The (Still) Compelling Case for Broadly Syndicated Loans

Even as the rate-hiking cycle looks close to its end, loans look well-positioned for strong performance in the year ahead, due largely to the high contractual income on offer.

As an asset class that pays investors a floating-rate coupon, broadly syndicated loans have historically outperformed in rising-rate environments—and the asset class certainly benefitted from that backdrop over the past two years. Now that the rate-hiking cycle may be reaching its end, however, there are questions as to whether this strength can continue. We believe it can, due largely to the contractual income currently on offer, which continues to hover around its peak post-financial crisis highs.

Strong Performance Amid Rising Rates

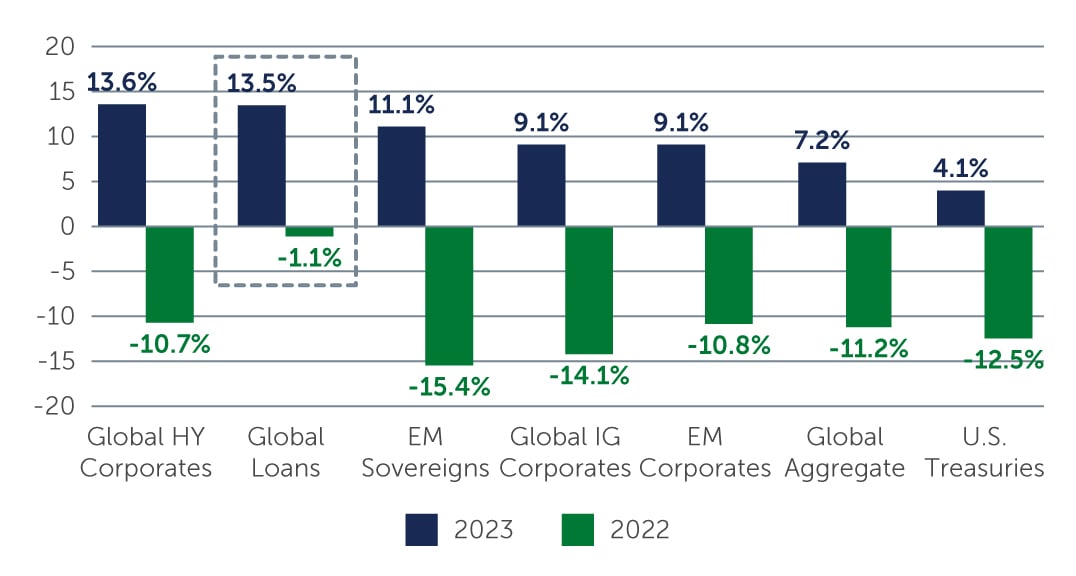

The loan market outperformed other fixed income asset classes in each of the last two years, as central banks steadily increased rates to combat inflation. In 2022, while performance was negative—which had previously only happened twice in the U.S. and three times in Europe—the loan market showed significant resilience relative to other fixed income markets due to its lower price sensitivity to increases in interest rates (Figure 1). Heading into 2023, the asset class was armed with a much higher coupon which, along with some modest price recovery, allowed it to quickly recapture the negative results of 2022 and outperform other markets for a second consecutive year.

Figure 1: Loans Have Outperformed Other Fixed Income Asset Classes

Sources: Sources: Credit Suisse; J.P. Morgan; Bloomberg. As of December 31, 2023. Returns are hedged to USD.

Sources: Sources: Credit Suisse; J.P. Morgan; Bloomberg. As of December 31, 2023. Returns are hedged to USD.