Global High Yield Capabilities

Barings Global High Yield Bond Fund

Income Potential Unfolded

CAPTURING ATTRACTIVE GLOBAL INCOME OPPORTUNITIES

![]()

Overall MORNINGSTAR RATINGTM1

1. Overall Morningstar Rating as of August 31, 2022 (EAA OE Global High Yield Bond). For the Tranche F USD Acc only, other share tranches may have different performance characteristics.

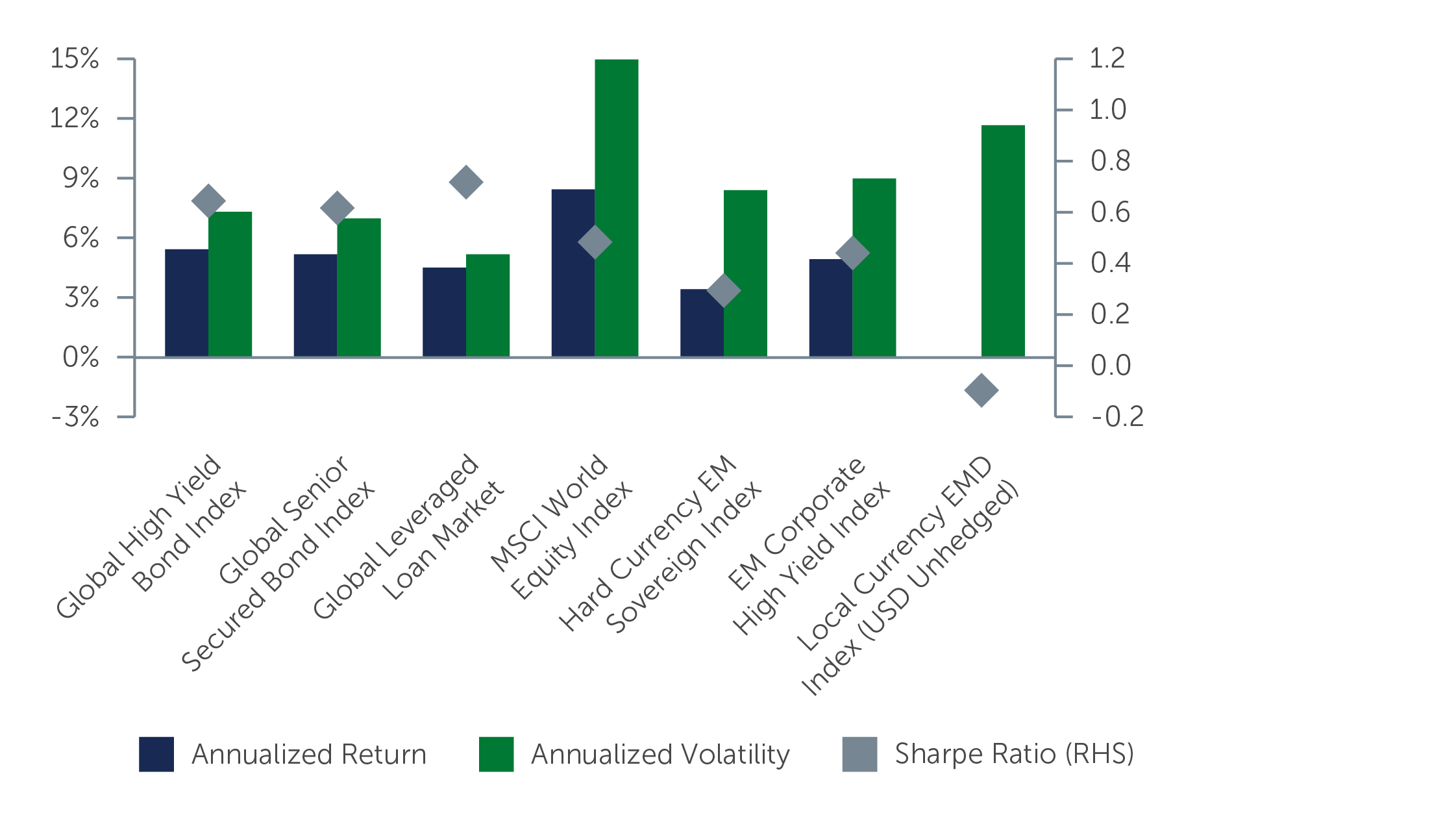

A Compelling Long-term Investment Opportunity

Attractive income potential, lower sensitivity to changes in interest rates, and a large opportunity set are reasons to consider a strategic asset allocation to high yield bonds.

Source: ICE BofA Non-Financial Developed Markets High Yield Constrained Index (USD Hedged), ICE BofA BB-B Global High Yield Secured Bond Index (USD Hedged), JPM CEMBI BD Non-Investment Grade Index, JPM EMBI GD Index, JPM GBI-EM GD Index (USD Unhedged), MSCI World Equity Index, CS Leveraged Loan Index, CS Western European Leveraged Loan Index (USD Hedged). As of July 31, 2022.

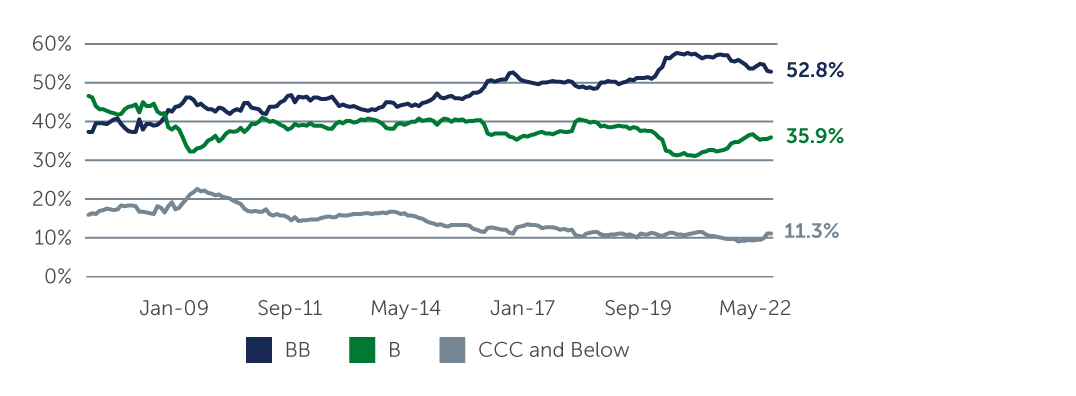

Improved Credit Quality Profile

The high yield bond market is higher-quality relative to history, and the opportunity set is made up of a number of large and well-established businesses, including potential rising stars.* (*Rising stars are companies that are upgraded from high yield to investment grade.)

Source: ICE BofA Non-Financial Developed Markets High Yield Constrained Index (HNDC). As of July 31, 2022.

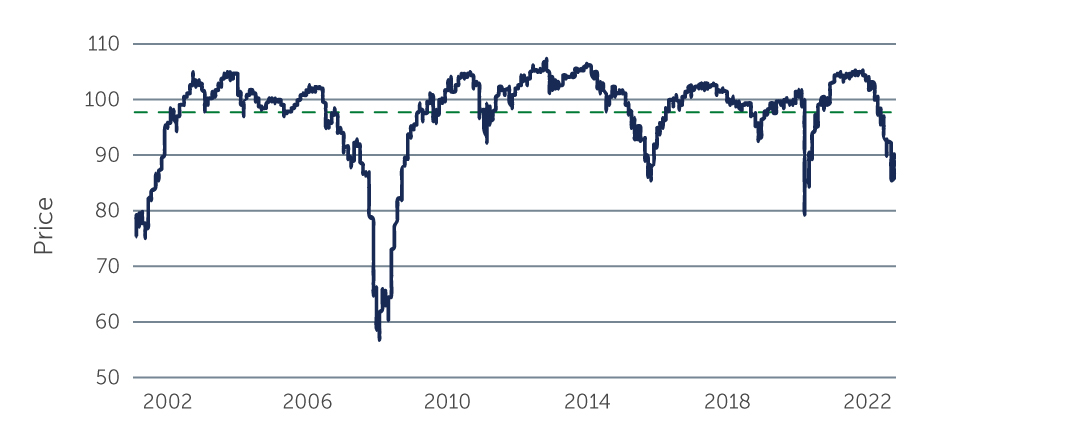

Discounted Prices Offer Potential for Capital Appreciation

Given that high yield bonds are currently trading at a significant price discount, there is strong upside potential—however, security selection is key to capitalizing on opportunities and avoiding additional downside.

Sources: Barings and ICE BofA. Global high yield bond market represented by the ICE BofA Non-Financial Developed Markets High Yield Constrained Index (USD Hedged) (HNDC). As of July 31, 2022.

Note: Effective June 30, 2022, the ICE Fixed Income Index reflects transaction costs. As a result, existing index level total return, price return and excess return fields have been adjusted to reflect the new methodology. All return information prior to June 30, 2022 has not been adjusted.

A Flourishing Income Opportunity

Explore the Global Senior Secure Bonds Strategy that Barings offers