A Solid Case for IG Credit, But Caution is Required

Against a backdrop of elevated uncertainty, IG corporate credit—with healthy corporate balance sheets and a relatively attractive total return potential—looks well-positioned.

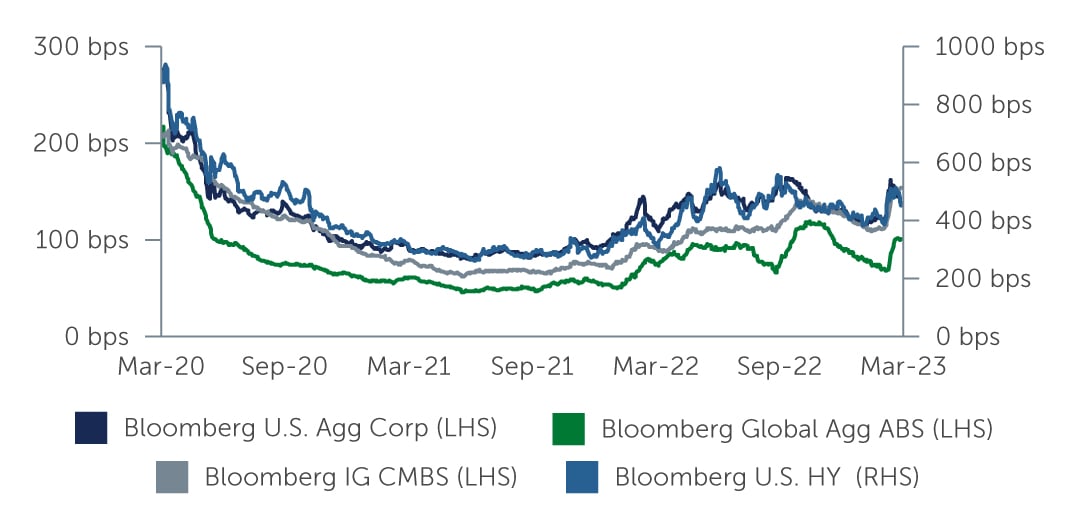

Adding to the already long list of challenges facing investors, which includes elevated inflation, rising rates and recession risks, were the difficulties that emerged in the U.S. banking sector in March, which rattled markets. Within the investment grade (IG) corporate space, banking spreads widened by 50 basis points (bps) during the month alone. The broader market fared slightly better, with spreads ending the quarter only 28 bps wider than where they started the year.1 More broadly, the challenges facing the banking sector will likely contribute to tighter financial conditions going forward, with less available credit increasing the potential for a recession.

Figure 1: IG Spreads Have Remained Relatively Stable Despite Banking Concerns

Source: Bloomberg Barclays. As of March 31, 2023.

Technicals & Fundamentals Still Sound

Despite the volatile backdrop, technicals across the market have remained relatively supportive. While the new issue market shut temporarily with the onset of the banking challenges, it has since reopened, mainly to defensive sectors such as utilities and industrials. During the first quarter, overall new issuance reached roughly $508 billion.2 Higher rates are also keeping issuance levels lower than expected, which is supportive of the asset class overall. Meanwhile, demand has been encouraging. The theme of outflows last year, which was largely a result of the negative total returns, has reversed this year as higher yields continue to attract renewed interest in IG. More specifically, almost every week this year has recorded inflows into the asset class—with only very modest outflows toward the end of March when the banking crisis hit. In total, around $61.7 billion of flows entered the asset class during the first quarter.3

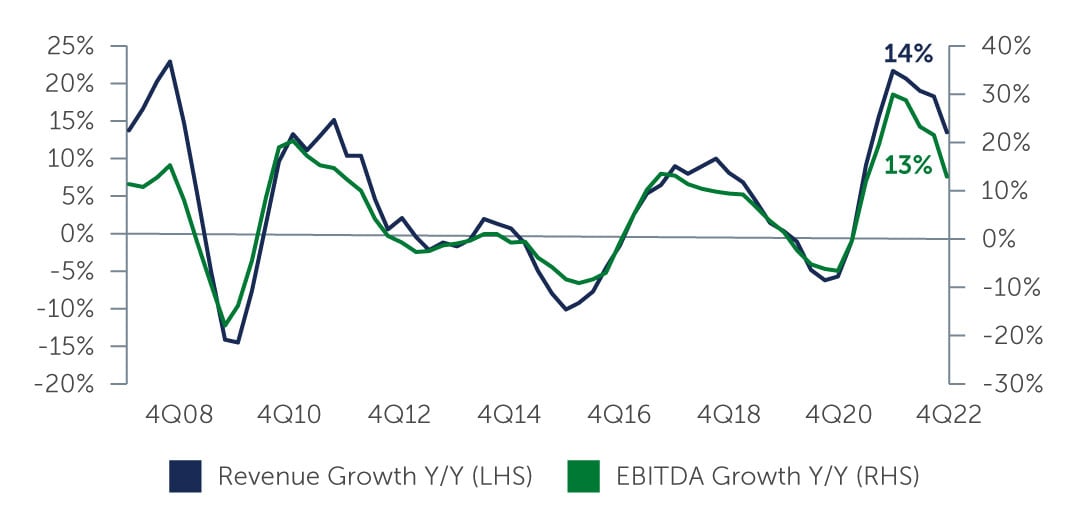

From a fundamental standpoint, IG corporates remain well-positioned entering this challenging period. While inflation is still elevated, and the risks of a recession have risen, corporate profit margins may decline slightly going forward—but companies are still being fairly conservative in managing their balance sheets. In particular, revenues and EBITDA remain healthy and leverage levels have also continued to decline (Figure 2). That said, we are likely to see some impact on the fundamentals of issuers in the financial sector as well as those that have been directly impacted by the bank failures, such as smaller tech companies.

Figure 2: Corporate Fundamentals Remain Solid

Source: J.P. Morgan. As of December 31, 2022.

A Still-Strong Case for IG

With a number of uncertainties on the horizon, volatility is likely a given in the near term. But market movements can also offer attractive opportunities, especially in sectors where spreads have widened beyond what fundamentals would suggest. For instance, given the wide dispersion across the banking sector today, there are select opportunities in banks that remain sound from a credit perspective—such as U.K.-based banks, which currently look less risky than their global peers but offer similar return profiles. We also continue to see value in insurance companies and select REITs. That said, given the risks facing the office sector, issuers with exposure to commercial real estate are likely to be challenged going forward. Across the market, more defensive sectors such as utilities also look well-positioned.

Despite the near-term unrest in markets, the case for investing in IG remains strong. In addition to IG corporates’ strong balance sheets and healthy fundamentals—as well as the liquidity on offer in public fixed income—the total return potential is much more attractive than it has been over the last several years. Indeed, higher rates have driven up current yields on IG corporates to between 4.99% and 5.49% today,4 versus the low single digits of the past several years. This is likely to continue investors’ cyclical shift back into fixed income, and specially IG, going forward.

Key Takeaway

Looking ahead, there are a number of factors that require a more cautious approach to investing. For instance, while some of the stress in the banking sector has been alleviated, there is still instability in financial markets. At the same time, there is uncertainty around the path of economic data and what it could indicate in terms of a recession. Given this backdrop, a bottom-up approach to credit selection is paramount, not only to managing the risks at hand, but also to identifying the issuers that are best positioned to withstand the challenges ahead.

1. Source: Bloomberg Barclays. As of March 31, 2023.

2. Source: Bloomberg. As of March 31, 2023.

3. Source: J.P. Morgan, Bloomberg. As of March 31, 2023.

4. Source: Bloomberg U.S. Corporate Index. As of March 31, 2023.

23-2830113