CLOs: Up in Quality

Against a challenging macro backdrop, CLOs look attractive given the strong structural protections and incremental yield on offer—but there is a case to be made for staying up in quality.

High inflation, hawkish central banks, recession fears and rising geopolitical tensions—these are a few of the prevailing challenges facing markets today. And as interest rates continue to rise, exacerbating concerns about the global economy, volatility will likely remain elevated and continue to weigh on performance across risk assets. Against this uncertain backdrop, the collateralized loan obligation (CLO) market saw mixed/negative performance across the capital structure in the third quarter, with AAAs, AAs and single-A tranches returning 0.23%, 0.08% and -1.10%, respectively, and BBB, BB and single-B tranches returning -1.43%, -2.56% and -2.57%, respectively.1

Technicals Create Opportunity

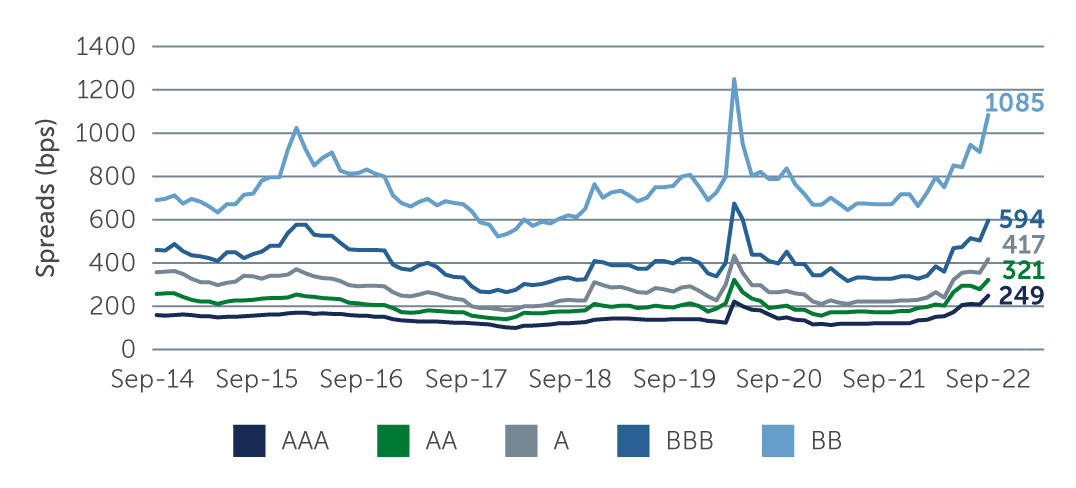

Unsurprisingly, spreads have widened across the CLO market and remain wide relative to both historical averages and other corporate credit asset classes (Figure 1). As many investors fled to more liquid asset classes amid heightened macro concerns, the meaningful spread widening—and sharp decline in prices in the case of mezzanine tranches trading in the secondary market—created a number of compelling opportunities. Current trading levels for both new issues and secondary CLO offerings look attractive relative to both the risks in the underlying portfolios and other asset classes. While defaults are likely to tick up over the next 12 to 18 months, they are expected to remain within the context of historical averages of 2.5% to 3.0%—and such levels are well within the range of what CLO structures are built to withstand.2 In addition, in a rising-rate environment the floating-rate nature of CLOs continues to be a positive and current yields are becoming increasingly attractive. While tranche prices may not rebound as quickly as recent episodes, we remain confident they ultimately will recover and that patient investors will be potentially well-rewarded.

Figure 1: CLO Spreads Remain Wide Relative to Historical Averages

Source: J.P. Morgan. As of September 30, 2022.

Source: J.P. Morgan. As of September 30, 2022.

At the same time, issuance remains low relative to a year ago, despite picking up in recent weeks. Demand, meanwhile, has remained muted. At the top of the capital structure, this is largely due to banks pulling back from the market as they move to shore up liquidity. Further down in the mezzanine space, there are also fewer buyers for new issues given the lack of discount available, and therefore the lower total rate of return potential a market rebound, relative to secondary market opportunities.

Up in Quality

While there are potentially attractive returns to be had across the capital structure, given the heightened uncertainty and fundamental concerns across markets today, we believe it makes sense to stay up in quality. Risk-remote AAA and AA tranches, in particular, continue to look attractive given that spreads are wide relative to historicals and the credit risk component is minimal. In recent weeks, new issues from strong tier 2 managers have, in our view, offered an attractive spread pick-up relative to deals from tier 1 managers—a potentially compelling opportunity for longer-term, risk-based capital buyers, such as insurance and reinsurance companies. That said, we continue to see greater value in the secondary market, where we see more total return upside, with opportunities to buy CLO tranches at a greater discount to par.

In the mezzanine space, we also see benefits to moving up in quality to BBBs and higher-quality BBs—given that some BBs will likely face increasing challenges if the macroeconomic environment deteriorates further. Similar to the top part of the capital structure, we believe the secondary market looks attractive relative to new issues. While spreads between the secondary and new issue market have experienced similar widening, the latter are generally coming to market near par, whereas the secondary market offers opportunities at a significant discount. With current entry points typically in the $80s—and assuming that discount can be monetized as the dislocation in the market normalizes over the next year or two (or even three)—the total rate of return for buying a tranche in the secondary market is potentially much greater than for buying a high-coupon deal at 99 or par in the new issue market.

It is also worth noting that CLOs have weathered past periods of stress relatively well and have defaulted far less frequently than equivalently rated corporate credit and other securitized products. BBs, for instance, have historically had a default rate of less than 1.1%3, compared to 7.4%4 for similarly rated corporates. AAA tranches have never defaulted or experienced a principal impairment. This is because CLO structures are notably robust, and contain cash diversion mechanics that protect investors’ capital over the structure’s life.

Takeaway

While there are certainly a number of risks on the horizon and expectations for further economic weakness, we believe there is considerable value to be had in CLOs by patient investors over a medium-term horizon. In addition to their floating-rate offering and robust structural protections, CLOs provide the potential for considerable incremental yield relative to similarly rated investment grade and high yield corporate credit. That said, in today’s volatile environment, we are likely to see more dispersion among deals and among managers going forward. For this reason, active management—and careful manager selection—remains critical to both minimizing potential risks and capitalizing on relative value as it emerges up and down the capital structure.

1. Source: J.P. Morgan CLOIE. As of September 30, 2022.

2. Source: S&P.

3. Source: S&P. As of March 17, 2022.

4. Source: S&P. As of April 13, 2022.

22-2455250