Private Credit’s ‘Free Lunch’ for Insurers

Private assets don’t trigger any additional capital charges above what regulators require of equivalent public assets in insurer portfolios. That makes private credit’s illiquidity premium the investment equivalent of a “free lunch.”

While economist Milton Friedman popularized the line “there is no such thing as a free lunch,” the source of the quip is thought to be patrons of 19th century saloons who realized that the salty sandwiches they got at no cost made them thirstier for the beer they had to buy. Contrary to Friedman and the beer drinkers, however, U.S. insurers may be able to enjoy the investment equivalent of something for nothing.

The reason stems from insurance regulations intended to mitigate risk. Insurance capital requirements commonly apply risk factors to calculate required capital charges intended to support insurers’ capital adequacy. For investment risks, these risk-based capital (RBC) charges typically vary by the predominant risks for capital purposes, namely the asset class and credit rating of the underlying securities.

Other risk factors are not subject to additional capital charges. For example, bonds with longer duration and negative convexity usually don’t trigger capital consequences, except in cases where assets are severely misaligned with liabilities. Rating agencies such as S&P and AM Best impose higher capital charges on longer-dated bonds, but the RBC framework of the National Association of Insurance Commissioners (NAIC) does not require such charges.

Importantly, the illiquidity/complexity of private credit assets—which delivers potential additional yield over public equivalents—does not incur an additional capital charge expense across capital regimes for insurers that have the illiquidity capacity. This is not to say there is a regulatory miscue, but rather a recognition of the potential performance, diversification and covenant benefits private assets can provide. Coupled with insurers’ capacity to comfortably tolerate illiquid assets given their liability profiles, this regulatory advantage has been one of the fundamental drivers of private asset growth in the industry in recent years. Simply put, investment allocations that avoid capital headwinds have the potential to greatly improve capital-adjusted yields (and spreads).

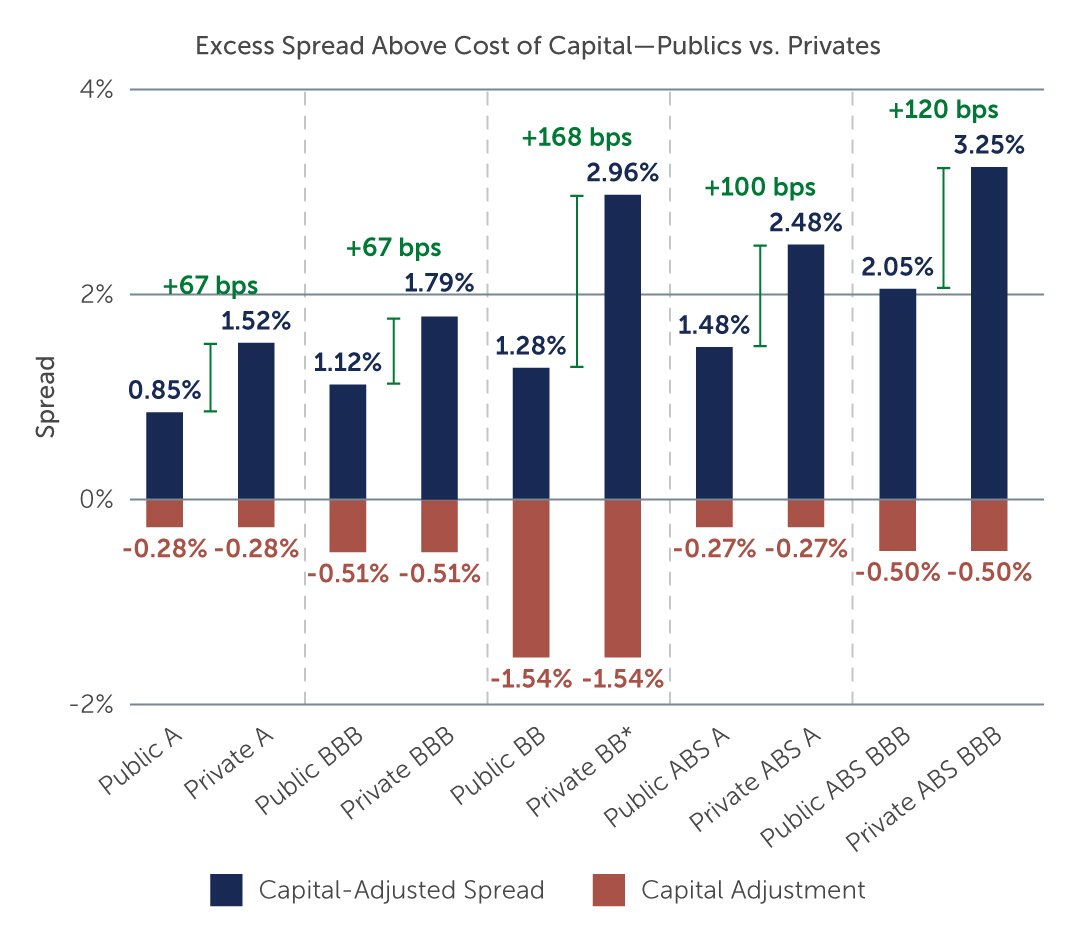

Figure 1 highlights the impact capital charges can have on capital-adjusted spreads over U.S. Treasuries. Capital-adjusted spreads net out the effects of the cost of capital. In a simplified case, NAIC RBC factors are applied to the investments, grossed up by a typical RBC ratio and reduced by a covariance adjustment to provide a reasonable approximation of the capital required to support each investment. That is then multiplied by the targeted return on capital of 12% to result in the cost of capital adjustment for the investment. After some slight adjustments for taxes and reinvestment, this calculation becomes the “rent” for additional capital needed to support the investment—which then directly reduces the expected spread.

Figure 1: High Capital Charges Reduce Net Capital-Adjusted Spreads

Source: Barings Investment Opportunity Set. As of September 26, 2023. Bonds assume a 5-year tenor, securitized assets assume a 3-year tenor; *Pvt 5-year BB is represented by infrastructure debt. Capital-adjustment is a cost of capital estimate using regulatory capital charges for a life insurance company under the following assumptions: target NAIC CAL RBC ratio of 400%, covariance adjustment of 80%, 12% return on capital, and 21% tax rate.

Source: Barings Investment Opportunity Set. As of September 26, 2023. Bonds assume a 5-year tenor, securitized assets assume a 3-year tenor; *Pvt 5-year BB is represented by infrastructure debt. Capital-adjustment is a cost of capital estimate using regulatory capital charges for a life insurance company under the following assumptions: target NAIC CAL RBC ratio of 400%, covariance adjustment of 80%, 12% return on capital, and 21% tax rate.

High capital-charge assets like equities can have a negative capital-adjusted return given the high level of capital required to support the investment. That is the chief reason life insurers invest relatively little in equities. Since property and casualty insurers and health companies are subject to roughly half the capital charges on equity investments as life companies, they tend to invest somewhat more in the asset class, but still find equities expensive. In public debt markets, lower-rated securities may have much reduced attractiveness after capital adjustments.

Illiquid private assets, however, are free of additional capital relative to equivalent public assets. With no additional capital cost, private credit’s illiquidity premium, or compensation for taking illiquidity risk, is—as traders like to say—a free capital pick.