Why Securitized & Why Now: $12.5 Trillion Market Goes on Sale

Today’s securitized market presents a rare opportunity to add diversification via an asset class with the potential to provide defensive opportunities with outsized returns.

Public fixed income markets broadly underperformed in 2022, with the U.S. Aggregate Index down by more than 13% at year-end, and the Global Aggregate Index down more than 16%.1 The massive $12.5 trillion securitized market has not escaped the carnage of higher rates and wider spreads, with MBS, CMBS and ABS components of the Aggregate indexes down 11.8%, 10.9% and 4.3%, respectively.2 More dramatic are the broader securitized investment grade credit indexes, excluding AAAs, which underperformed materially, with CMBS down -12.6%, ABS -6.3% and RMBS -15.7% through the end of December.3

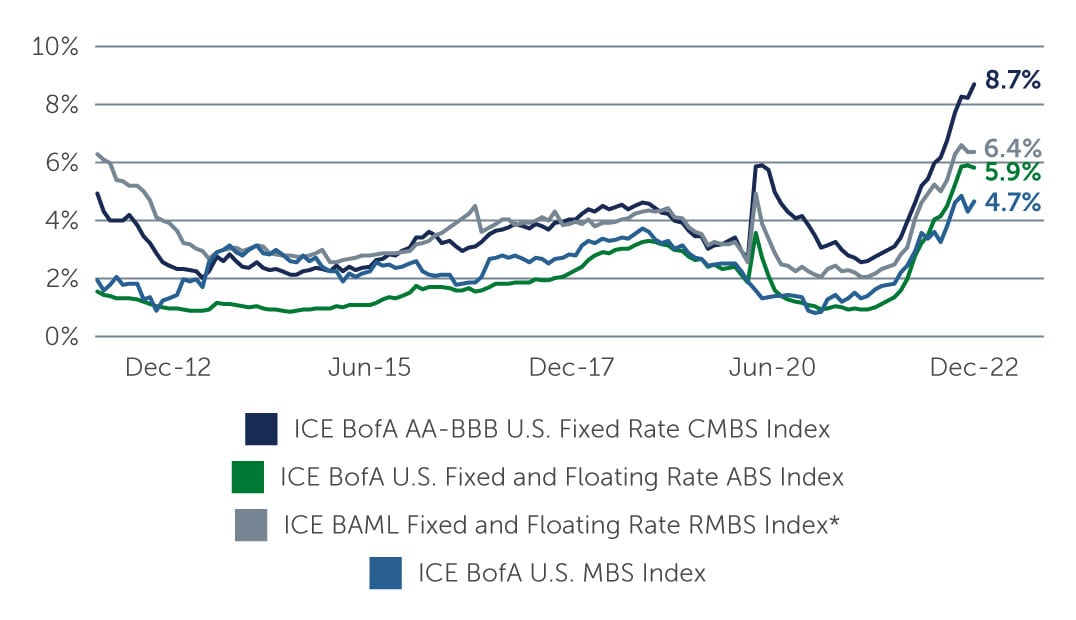

Securitized Yields: Most Compelling Levels in a Decade

At the same time, with the move higher in interest rates, securitized yields are significantly higher across the board. IG CMBS, excluding AAA securities, are currently yielding roughly 8.7%, well above the 3.7% average of the last 10 years. ABS yields have nearly doubled, increasing from an average of 3.0% to 5.9% in the same period, while RMBS yields have jumped from an average of 3.7% to 6.4%. Meanwhile, Agency MBS yields have increased from an average of 2.5% to 4.7% (Figure 1).

Figure 1: Securitized Yields are Higher Across the Board

As of December 31, 2022.

As of December 31, 2022.

*Housing related sectors of Manufactured Housing collateral and Home Equity Loans below AAA.

1. Source: Bloomberg. As of December 31, 2022.

2. Source: Bank of America. As of December 31, 2022.

3. Source: Bank of America. As of December 31, 2022.