Important Information

The document is for informational purposes only and is not an offer or solicitation for the purchase or sale of any financial instrument or service. The material herein was prepared without any consideration of the investment objectives, financial situation or particular needs of anyone who may receive it. This document is not, and must not be treated as, investment advice, investment recommendations, or investment research.

In making an investment decision, prospective investors must rely on their own examination of the merits and risks involved and before making any investment decision, it is recommended that prospective investors seek independent investment, legal, tax, accounting or other professional advice as appropriate.

Unless otherwise mentioned, the views contained in this document are those of Barings. These views are made in good faith in relation to the facts known at the time of preparation and are subject to change without notice. Parts of this document may be based on information received from sources we believe to be reliable. Although every effort is taken to ensure that the information contained in this document is accurate, Barings makes no representation or warranty, express or implied, regarding the accuracy, completeness or adequacy of the information.

Forecasts in this document reflect Barings’ market views as of the preparation date and may change without notice. Projections are not guarantees of future performance. The value of investments and any income may fluctuate and are not guaranteed by Barings or any other party. Examples, portfolio compositions, and investment results shown are for illustrative purposes only and do not predict future outcomes. Actual investments may differ significantly in size, composition, and risk. No assurance is given that any investment will be profitable or avoid losses. Currency exchange rate fluctuations may impact investment value.

Investments involve risks, including potential loss of principal. Past performance is not indicative of future results. Investors should not only base on this document alone to make investment decision.

This document is issued by Baring Asset Management (Asia) Limited. It has not been reviewed by the Securities and Futures Commission of Hong Kong.

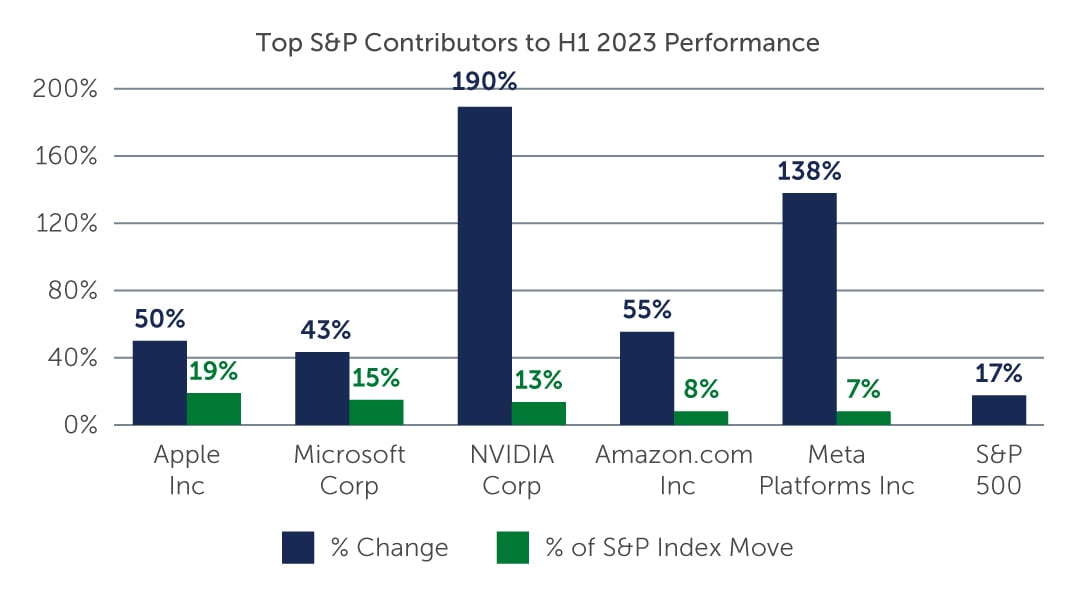

Source: Bloomberg. As of June 30, 2023.

Source: Bloomberg. As of June 30, 2023.