Hong Kong-China Equities: Opportunities Emerge in Challenging Backdrop

Nicola Lai discusses how, despite the challenges facing Hong Kong-China equities, potential opportunities are emerging in the asset class.

What are the biggest risks facing Hong Kong-China equities today and going forward?

There are a number of risk factors facing the Hong Kong-China equities market. At a macro level, there is uncertainty around the path of the U.S. Federal Reserve’s (Fed) interest rate policy, at a time when cost pressures from rising energy prices and input costs are creating upward inflationary pressures. At the same time, there is the rising risk of a global recession. And all of this is against a backdrop of ongoing geopolitical risks.

In China, more specifically, the dynamic COVID policy and related lockdowns have impacted domestic consumption and activity levels, while challenges across the property sector continue to dampen consumer confidence. In the near term, there is also uncertainty around Hong Kong-China company earnings. Looking forward, China’s policy response will play a key role in in the economic recovery. In our opinion, Chinese authorities have the ability to further stimulate and support the economy—and we expect to see some recovery as the economy reopens following the lockdowns.

To what extent are these risks already priced into the market?

In our view, the majority of the downside risks have already been priced into the Hong Kong-China equities market. After reaching highs last year, Hong Kong-China equity valuations have retreated to more reasonable—and attractive—levels recently, falling below the 10-year average. In particular, the traditionally favored growth sectors have retreated much more across both valuations and earnings expectations, with the tech sector reaching 10-year lows in terms of 12-month forward P/E.1

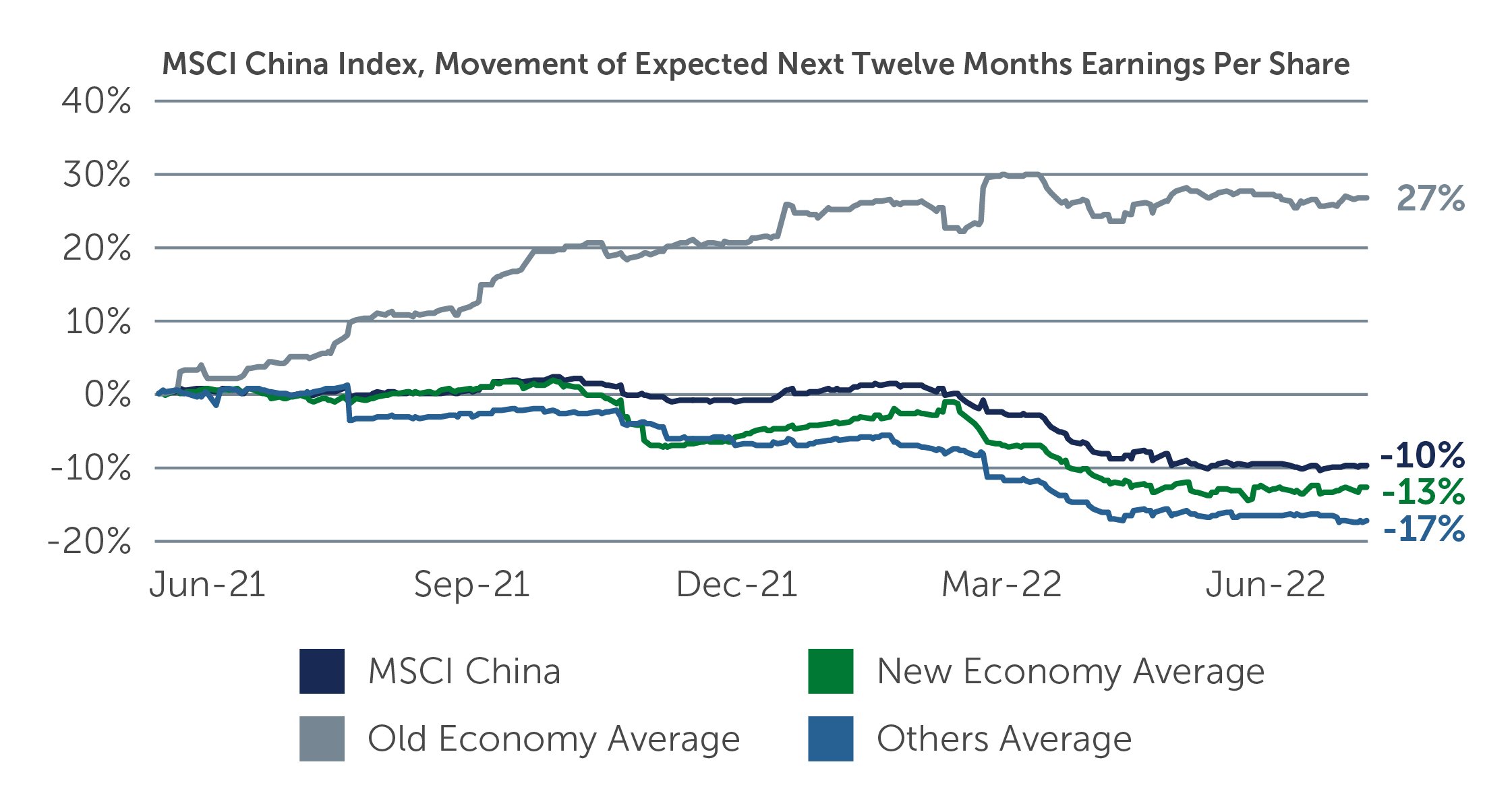

With equity valuations reaching multi-year lows, the cycle of downward earnings revisions could come to an end. In fact, steep earnings cuts have already taken place in the new economy sectors, which has resulted in valuations reaching historically cheaper levels (Figure 1). At the same time, we are also starting to see evidence of growth sectors once again outperform value sectors.

Figure 1: New Economy Sectors Most Impacted by Covid, Eps Bottomed in June

Source: Barings, FactSet Estimates. New Economy sectors include Consumer Staples, Consumer Discretionary, Healthcare, Information Technology, and Communication Services; Old Economy sectors include Energy, Industrials, Materials; Other sectors include Financials, Real Estate, and Utilities. As of August 5, 2022. Data rebased to 0% on June 30, 2022. It is not possible to invest directly in an unmanaged index.

While U.S. companies are showing some recovery, Chinese tech companies seem to be falling behind. What does this mean for opportunities and risks in Chinese and U.S. tech companies?

Chinese tech and internet companies are currently facing regulatory headwinds, which have somewhat clouded the near-term outlook for the sector. As an example, whereas the Nasdaq Index rebounded more than 15% from its mid-low level in June, the HSBC Hang Seng Tech Index declined 16% from its highs at end-June.2 However, we believe the recent share price corrections aren’t justified by fundamental earnings. For example, amid U.S. companies outperforming Chinese firms on a quarter-to-date basis, the MSCI China Information Technology EPS has rose by 5%, while the MSCI U.S. Information Technology EPS fell by 2.2%.3

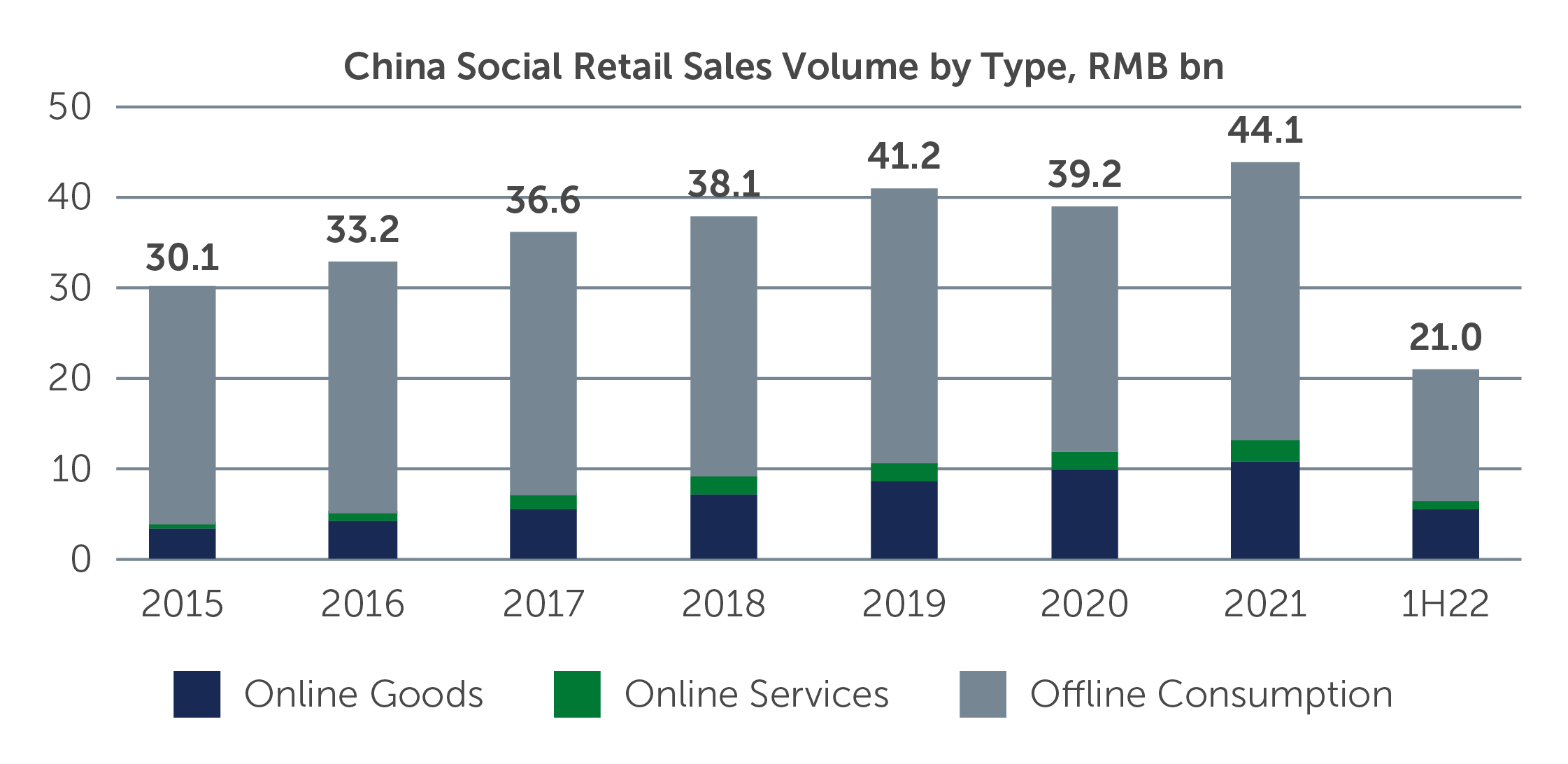

Looking ahead, as the cost of capital increases, companies (whether in the U.S. or China) with poor earnings visibility or with little cash flow could face challenges in terms of investor sentiment—and we believe that fundamentals will once again be the key driver of the Chinese tech market. In the longer term, the pandemic has brought on structural opportunities for the internet sector, such as an acceleration in the online consumption trend. We believe Hong Kong-Chinese companies that have exposure to such secular growth themes are well-positioned going forward.

Figure 2: Consumers Sector: Total Retail Sales in 1h22 Was 0.69% Lower Than 1h21 Due to Covid, but Online Sales Increased by 8.4%

Source: National Bureau of Statistics, Wind, data as of June 30, 2022.

Are global investors, generally speaking, still underweight the Hong Kong-China equities market?

In terms of allocation, practical analyses indicate that global investors are likely under-allocated to Hong Kong-Chinese equities relative to the country’s global economic standing. In fact, China is underrepresented across major developed market equity indexes, which means global investors gaining exposure to China via these indexes likely remain underweight to the key structural growth drivers shaping the asset class.

What indicators can investors consider to identify attractive opportunities in Hong Kong-China equities?

At Barings, we model and monitor companies on a long-term basis and base our target price on a company’s long-term prospects. We look for companies with strong franchises and the ability to deliver sustainable growth over three to five years. Our approach remains anchored in our Growth-at-a-Reasonable-Price (GARP) investment philosophy. In other words, we seek a reasonable valuation based on our growth projections.

We also watch companies’ near-term earnings delivery as this has implications for our long-term earnings forecasts, and we incorporate various market risks into the discount rate we use to calculate our target prices. We actively monitor changes in a company’s growth visibility, valuations, and near-term earnings revisions, and we look for any improvements at a macroeconomic level, which would lower the market discount rate.

Looking across the market, where do you see opportunities emerging?

In our many company interactions recently, we have found that a substantial number of companies are stronger today than before COVID and are entering this post-lockdown, inflationary and demand down-cycle phase on healthier footing. Many companies have built scale from market share gains and vertical integrations, and have made organizational changes, building an even more disciplined and focused management culture to capture growth and provide value to customers.

Looking across the market today, we see opportunities in solid companies that can benefit from market consolidation, as well as those businesses that have exposure to reopening themes. We also believe that the recent regulatory policies in China, which are aimed at shaping the Chinese economy for long-term sustainable growth, could lead to a new wave of structural opportunities. We continue to see attractive growth prospects in companies with exposure to structural trends such as self-sufficiency in the supply chain, technological innovation and ecological awareness. More specifically, we are focused on identifying opportunities in the new infrastructure, domestic consumption, health care, technology localization and sustainability sectors.

1. As of August 2022.

2. Source: FactSet. As of August 5, 2022.

22-2391980