IG Credit: Idiosyncratic Opportunities in a Favorable Environment

Given the combination of still-elevated yields, solid fundamentals and technicals, and a resilient U.S. economy, IG corporate credit looks well-positioned for the months ahead.

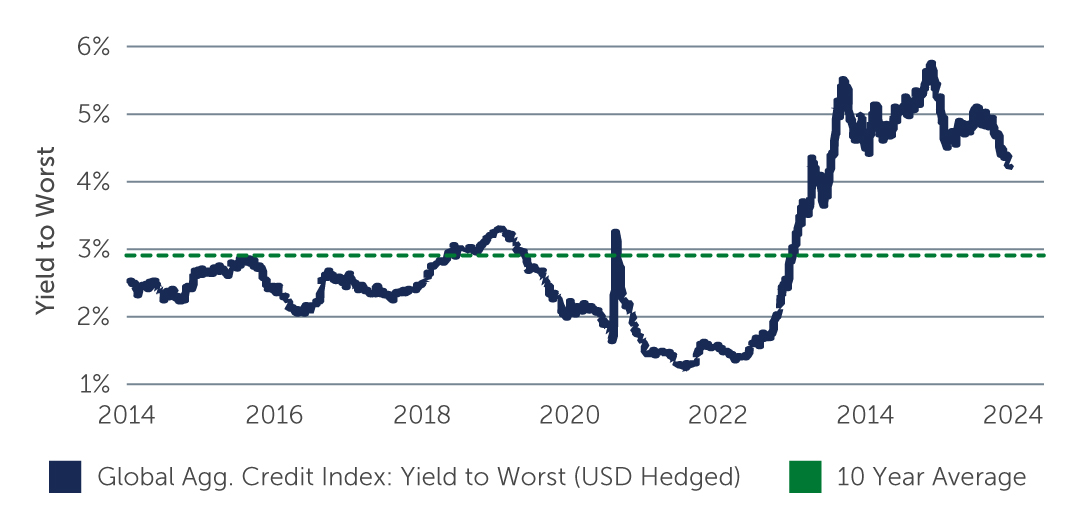

There are a number of tailwinds supporting the case for investment grade (IG) credit today. For one, yields in the U.S. remain compelling at 4.20%, which is 1.5 times higher than the 10-year average (Figure 1), while in Europe yields are at 3.2%.1 At the same time, recent data suggests the U.S. economy looks more robust than markets were initially thinking—and, as a result, the pace of rate cuts from the U.S. Federal Reserve (Fed) may be slower going forward. In addition, technicals remain robust, while recent data suggests a stabilizing picture on corporate fundamentals. While risks remain on the horizon—including the shifting macroeconomic and political backdrop and heightened geopolitical concerns—this backdrop suggests IG credit is well-positioned going forward.

Figure 1: IG Yields Remain Attractive

Source: Bloomberg, Barings. As of September 30, 2024.

Source: Bloomberg, Barings. As of September 30, 2024.

Supportive Fundamental & Technical Backdrop

From a fundamental standpoint, there have been signs of improvement across the market. In the U.S., revenue growth in the second quarter came through at 1.1%, while EBITDA was positive for the first time in five quarters at 1.1%.2 In particular, EBITDA ex-commodities rose by 7.1%, which is the fastest pace in two years.3 Meanwhile, net leverage, while higher on an annual basis, remained flat from the previous quarter at 2.9x, and interest coverage declined by 1.5x but remained in line with long-term averages.4 While CAPEX also increased, it was the slowest growth in three years, suggesting IG companies remain conservative in their approach to managing their balance sheets. The fundamental picture is similar in Europe—EBITDA rose 2.5% year-on-year, for instance, while net leverage is 2.7x.5 Adding to the strong credit story is the ratings profile of the market. In particular, the first half of this year saw roughly five times as many upgrades as downgrades—with the percentage of the IG universe rated BBB- at its lowest since 2012, and the single-A rated percentage at its highest since 2011.6

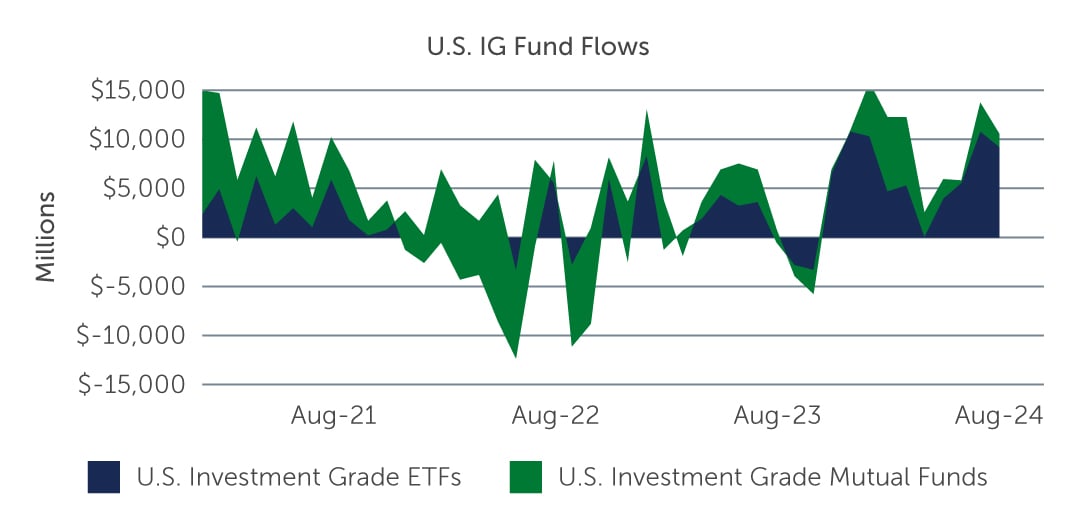

The technical picture also remains supportive. While new issuance has surpassed expectations, reaching $1.26 trillion in the U.S. year-to-date, it has been well absorbed by the market.7 For example, in terms of fund flows, inflows into U.S. IG funds this year have reached $260 billion compared to $182 billion of inflows in all of 2023 (Figure 2). Demand for IG corporate credit remains strong, particularly from yield-focused insurers, as they seek to match liabilities coming from surging demand for fixed annuities. That said, while yields are near their highest levels in the last decade, they are at their lowest levels in the past 18 months—and this has the potential to impact demand going forward. Nevertheless, following the Fed’s rate cut, we could also see some demand move out of money market funds and into corporate credit. At the same time, the recent policy changes from the Fed and the Bank of Japan have reduced hedging costs, making this asset class particularly appealing for buyers out of Asia.

Figure 2: U.S. IG Fund Inflows Absorb Elevated Supply

Source: Bloomberg Intelligence. As of August 31, 2024.

Source: Bloomberg Intelligence. As of August 31, 2024.

Idiosyncratic Opportunities & Crossover Credits

Spreads in IG credit remain tight overall compared to the start of the year, but given the high degree of dispersion among spreads, we continue to see attractive opportunities in the market. From a sector perspective, we see value in energy, which has been impacted by recent higher levels of volatility. In particular, new issues from midstream corporates look attractive. In addition, we continue to see opportunities in financials—albeit to a lesser extent than at the start of the year, given the significant spread tightening across the sector from banks to insurers to real estate investment trusts (REITs).

Looking across the market, some of the most interesting opportunities today, which we believe offer the potential for spread tightening, are of a more idiosyncratic nature. For example, we identified an opportunity in a manufacturer of computer components, which saw its spreads widen on the back of recent financial challenges and a ratings downgrade. Following positive news that the company signed a deal to manufacture AI chips, its spreads started to recover.

A key opportunistic theme we also like is in ‘crossover credits,’ which have generated 57% higher cumulative returns compared to the broader IG index and have outperformed the broader market in seven out of the last 10 years.8 These “rising stars” and “fallen angels” are companies poised for upward migration in credit ratings and those expected to see a downgrade from IG to high yield. In particular, rising stars tend to outperform a few months prior to upgrade. Here, we see select value in REITs and have identified an opportunity in a high yield-rated triple net lease corporate where the management team has expressed a desire to return to IG in the next couple of years. In our view, there could be some spread tightening if the company is upgraded.

Looking Ahead

The current backdrop is very favorable for IG credit. However, there are uncertainties on the horizon, from political to geopolitical risks, which have the potential to drive spreads considerably wider from current levels. With this in mind, while we believe there is a compelling case for IG credit going forward, taking a fundamental, bottom-up approach to investing—while being open to opportunistic and idiosyncratic opportunities—will be key.

1. Source: Bloomberg. As of September 30, 2024.

2. Source: J.P. Morgan. As of June 30, 2024.

3. Source: J.P. Morgan. As of June 30, 2024.

4. Source: J.P. Morgan. As of June 30, 2024.

5. Source: J.P. Morgan.. As of June 30, 2024.

6. Source: J.P. Morgan (ex-EM issuers). As of September 30, 2024.

7. Source: J.P. Morgan. As of September 30, 2024.

8. Sources: Barings; Bloomberg. As of September 30, 2024.