CLOs: A Bifurcated Field of Opportunities

While the likelihood of higher-for-longer interest rates continues to present challenges, it has also created attractive opportunities across the CLO market—particularly in higher quality tranches.

Against a backdrop of ongoing macroeconomic uncertainties, and with interest rates likely to remain higher for longer, the collateralized loan obligation (CLO) market continues to look attractive—especially given the strong structural protections and the incremental yield on offer. As a result, CLOs performed well compared to similarly rated corporate credit. For example, the CLO market returned 2.43% for the second quarter, outperforming both U.S. investment grade corporates (-0.34%) and U.S. high yield corporates (1.73%).1

That said, the bifurcation that has characterized the CLO market over the last several months continues unabated. At the highest-rated end of the capital structure, the value on offer continues to look extremely attractive due to fewer credit concerns, little tail risk, and unusually high yields that have risen in tandem with interest rates. Lower down the capital stack, higher coupons have attracted some interest but haven’t completely offset investor wariness about potential credit issues that could ensue if an economic downturn materializes. In equity tranches, where uncertainty over the future is being expressed most directly, activity has largely frozen.

Fundamentals & Technicals Support Market Divergence

With the eurozone technically in recession, aggressive central bank tightening has yet to produce the same result in the U.S. or U.K., but the policy is having an impact. Inflation has slowed along with several measures of economic activity. Fundamentals remain relatively strong, although less robust than at the start of the year, causing leveraged loan defaults to start ticking slowly higher. In February, the U.S. leveraged loan default rate rose above 1% for the first time in 20 months2 and stood at about 1.5% at the end of June, still below the 10-year average of 1.86%3. If economic conditions deteriorate further, defaults could reach 3% or even 4%.4 At the same time, recoveries are likely to be lower this cycle than the historical average of about 70%, and in many cases may take longer to realize than in previous cycles.5 In addition, CCC-rated issues as a proportion of CLO portfolios have started to rise.6 Still, these higher risks should remain manageable. This is in large part due to the ability of CLO managers to actively trade around defaults and losses, while protections inherent in the CLO structure were built to withstand such stresses. These protections are particularly strong for higher-rated tranches—in fact, AAA tranches have never defaulted or experienced a principal impairment.7

Given the economic environment, and with concerns about credit quality ongoing, investors have been flocking to the highest end of the CLO market in terms of both ratings and managers. In the secondary market, higher quality CLO tranches continue to be well-bid. For mezzanine and equity tranches, the current environment poses challenges, particularly for mezzanine tranches in certain 2017-2018 deals that are near or coming out of their reinvestment period and have more exposure to tail risks. Meanwhile, for CLO equity tranches, liabilities remain wide to loan prices, which makes earning an attractive return on the tranches more difficult.

The bifurcation has been exacerbated by technical factors. U.S. banks have continued to be mainly on the sidelines as buyers of CLO paper even as Japanese banks continue to make their presence felt strongly—particularly in the AAA segment. New issuance also remains relatively muted, with $55.6 billion and $12.6 billion issued in the U.S. and Europe, respectively, by quarter-end as the wider CLO liabilities make pricing new deals challenging, particularly for non-tier 1 managers.8

The theme of bifurcation is playing out in different parts of the market as well. For instance, there have been notable pricing differences in the CLOs issued by tier 1, tier 2, and tier 3 managers—presenting potential opportunities for an attractive spread pick-up. In particular, when it comes to AAA in today’s market, there can be up to a 50 basis points (bps) difference between managers and, therefore, it is not surprising that most of the volume this year has been concentrated from tier 1 managers while others are waiting on the sidelines to issue.9 There is further bifurcation in the underlying loan market, where high-quality names are trading in the 98 range and more “storied” names are trading at steep discounts.10

The Attraction of Higher Quality

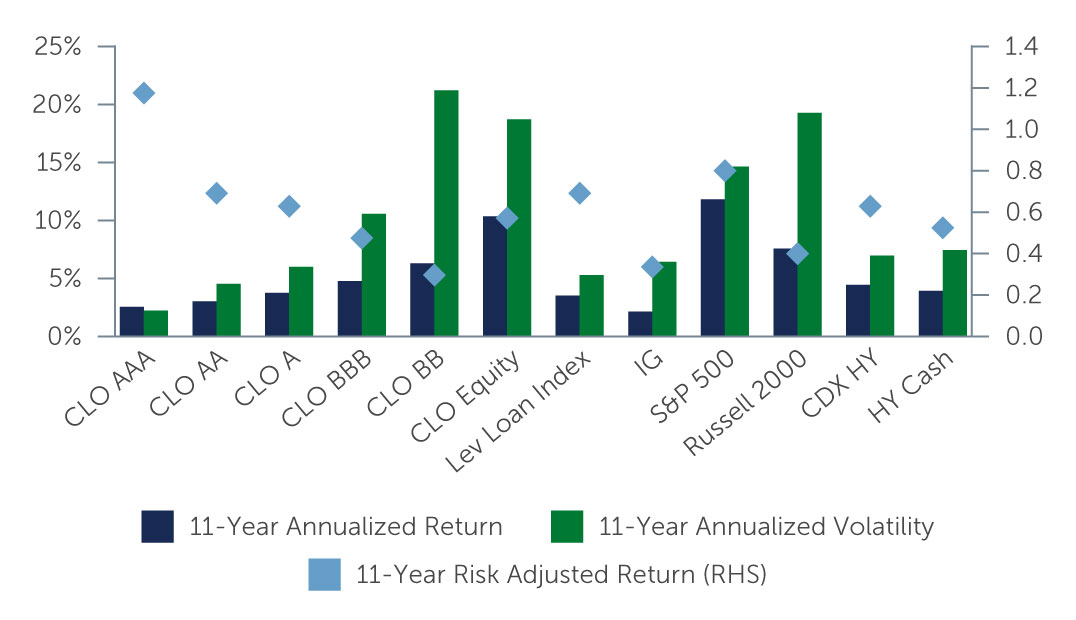

Across the market, select opportunities continue to emerge. With base rates currently above 5% and coupons on risk-remote new issue AAA CLOs roughly at 7%, the top part of the capital structure looks extremely attractive today.11 In addition, AA tranches offer a more significant pick-up to AAAs versus historical levels and have significant structural support. The higher-quality CLO tranches in the secondary market continue to be well bid, especially with investors continuing to move toward higher ratings and higher liquidity.

Lower down the capital stack, BBB tranches are also well-bid and we believe opportunities continue to surface, but as investors continue moving down in terms of quality, selectivity becomes even more critical. With careful assessment of credit and manager risk, we believe that selectively adding positions here can boost an overall portfolio’s yield without taking on more risk than is prudent. Given the appeal of higher-rated tranches today, we see less value in new issue equity given that is the riskiest, first-loss position in the capital structure and the incremental potential returns on offer today do not appear to compensate for the added risk.

Figure 1: CLO AAA Offers Compelling Risk-Adjusted Returns

Source: Citi. As of June 9, 2023.

Source: Citi. As of June 9, 2023.

Takeaway

Looking ahead, with the macro story taking longer than expected to play out, and with defaults likely to tick higher and recoveries likely to be lower, staying up in quality and liquidity makes sense—especially given the very attractive opportunities on offer in the high-quality part of the CLO market. That said, we believe it is important not to lose sight that over the medium term, credit looks compelling, and current market conditions are creating opportunities at a significant discount. In addition, CLOs offer robust structural protections and provide the potential for considerable incremental yield relative to similarly rated investment grade and high yield corporate credit.

As a result, and given that timing the market is challenging, we think now is a good time to consider the asset class. But active management and careful manager selection remain critical to both minimizing potential risks and capitalizing on relative value as it emerges up and down the capital structure.

1. Source: J.P. Morgan. As of June 30, 2023.

2. Source: Pitchbook. As of July 6, 2023.

3. Source: Pitchbook. As of May 31, 2023.

4. Source: S&P.

5. Source: Moody’s. As of March 13, 2023.

6. Source: BofA, Bloomberg, Intex. As of June 30, 2023.

7. Source: S&P. As of December 31, 2022.

8. Source: J.P. Morgan. As of June 30, 2023.

9. Source: Citi. As of June 9, 2023.

10. Source: Barings’ observations.

11. Source: Barings. As of June 30, 2023.