EM Debt: Reasons for Optimism, But Risks Remain

The upbeat note on which EM debt entered the year continues to prevail. While tailwinds exist, there is also a myriad of potential risks to navigate in the coming months.

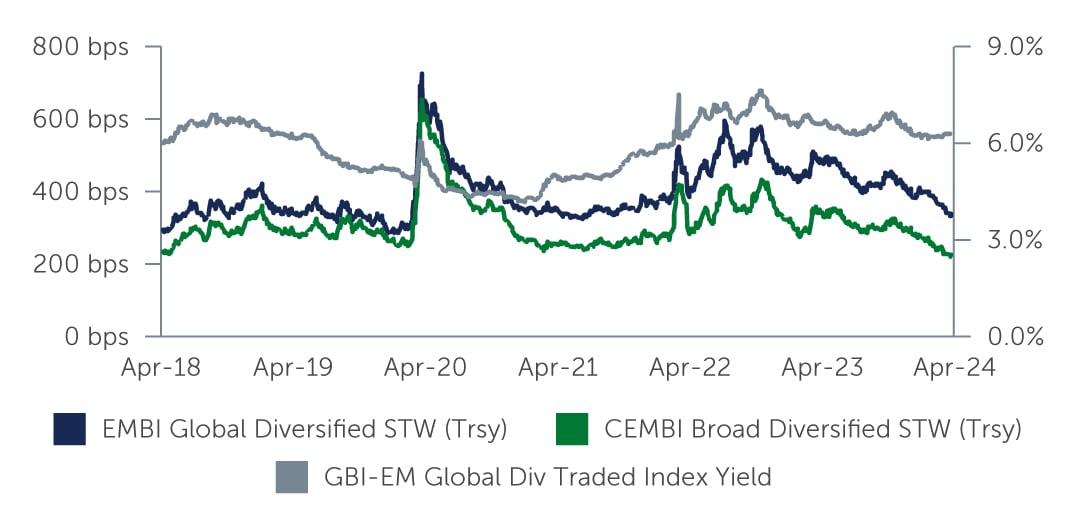

Improving prospects for global economic growth, coupled with the U.S. Federal Reserve (Fed) likely being at or near peak rates, have buoyed sentiment across emerging markets (EM) debt. Spreads, accordingly, continue to grind tighter across sovereigns and corporates (Figure 1). And while the aforementioned factors are certainly reasons for optimism, the significant tightening in spreads is also evident among weaker EM regions and credits. This widespread rally, when viewed in the context of what appears to be a challenging last mile in the global battle against inflation, ongoing wars in Europe and the Middle East, and elevated political uncertainty around the world, begs the question: Are markets getting ahead of themselves?

Figure 1: EM Spreads Continue to Grind Tighter

Source: J.P. Morgan. As of April 4, 2024.

Source: J.P. Morgan. As of April 4, 2024.

Sovereign & Local Debt: Supportive Backdrop, but Risks Remain

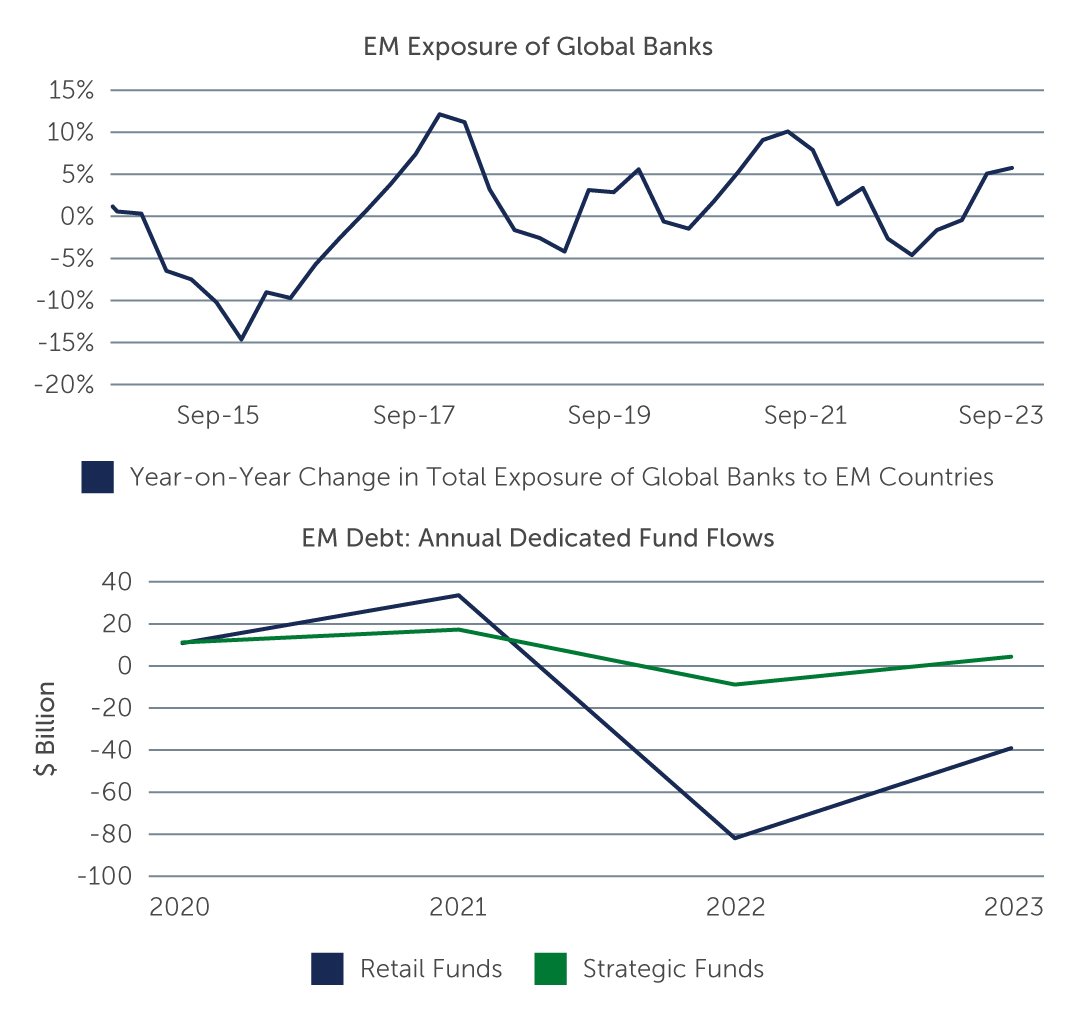

With the U.S. economy growing, China’s weakness appearing to have found a bottom, and the rest of Asia continuing to gain strength, sovereign hard currency debt remains on solid fundamental footing as recession concerns ebb. In particular, the strength of the U.S. economy benefits countries in South and Central America and the Caribbean given the multiple linkages between them from trade to tourism. At the same time, concerns about higher rates leading to refinancing problems remain at a low simmer—Zambia has reached an agreement on its debt while Ghana and Sri Lanka continue to negotiate. The technical picture also remains supportive for EM debt, with “smart money” (or institutional investment) flows in EM turning positive in 2023 following a year of outflows (Figure 2). Specifically, last year, EM debt outflows were dominated by retail funds, but developed market commercial banks increased their exposure to the asset class. Historically, smart money inflows have been a leading indicator of overall investor inflows into EM debt.

Figure 2: Smart Money Flows in EM Debt Turn Positive

Source: JP Morgan, EPFR, Bank of International Settlements. As of February 2024.

Source: JP Morgan, EPFR, Bank of International Settlements. As of February 2024.

However, the overall picture is also one of a number of potentially significant risks. For one, there is the possibility for further escalation in the Russia-Ukraine war, which could have a contagion effect on neighboring countries in the region. Adding to this is the elevated political risk given the number of elections around the world this year. On the positive side, many of the EM election outcomes are widely expected and priced into the market and therefore unlikely to result in any major disruptions. Perhaps counterintuitively, the U.S. presidential election may be the one most likely to introduce volatility to the EM market. If former President Donald Trump returns to office, for instance, it could call into question a number of major international policies.

In this environment, we continue to see value in investment grade (IG) sovereigns with solid fundamentals—particularly BBB countries such as Mexico, Uruguay, Bahamas, and Indonesia. Select opportunities remain in the high yield space as well, especially where spreads continue to offer a healthy overcompensation for default risk. Specifically, we see value in high-quality BB sovereigns such as Dominican Republic, Costa Rica, Jamaica, and Paraguay, as well as in a number of Eastern European countries—though careful monitoring is critical given the heightened geopolitical risk in the region. Meanwhile, we remain positive on Sri Lanka given the country’s positive trajectory, but we believe a more cautious approach is required for single B and below issuers.

In the local debt space, we are less constructive on local interest rates than we were six months ago. This is because we expect to see fewer and smaller rate cuts from EM central banks going forward, given that inflation has largely come down in many countries. However, there are a few EM countries that still have room to cut, such as Mexico and some Central and Eastern European nations. Within local currencies, the overall picture is arguably more nuanced due to the many geopolitically driven differences among regions and countries. In our view, the Argentinian peso, Egyptian pound, Kenyan shilling, and Nigeria naira have readjusted and settled at exchange-rates that are more at equilibrium, and currently appear attractive.

Corporate Debt: A Case for IG and Select HY

Looking at the EM corporate market, spreads continue to tighten in tandem with other markets, and are now approaching post-crisis tights. However, absolute yield levels continue to look attractive relative to many other fixed income asset classes. While there are potential significant risks on the horizon that could derail the current tightening and drive spreads wider—which provides a reason to advocate for some degree of defensiveness—we also see tailwinds supporting the market. In particular, funds are being reallocated from money market funds into developed market investment grade (IG) asset classes, which is providing crossover demand tailwinds for select segments of EM corporates.1

Specifically, we see value in EM IG corporates—which constitute roughly 60% of the EM corporate debt universe2—as the segment is not only benefitting from the demand tailwinds, but is also likely to benefit from potentially attractive convexity when the Fed starts to cut rates. We also see value in select idiosyncratic opportunities in the high yield space, as the segment is likely to benefit if economic data continues to point toward a ‘no landing’ scenario and sentiment improves for riskier debt. In addition, corporate fundamentals overall remain sound for both IG and HY companies. In particular, leverage levels of EM high yield corporates are at 2.2x, which compares to 3.4x for U.S. high yield companies and 4.4x for European high yield companies. EM IG corporate leverage is at 1.0x, relative to 2.8x for U.S. and European IG companies.3 This, combined with the low default rate of EM corporate issuers over the past decade—an annual average of 1.3% versus 2.8% for U.S. high yield—contradicts the common misconception that EM issuers are lacking in creditworthiness.4

From a sector perspective, we remain cautious around sectors which have been impacted by the lower cost product exports from China such as petrochemicals and steel. We also see some technology, media, and telecommunications companies especially in Latin America challenged with the aftermath of higher funding costs, the capital expenditure overhang from previous years, and a reduced ability to pass through costs to consumers. At the same time, we see value in renewables and in infrastructure deals involving ports and toll roads, as well as in subordinated credits of selective IG rated banks.

A Cloudier Crystal Ball

While current conditions remain favorable for EM debt overall, the potential for disruption exists across many fronts—and either political or geopolitical events could shape the course of EM and risk assets overall going forward. These developments, as well as possible ramifications of climate change, such as shocks to global food supplies, pose potential risks.

Despite the riskier backdrop, we believe the diversity within EM sovereign, corporate and local debt provides a breadth of opportunities across issuers and regions which have unique performance drivers. As a result, EM issuers often outperform or underperform at different times and across a range of market conditions. In our view, rigorous, bottom-up credit and country selection, combined with active and discriminating management, remain paramount to managing the risks across the market, as well as to identifying the issuers that are well-positioned to navigate the uncertain environment.

1. Source: Barings’ observations. As of March 31, 2024.

2. Source: JP Morgan. As of December 31, 2023.

3. Source: JP Morgan. As of February 26, 2024.

4. Source: JP Morgan. As of December 31, 2023.