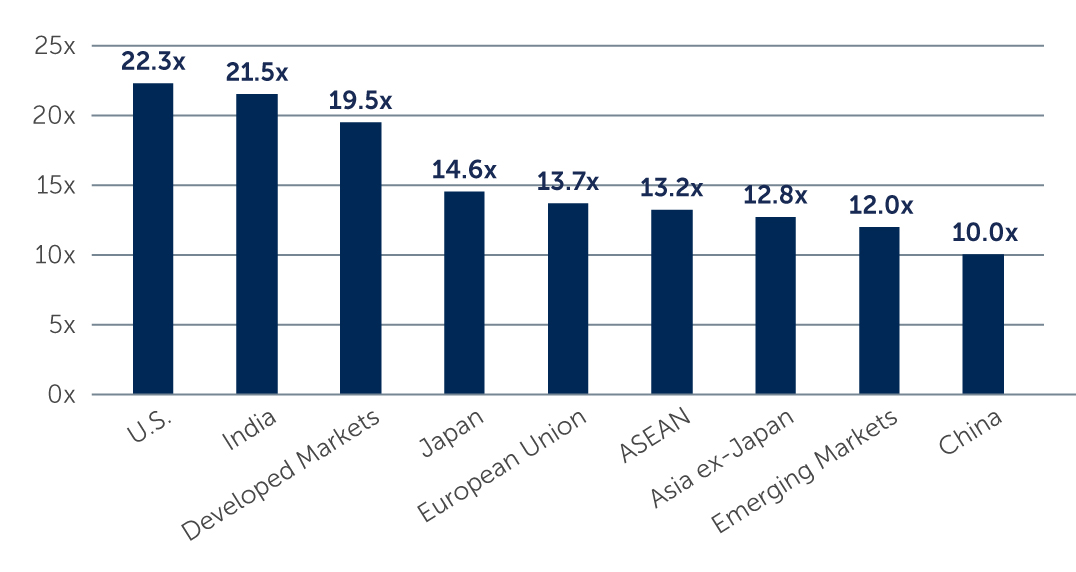

Valuations in international equities continue to look relatively attractive to us. With most major markets trading at a meaningful discount to the U.S., we continue to find inefficiencies in the market with respect to the valuations and earnings outlooks for similar companies—and we believe this is presenting potentially compelling opportunities. We are seeing a world that is increasingly multi-polar, and therefore domestically oriented companies may be stronger beneficiaries of unique, localized opportunities in a fragmented outlook. As a result, we are largely neutral on U.S. equities but are cautiously optimistic for other major markets as we expect to see ongoing earnings progress rewarded given the low starting level of valuations in many markets.

Figure 1: Comparison of Forward P/E Multiples Across Major Equity Markets

Source: Refinitiv, MSCI, Barings. As of January 31, 2025. USA: MSCI USA Index; India: MSCI India Index; Developed Markets: MSCI World Index; Japan: MSCI Japan Index; European Union: MSCI EMU (European Economic and Monetary Union) Index; ASEAN: MSCI AC ASEAN Index; Asia ex-Japan: MSCI AC Asia ex-Japan Index; Emerging Markets: MSCI Emerging Markets Index; China: MSCI China Index.

Source: Refinitiv, MSCI, Barings. As of January 31, 2025. USA: MSCI USA Index; India: MSCI India Index; Developed Markets: MSCI World Index; Japan: MSCI Japan Index; European Union: MSCI EMU (European Economic and Monetary Union) Index; ASEAN: MSCI AC ASEAN Index; Asia ex-Japan: MSCI AC Asia ex-Japan Index; Emerging Markets: MSCI Emerging Markets Index; China: MSCI China Index.

Bond Market Outlook

Bond markets continue to offer elevated yield levels (a proxy for forward looking return expectations) relative to longer-term historical averages. Bond markets have also historically provided strong diversification benefits during periods of elevated equity drawdowns. The one main exception here was in 2022, when the fastest pace of U.S. rate hikes in over 40 years meant that both equity and bond markets sold off simultaneously. We believe the market conditions are very different today, with interest rates and bond yields starting at a much higher level (which provides central banks room to cut should economic conditions worsen), and with inflation much closer toward central bank targets. This should make for a stronger case for an allocation to bonds within a diversified portfolio today.

Over the past several months, interest rate volatility has remained highly elevated given the uncertainty surrounding geopolitical developments, inflation trends, and most recently with the outcome of the U.S. presidential elections in November 2024 and the new administration’s subsequent policy initiatives. Conversely, credit spread levels (which are a measure of the risk inherent in lending to corporates over risk-free debt) have remained very stable, with a general theme toward spread compression, i.e. lower-quality rated issuers outperforming higher-quality issuers. The overall economy, particularly in the U.S., has also remained very resilient, with higher wages and strong consumption continuing to support growth.

Further, while some recent inflation prints have proven to be sticky and remain above central bank targets, we have come a long way since the near double-digit peak in inflation rates observed in mid-2022. As a result, most central banks globally were able to embark on rate cuts in 2024, with the U.S. Federal Reserve cutting rates by 1% in H2 2024. Lower interest rates should ease the cost of financing for corporates and households, against a macroeconomic backdrop of a soft landing outcome, which remains our base case. From a historical perspective, this may resemble periods such as the mid-1990s, whereby shallow interest rate cuts alongside resilient overall growth dynamics presented a favorable market backdrop for the high yield asset class.

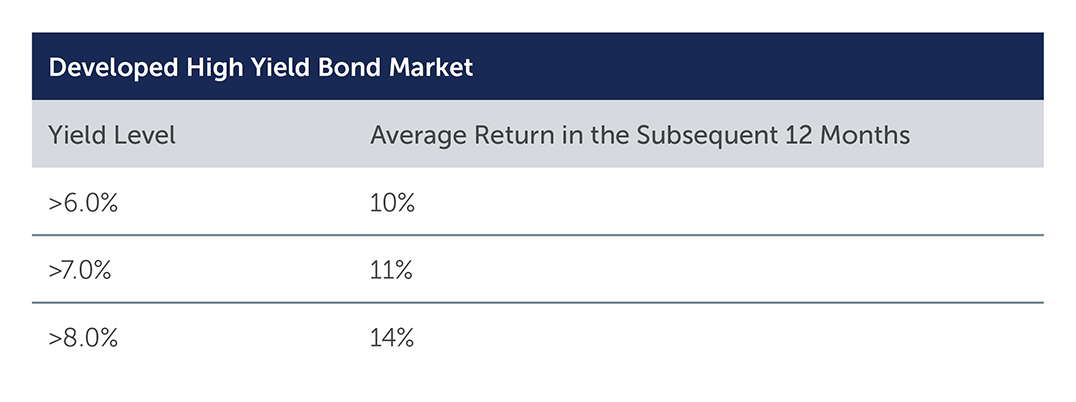

As of February 2025, future rate cut expectations remain relatively muted, with financial market expectations of only 0.44% of further rate cuts by the U.S. in 2025.1 In this type of higher-for-longer rate environment, we should expect coupon levels on bond investments to continue to increase, as maturing low coupon bonds are refinanced into higher coupon investments. Indeed, average coupon levels across the high yield and investment grade corporate bond markets are currently at around eight year highs. Higher overall starting yield and income levels should provide a cushion to forward looking return outcomes, as illustrated by the table below. For some context, over the past 20 years, yields at current market levels have only delivered negative forward 12-month returns during the 2008 global financial crisis period, when we observed a severe economic contraction.

Source: Bloomberg, ICE BAML. Data based on the ICE BAML Developed Markets High Yield Index (HYDC). As of December 31, 2024, based on monthly observations.

Source: Bloomberg, ICE BAML. Data based on the ICE BAML Developed Markets High Yield Index (HYDC). As of December 31, 2024, based on monthly observations.

Summary

In summary, the team is taking a balanced view set within the global developed and emerging equity markets, and sees opportunities for considerable income across credit markets. However, given the potential for a more uncertain macroeconomic scenario to unfold, the team believes that a bottom-up approach to investing is crucial to identifying stocks and issuers that can both withstand the challenges ahead but that also present attractive upside potential.

1. Source: Bloomberg, Fed Fund Futures. As of February 24, 2025.

25-4272791