Hong Kong & China Stock Markets: Investment Case for 2026

Hong Kong and China stock markets are nearing a pivotal moment, driven by secular trends, policy support and evolving global dynamics. The key investment themes of the region are technological innovation, sectoral transformation, consumer opportunity and market structure.

Technology as a National Priority

AI, Semiconductors & Localization

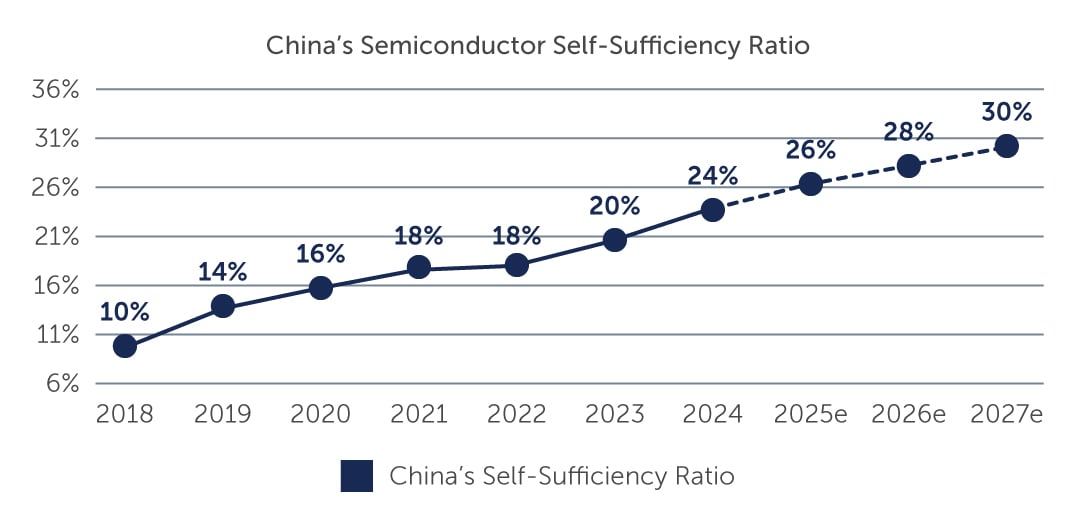

China’s unwavering commitment to technological advancement remains at the heart of its forward-looking investment agenda. Artificial intelligence (AI) is poised to become a transformative force, driving productivity gains in an economy where the workforce has already peaked and is now shrinking. Amid this backdrop, government industrial policy continues to prioritize foundational sectors, including semiconductors, foundries, memory and analogue components. In turn, Chinese equity markets are increasingly benefiting from this trend, with a diverse pipeline of technology IPOs enhancing the breadth and depth of investment opportunities.

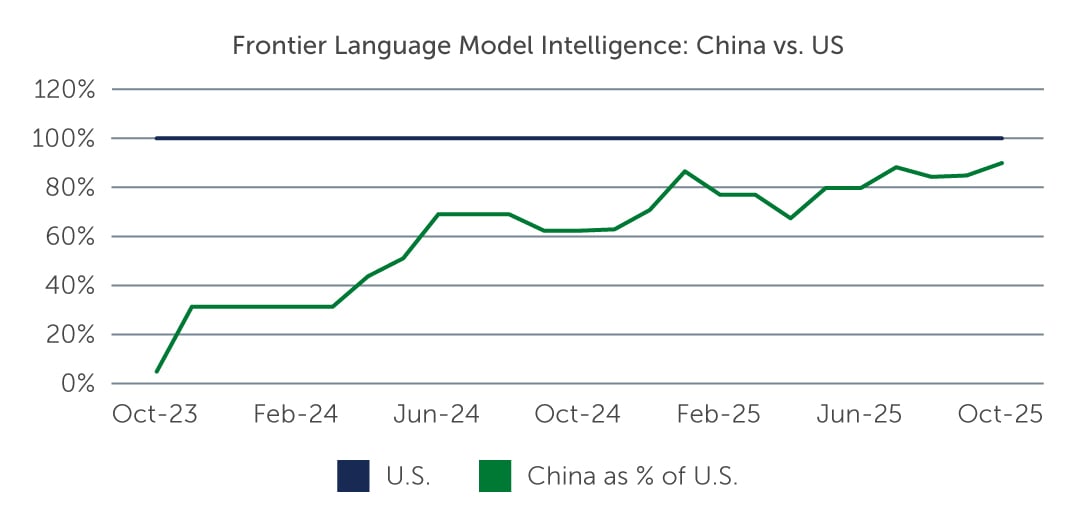

China’s domestic AI models are rapidly narrowing the gap with their U.S. counterparts, achieving near-parity in a range of practical applications, from language processing to image and video analysis. This progress is mirrored in the local ecosystem’s surge in innovation, driven by both large-scale and specialist developers working across verticals such as voice, video and image recognition. The localization of technology—reducing reliance on foreign suppliers and cultivating indigenous platforms—has become a strategic imperative, further supporting sustainable, long-term growth.

Figure 1: China’s AI Models Are Reaching Parity With the U.S.

Source: Jefferies. As of November 2025.

Source: Jefferies. As of November 2025.

Figure 2: China’s Localization Efforts Are an Important Driver of Growth & Innovation

Source: Gartner, WSTS, SIA, Company Data, Morgan Stanley research. As of November 2025. E = estimates.

Source: Gartner, WSTS, SIA, Company Data, Morgan Stanley research. As of November 2025. E = estimates.

26-5115749