The Evolving Opportunity in Real Estate Debt

While the current landscape may be challenging to navigate, it is also shaping a compelling opportunity in real estate debt—from core to opportunistic lending.

There are a number of risks facing real estate today—from a macro environment characterized by higher rates and persistent inflation, to structural changes in investor demand, particularly for sectors like office. However, the significant increase in base rates over the last six to nine months, combined with wider spreads in the market, has also resulted in a more attractive risk-return profile for real estate debt. This suggests that while the current landscape may be difficult to navigate, it is also presenting select compelling opportunities across the asset class.

A Murky Picture on Valuations

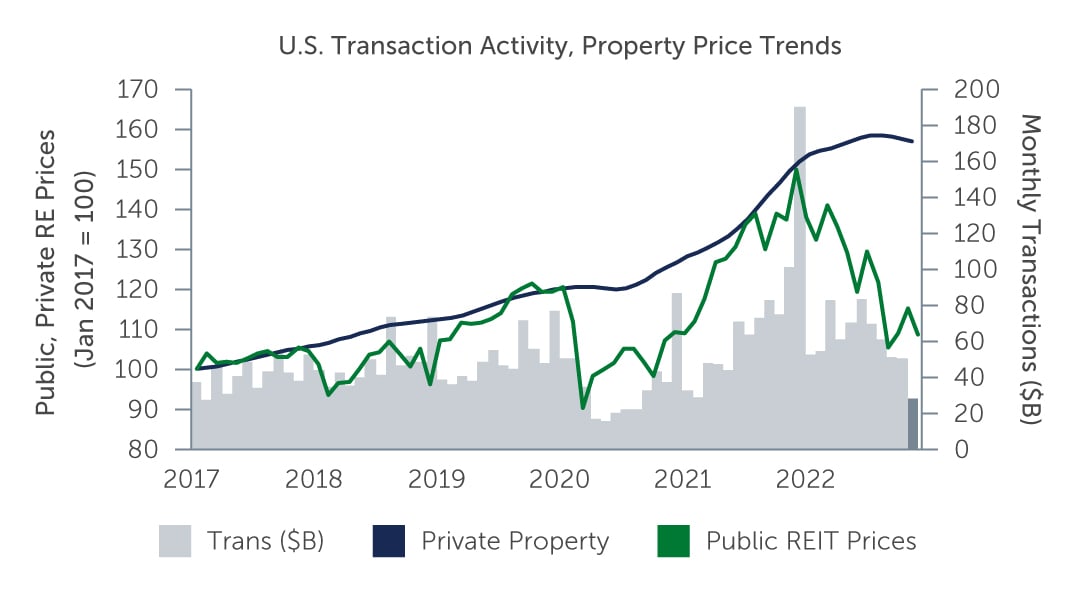

Against the challenging backdrop, transaction volumes in the U.S. real estate market have fallen precipitously (Figure 1), and it is a similar case in Europe. Given the expectations for lower interest rates in the future, there is less refinancing activity in the market. At the same time, financing for new acquisitions—which can make up around 40–60% of the pipeline—has all but disappeared. With fewer transactional data points, the picture on underlying real estate valuations is murky—and depending on how the macro picture evolves, there could be continued pressure on capitalization rates and property level cash flows. This uncertain environment has led to a pull back from traditional lenders such as banks and insurers who are facing potential challenges with their existing portfolios. That said, it appears to be a great time to be a lender if you have dry powder and can structure around the current risks.

Figure 1: U.S. Transactions Have Fallen Back to Pandemic Lows

Source: Bloomberg, Federal Reserve, NAREIT, NCREIF. As of December 31, 2022.

Source: Bloomberg, Federal Reserve, NAREIT, NCREIF. As of December 31, 2022.