CLOs: Quality is Key

While there are potential opportunities across the CLO capital structure, we continue to favor higher-quality tranches.

It was another strong quarter for collateralized loan obligations (CLOs), which benefitted from improved sentiment and the growing likelihood of an economic soft landing. Through December, AAA, AA and single-A CLOs returned 2.18%, 2.60% and 2.89%, respectively.1 BBB, BB and single-B CLOs returned 4.65%, 7.33% and 8.08%.2 As interest rates stabilize and perhaps decline, the floating-rate nature of the asset class will inevitably become less of a tailwind. Nonetheless, CLOs remain relatively well-positioned and, while macro challenges and uncertainties lie ahead, should continue to offer opportunities going forward.

Mixed Fundamentals, Positive Technicals

Fundamentals continue to hold up well despite some deterioration. Unsurprisingly, the effects of higher interest rates in the form of increased borrowing costs have continued to weigh on the leveraged loan market and, among other factors, have contributed to an increase in the default rate for U.S. loans, from 1.6% in 2022 to 3.2% for the trailing 12-month period ending in December.3 Even if interest rates level off, the effects of higher rates will likely continue to be felt. And while we don’t expect the default rate to go beyond the 3%-5% range, downgrades will probably continue—although even at these levels, defaults would not exceed the stress capacity that CLO structures were built to withstand. Noteworthy, also, is the growing bifurcation of the market, with certain subsets likely to experience more stress than others.

The market’s technical forces look to become more nuanced drivers in the months ahead. In contrast to 2023’s low level of new issuance and refinancing/reset activity, 2024 is likely to see an upswing in both, increasing supply. This is partly due to the return of AAA buyers, namely banks, to the new issue market after sitting on the sidelines for much of last year. AAA spreads will likely continue to tighten as a result, which may also contribute to increased supply. At the same time, many deals that were not called in 2023—as loan prices were too low to sell all the collateral and pay off the debt tranches—may now become callable because as loans are prepaying, managers are finding it more difficult to reinvest proceeds. This could present significant upside for seasoned lower-mezzanine tranches from under-performing deals in particular, where prices have remained depressed due to the increased risks. Finally, the still-elevated coupons received on the January payment dates, will provide significant funds to re-deploy and further contribute to the positive technical backdrop and potential spread tightening.

Private Credit CLOs & Other Opportunities

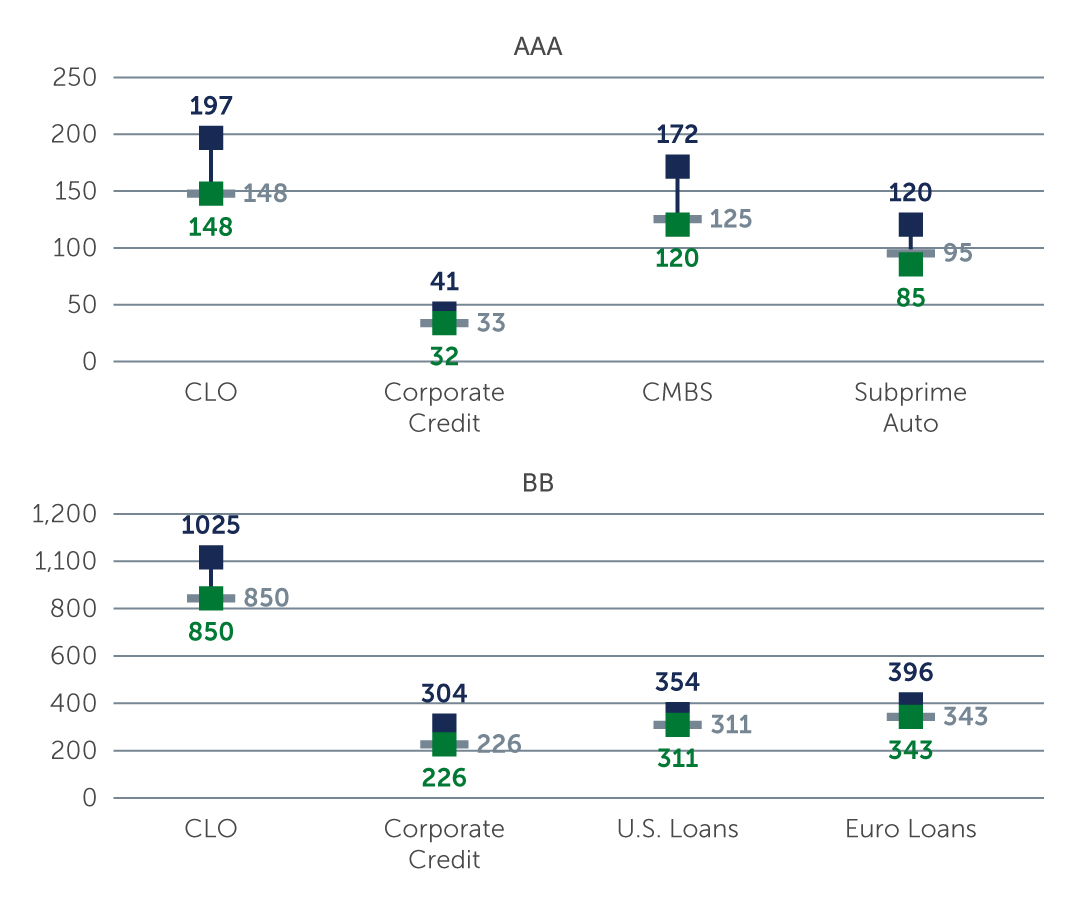

There are potential opportunities across the capital structure, but with companies still facing significant debt burdens, we continue to favor higher-quality tranches. At the top part of the capital structure, AAAs look compelling on a risk-adjusted basis—despite the recent tightening—especially considering that the credit risk component is minimal. For insurance companies and other long-term, buy-and-hold investors, we continue to see a potentially compelling value proposition is the private credit/middle market CLO space. Historically accounting for about 10% of the market, private credit last year grew to roughly 20% of total issuance, with expectations for 30% in 2024.4 Relative to the broadly syndicated market, private credit CLOs offer the potential for a significant spread pickup—AAA and AA tranches are currently offering a spread pick-up of around 75 bps.5

Figure 1: CLOs Offer Attractive Spread Pick-Up vs. Other Asset Classes

Sources: CLO spread: J.P. Morgan CLOIE Index DM. CLO spreads represent the entire U.S. CLO market. Subprime Auto Spread to Swap: Bank of America/Merrill Lynch. CMBS and Corporate Credit Spread to Swap: Barclays. U.S. and Europeans Loan Spread: Credit Suisse. As of December 31, 2023.

Sources: CLO spread: J.P. Morgan CLOIE Index DM. CLO spreads represent the entire U.S. CLO market. Subprime Auto Spread to Swap: Bank of America/Merrill Lynch. CMBS and Corporate Credit Spread to Swap: Barclays. U.S. and Europeans Loan Spread: Credit Suisse. As of December 31, 2023.

In the mezzanine part of capital structure, technicals are expected to be quite strong in the near term but we think there could be volatility as the year progresses and the U.S. prepares for a potentially tumultuous lead-up to the November presidential election. As such, we continue to favor an “up in quality and up in liquidity” approach to BB-rated tranche purchases in particular We favor a combination of new issues backed by clean portfolios and high-quality secondary market purchases at discounted prices, albeit with considerably less discount than was afforded in recent months. We also continue to find interesting one-off opportunities in secondary market CLO equity.

The Months Ahead

While fundamental and technical forces appear supportive for early 2024, the remainder of the year could prove challenging for the CLO market. Overall, borrowers are financially strong, but some could struggle if the economy weakens, or their interest burden becomes too onerous. Despite the uncertainty, the potential for attractive incremental yield through an investment with robust structural protections continues to make a strong case for CLO investing. Crucial to capitalizing on relative value opportunities and minimizing potential risks in the coming year will be experienced active management and careful manager selection.

1. Source: J.P. Morgan. As of December 31, 2023.

2. Source: J.P. Morgan. As of December 31, 2023.

3. Source: J.P. Morgan. As of December 31, 2023.

4. Source: J.P. Morgan. As of December 31, 2023.

5. Source: Barings. As of January 2024.