Understanding the Attraction of Continuation Vehicles

Continuation vehicles, an area of high growth in secondary private markets, can be an attractive investment option for limited partners if appropriate alignment, transparency and governance mechanisms are in place.

The last 24 months have seen a significant rise in the number of continuation funds. These vehicles allow general partners (GPs) to roll an asset or assets from one or more existing funds into a new investment vehicle with fresh or re-start capital. This is an alternative to selling the asset to an outside buyer. Historically, continuation vehicles were a way to give portfolio companies more time to deliver on expected returns. More recently, however, GPs are recapitalizing their higher-performing investments—the so-called “crown jewels” of their portfolios—to maintain exposure while providing additional capital for growth initiatives.

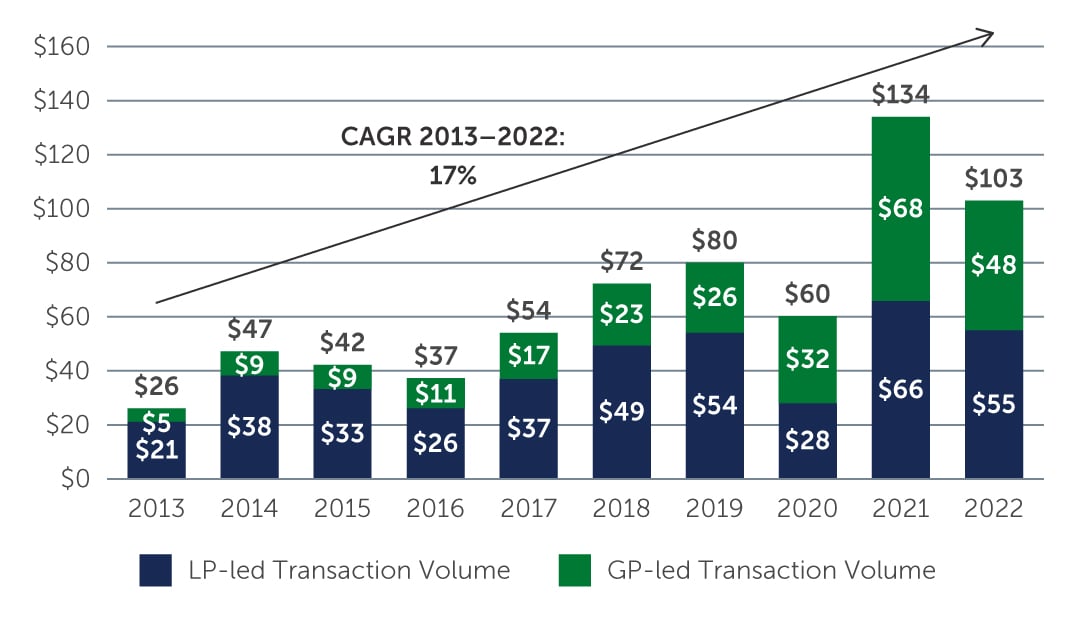

Figure 1: Secondary Market Transaction Volume Over Time ($B)

Source: Evercore 2022 Secondary Market Synopsis. As of January 2023.

Source: Evercore 2022 Secondary Market Synopsis. As of January 2023.

While continuation vehicles involve risk, namely around potential conflicts of interest and GP alignment, they also offer potential benefits. They provide GPs with the ability to continue managing a high-performing asset in a format that offers a larger fee base and a resetting of the deal carry pool, which can re-incentivize the team for continued value creation. For limited partners (LPs), assuming the new asset has been fairly priced and that the GP’s motivations are properly aligned, these vehicles can provide an attractive opportunity to maintain exposure to a successful company at a lower fee/carry basis. In addition, some LPs can invest secondary capital into what may be perceived as a less risky opportunity than buying a new, unknown asset. Over time, there is the potential for LPs to realize strong risk-adjusted returns, particularly with GPs and management teams that have worked together successfully in the past.