EM Debt: Reassessing Risk Amid Resilience

Tighter spreads and improving sentiment drove strong second-quarter performance for EM debt. While adding risk may not seem prudent given the economic weakening that potentially lies ahead, neither does reducing risk.

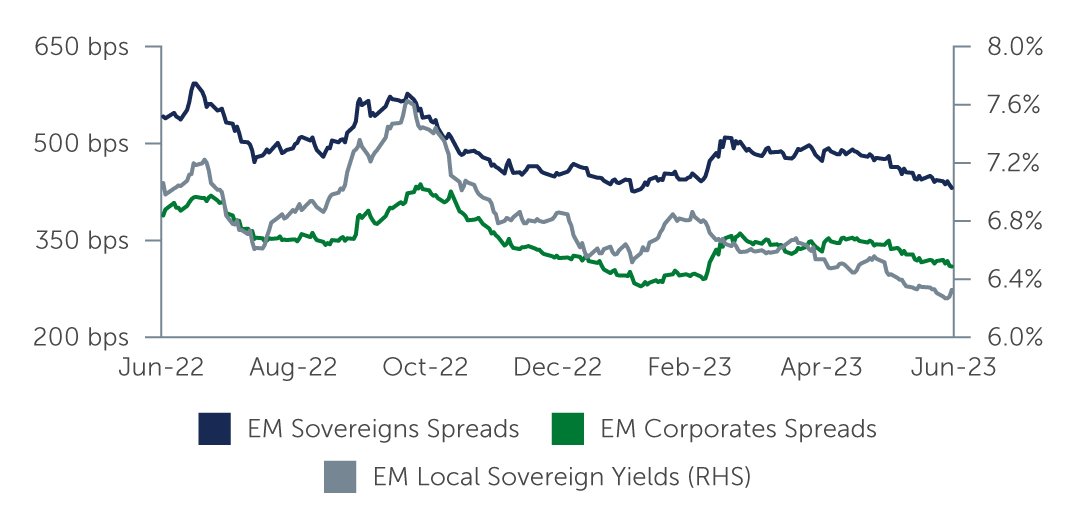

Global economic activity is softer, and production is down, yet markets are pricing in a relatively benign economic outlook. As household and corporate balance sheet resilience overcame first-quarter fears of an economic hard landing, the global economy remains relatively healthy, U.S. growth being the most resilient. Against this backdrop, sentiment improved, second-quarter performance ended in positive territory for emerging markets (EM) sovereign, local and corporate debt, and spreads tightened across the board (Figure 1). However, there are a number of risks still facing EMs—the biggest one likely being that still-high inflation leads to excessive tightening by developed market central banks, potentially triggering a recessionary cascade.

Figure 1: EM Spreads Tighten Across the Board

Source: J.P. Morgan. As of June 30, 2023.

Source: J.P. Morgan. As of June 30, 2023.

Sovereign & Local Debt: An Improving But Nuanced Picture

While uncertainty and headwinds remain on the horizon, the overall picture for EM sovereigns looks quite positive. On the inflation front, EMs still seem ahead of developed markets, with EM inflation largely slowing down and EM central banks no longer hiking interest rates. Some central banks, including those in Brazil and Chile, have also indicated rate cuts soon may be coming, while Costa Rica, Uruguay and Hungary already have cut rates. In addition, a number of tail risks across the market have recently improved. For instance, developments in Turkey appear to be positive with the appointment of a new finance minister, who is known for his more traditional policies. The outlook for Nigeria has also improved, with the change in administration offering the potential for reforms in the country.

From a sovereign and local debt perspective, this backdrop presents both opportunities and challenges to navigate. In terms of rates, the differential between local rates and 5-year U.S. rates is near record low levels today.1 That poses a headwind for local currencies, but if the U.S. Federal Reserve (Fed) is close to the end of its rate-hiking cycle, EM financial markets may be positioning themselves ahead of that move. At current levels, however, carry remains attractive for investors in many cases. In particular, the Indonesian rupiah, Polish zloty, Mexican peso, and Peruvian sol look attractive. We also see some value in the Colombian peso, which has recovered from very low levels, but may offer only limited room to appreciate. Meanwhile, the depreciation in the Chinese renminbi and South African rand looks likely to continue, while the Turkish lira may continue to be impacted by government policies.

In terms of sovereign hard currency, while high yield sovereigns outperformed investment grade in recent weeks, we believe this is not the time to add excessive risk. In fact, looking beneath the high-level index numbers reveals that the drivers of outperformance may be too risky to warrant investment today—with countries such as Ukraine, Tunisia, Ghana and Zambia rallying most. In an environment with continuing tightness in credit conditions, we continue to see value in investment grade sovereigns with strong fundamentals. Countries whose credit merits high yield status continue to find the cost of borrowing steep, and, in many cases, high enough to keep them out of the market. In the near term, we don’t see the market dynamics changing much, especially as lenders face increasing difficulty in negotiating redress with issuing nations that fail to meet the terms of their bond indentures. That said, we do see very select opportunities in high yield, specifically some positively trending BBs including Serbia, Oman, Morocco, and Dominican Republic. We also continue to see value in Sri Lanka as the country is still trending positively while in the process of restructuring their debt.

Corporate Debt: A Case for Cautious Optimism

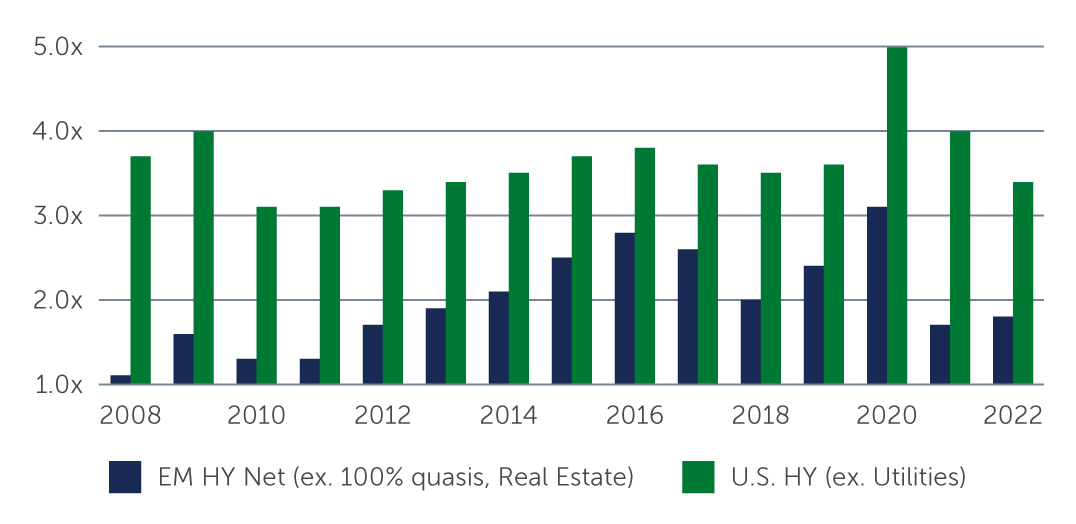

As worries about spreads widening and defaults spiking took somewhat of a backseat in recent months, EM corporate debt bounced back. The spread narrowing that took place—to levels prevailing just before the Russia-Ukraine war—was driven by resilient corporate earnings and balance sheets (Figure 2), markets pricing in a relatively benign economic outlook in the U.S. and thus the Fed possibly being close to the peak, and finally, improvements to some idiosyncratic credit stories during the quarter. The improvement in sentiment was reflected with high yield corporates outperforming investment grade, and an increasing number of high yield issuers were also able to access the new issue market to raise financing—versus a largely investment grade-dominated new issue market in the previous quarter. Despite the stronger technical backdrop, there are still reasons for caution, and further spread tightening may be limited. Fund flows also remain negative, but going forward, if the asset class starts to see inflows, it could be a tailwind to drive spreads tighter.

Given the largely positive fundamental backdrop for EM corporates, the low corporate default environment is persisting. In addition, there have been strong anecdotal indications that private credit is stepping in and disintermediating banks in cases where public markets would not be accommodating—this is playing a key role in staving off defaults. In particular, the default rate for EM corporates is 2.4%—mainly driven by Brazil, which has been experiencing tighter credit conditions domestically following the accounting scandal around Brazilian retail chain Americanas—as well as by China and Ukraine.2

Figure 2: EM vs. U.S. High Yield Corporate Net Leverage

Source: J.P. Morgan. As of December 31, 2022.

Source: J.P. Morgan. As of December 31, 2022.

While macro conditions largely support a glass-half-full outlook, risks persist, and the picture remains nuanced. We see select opportunities at the high-quality end of high yield corporate market, particularly BB names. Across the market, we see value in issuers with exposure to sectors related to climate transition, such as renewable power, as well as low-cost, high-quality producers, and companies involved in the structural shift taking place in the Gulf region. In investment grade, we continue to see value in the BBB bucket because it still offers some room for spread compression. While the higher quality part of this market has outperformed, selective opportunities remain.

Risks Ahead

Today, the EM debt market finds itself in a Goldilocks state. EM corporates and sovereigns generally are in strong financial shape, inflation is coming down, interest rates may be reaching their peak, and while the global economy may not be booming, it continues to defy predictions of a significant downturn. Nevertheless, risk is always present, and some of the macroeconomic, market and geopolitical risks we are monitoring include:

- Fed policy: will the zeal to starve inflation drive the economy into recession?

- IMF policies around creditor rights.

- Geopolitical tensions including those involving China/U.S. relations and the issue of Taiwan’s status, as well as the Russia/Ukraine war and new signs of instability in Russia.

- Rising global food prices, which can lead to social instability in emerging markets.

- Oil prices are staying stable despite OPEC efforts to cut production—a possible sign that the global economy is weaker than widely assumed.

As a result, we continue to believe that rigorous, bottom-up credit and country selection remain crucial to navigating the risks at hand and identifying the issuers that are well-positioned to withstand a challenging environment.

1. Source: J.P. Morgan. As of June 30, 2023.

2. Source: J.P. Morgan. As of May 31, 2023.