Global High Yield Capabilities

Barings Global Senior Secured Bond Fund*

*The Barings Global Senior Secured Bond Fund principally invests in sub-investment grade and/or unrated debt securities. The Fund’s investment in senior secured debt securities does not guarantee repayment of the principal of investments by the investors

A FLOURISHING INCOME OPPORTUNITY

THINK DIFFERENTLY ABOUT HIGH YIELD

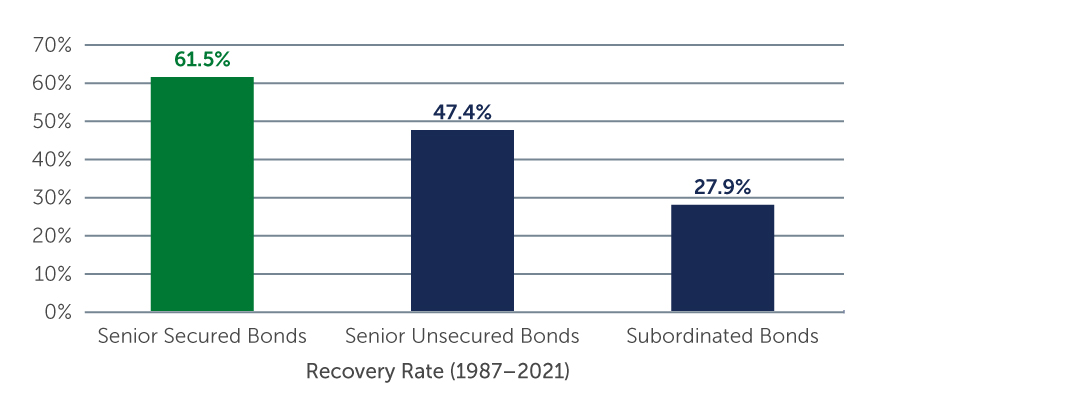

Higher Recovery Rates

Given their seniority in the capital structure, senior secured bonds offer greater potential for capital preservation relative to junior debt and equity.

Source: Moody’s global average corporate debt recovery rates. As of 8 February 2022.

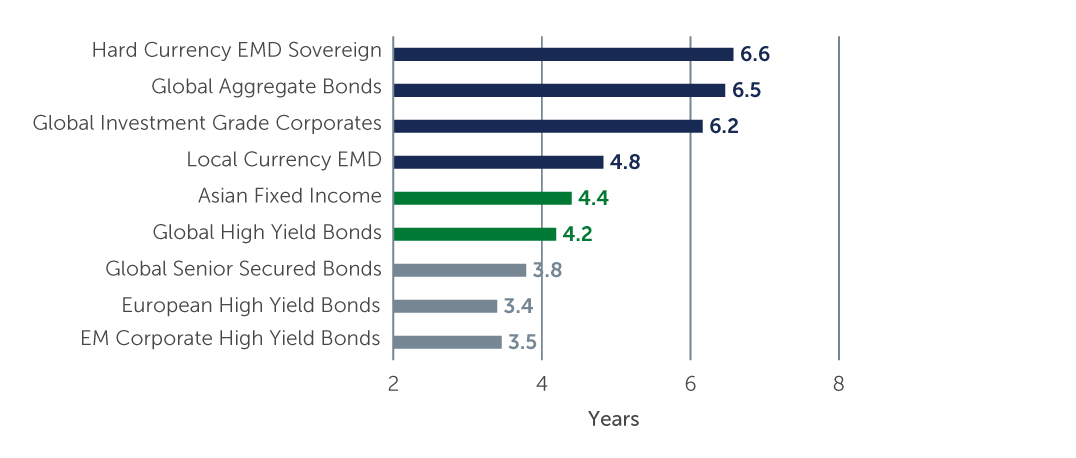

Lower Sensitivity to Changes in Rates

Compared to most other fixed income markets, senior secured bonds have relatively low sensitivity to changes in rates—a compelling feature in a rising-rate environment.

Source: JPM JACI Index, JPM GABI Index, JPM CEMBI BD Non-Investment Grade Index, JPM EMBI GD Index, JPM GBI-EM GD Index, ICE BofA Non-Financial Developed Markets High Yield Constrained Index, ICE BofA BB-B Global High Yield Secured Bond Index, ICE BofA Global Corporate Index. As of July 31, 2022.

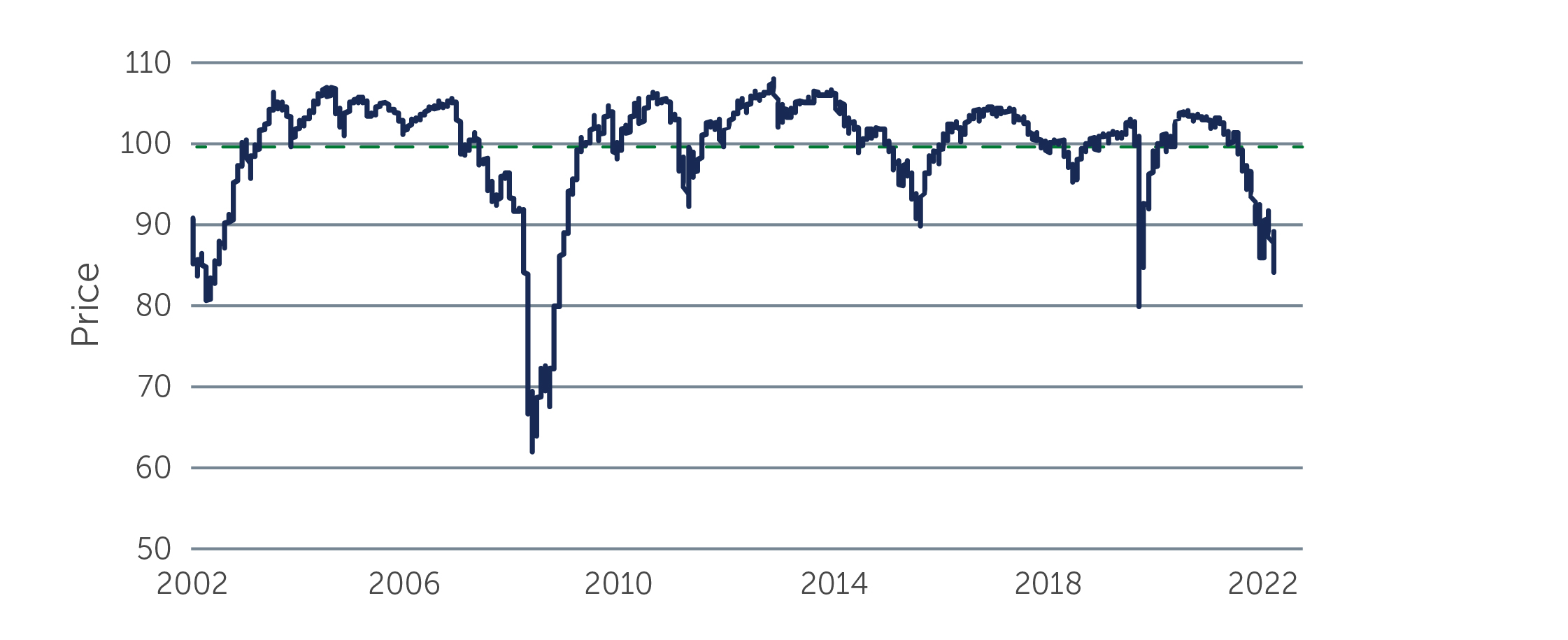

Discounted Prices Offer Potential for Capital Appreciation

Given that senior secured bonds are currently trading at a significant price discount, there is strong upside potential—however, security selection is key to capitalizing on opportunities and avoiding additional downside.

Sources: Barings and ICE BofA. Global senior secured bond market represented by the ICE BofA BB-B Global High Yield Secured Bond Index (USD Hedged) (HW4S). As of July 31, 2022.

Note: Effective June 30, 2022, the ICE Fixed Income Index reflects transaction costs. As a result, existing index level total return, price return and excess return fields have been adjusted to reflect the new methodology. All return information prior to June 30, 2022 has not been adjusted.