The Fed vs. Secular Growth: A Technology Conundrum

While the recent market turbulence has been characterized by a rotation out of highly valued growth stocks, the high and sustainable growth offered by tech companies will likely return to favor.

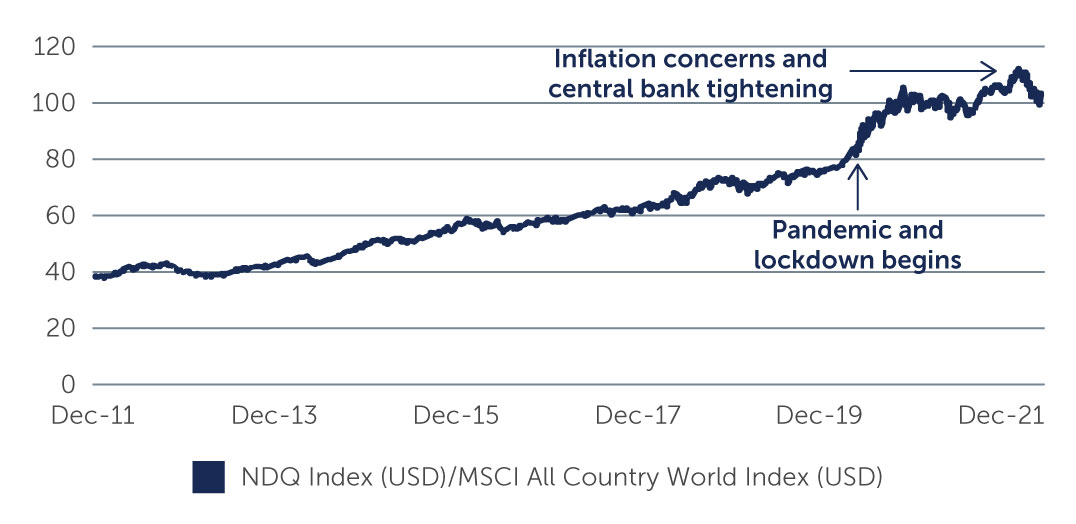

The recent turbulence across equity markets has been characterized by a rotation out of highly valued growth stocks, such as technology firms, and into companies benefitting explicitly from the backdrop of rising inflation and interest rates, including banks and energy names (Figure 1). This rotation has raised a key question: was the initial demand surge that technology companies enjoyed at the start of the pandemic just a one-off? Or was it in fact the launching pad for a more permanent migration of economic activity into the digital domain?

We believe it’s the latter. In particular, once the market has absorbed the shock of higher rates, the focus will likely return to companies that offer long-term, structural growth. In our opinion, the recent weakness in technology names, and the heightened market volatility driven by geopolitical developments in Ukraine, provides an opportunity for investors to build positions in likely long-term winners—most notably, tech companies that have the ability to pass on cost inflation, offer solutions to improve efficiency, and have exposure to the secular growth in cloud computing and the digitalization of traditional industries.

Figure 1: Performance of Growth-Focused NASDAQ 100 Index vs. MSCI ACWI

Source: Bloomberg. As of December 31, 2021.

The Opportunity After the Storm During periods of market stress, large flows of capital make for the exit at the same time, which tends to result in high stock correlations. For instance, toward the end of January, the market was suddenly unable to ignore the impact of central bank tightening measures. This resulted in a widespread sell-off across growth stocks, and an increase in implied correlations between Nasdaq companies to levels not seen since the pandemic hit in the first quarter of 2020. In our view, such periods of indiscriminate selling are a great time for long-term stock pickers to sharpen their pencils and update their funnel of ideas.