EM Debt: Navigating the Noise

Possible U.S. rate hikes, Omicron, and China are causes for concern, but select opportunities exist across sovereign, corporate and local debt.

The fourth quarter of 2021 saw a significant increase in risks for emerging markets debt (EM) investors. In China, two major real estate developers defaulted on their debt. Geopolitical tensions rose as Russia continued to build up troops along the Ukrainian border. And across a number of EM countries, interest rates rose. Brazil saw a dramatic increase, while in Central and Eastern Europe, where rates had already been steadily going up, the pace of the increases accelerated. At the same time, the U.S. Federal Reserve (Fed) became more hawkish to combat high inflation, announcing that it will taper its asset-purchase program by early 2022 and possibly raise rates shortly after. These conditions brought negative returns across sovereign (-0.44%), corporate (-0.61%) and local (-2.53%) debt in the fourth quarter and caused spreads to widen across the board.1

Risks Abound

China: Perhaps the biggest concern for investors across all emerging markets relates to the developments in China. Specifically, there are indications that China’s economic growth picture may be deteriorating, but—and maybe the bigger issue is—it is becoming harder for us as investors to understand the country's trajectory. Additionally, China has been imposing tougher regulations on industries such as technology, private education and real estate, with the regulatory crackdown on real estate also beginning to affect industries like heavy manufacturing, which has already seen a slowdown. These developments are all the more unsettling given that China, the world’s second-largest economy with $13.4 trillion in GDP, dramatically impacts demand in both EM and developed markets.

A More Hawkish Fed: The Fed’s commitment to aggressively combat inflation has led to questions around the path of future rate hikes and the withdrawal of liquidity. A more hawkish stance would be challenging for EM currencies, in particular, and would likely lead to currency depreciation in certain countries. Countries with fixed or rigid rate regimes would likely face the greatest difficulties, whereas countries with flexible exchange rates, like Brazil, Peru and Indonesia, may be better positioned.

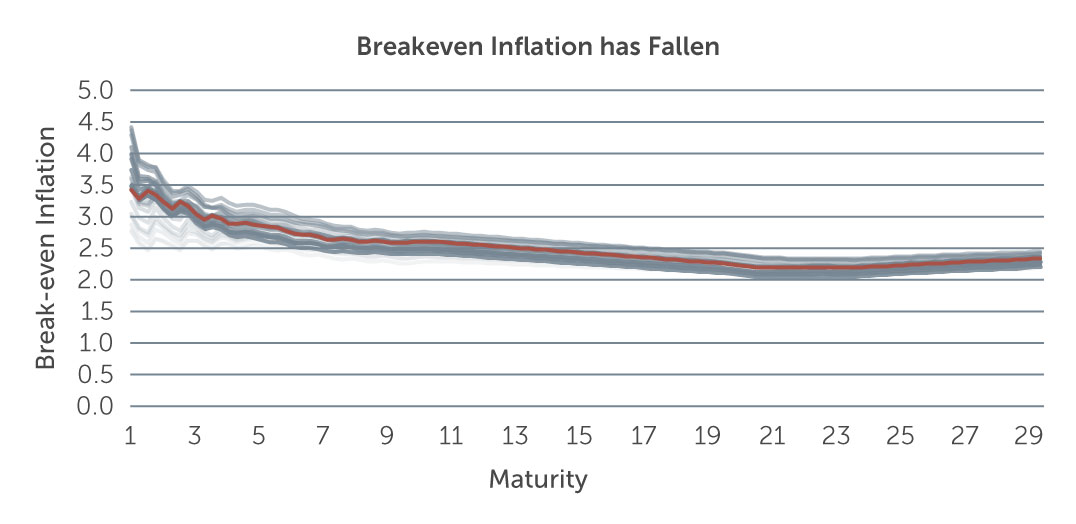

While expectations are for over three rate hikes in 2022, we do see one sign that might suggest a less aggressive path toward tightening. Breakeven inflation, or the difference between the nominal yield of a U.S. Treasury bond and an inflation-linked bond, fell in the fourth quarter. This is evident in Figure 1, which shows that the U.S. 10-year breakeven inflation rate dropped to 2.61% as of end December. The red line, representing the most recent data, is not at its 12-month low, but has come down notably since its peak several months ago.

Figure 1: A Possible Signal of a Less Aggressive Fed?

Lines represent weekly measurements with the red line being the most recent.

Source: Bloomberg. As of December 31, 2021.

In our view, this is an important measure to consider because it demonstrates where investors are pricing inflation—and a continuing decline in the breakeven rate might be enough for the Fed to take a less aggressive stance.

Politics and Geopolitics: The number of troops Russia has amassed along the Ukrainian border has many fearing an invasion. Still, given that Russia has not acted yet, we think the probability of an invasion over the course of the next 12 months is fairly low, suggesting the market may be overpricing this risk currently. And more recently, we have seen social discontent manifest in protests and military reaction in Kazakhstan. Elsewhere, in Turkey, it has been difficult to understand the central bank’s highly unorthodox approach to monetary policy. For instance, the central bank cut interest rates to boost growth, despite the Turkish inflation rate hovering above 20%, resulting in elevated volatility in the Lira.

On the bright side, geopolitical risk in Latin America has reduced since the start of 2021, following the elections in Peru, the sovereign downgrade of Colombian debt, a referendum vote in Chile, and concerns about a COVID voucher program in Brazil. While many of these risks have now passed, some uncertainties remain, including elections in both Brazil and Colombia.

COVID: Omicron certainly exacerbated some of the spread widening during the quarter, with the potential for further new strains raising the possibility of additional shocks to the EM universe. However, a number of factors suggest a more moderate economic impact from Omicron than earlier waves. For instance, vaccinations are much more widespread relative to prior waves—with overall EM vaccination rates higher and the booster shot rollout not too far behind developed market countries. As a result, EM governments are now less likely to lock down indiscriminately and should be able to sustain higher levels of activity relative to caseloads (excluding China, which has continued a zero-COVID policy).

The impact from Omicron will more likely be felt more through a weakening in sentiment due to more cautious behavior, as well as a reduced workweek due to having to self-isolate rather than government restrictions in most EMs. Omicron will further dampen demand for services in the early part of this year, but easing supply bottlenecks, as evidenced by the latest PMI surveys, should help to further reduce inflationary pressures relative to the latter part of last year.

Navigating the Noise

While there are several headwinds on the horizon and the potential for volatility, we still expect opportunities to arise for value creation—particularly for long-term investors.

SOVEREIGN HARD CURRENCY AND LOCAL DEBT

Given the risks of slower growth from China and a more hawkish Fed, we believe the top-down environment looks less welcoming for currencies in 2022, as mentioned. Within the local debt space, however, we do see select opportunities in local rates. Countries that have deep domestic markets and lower interest rates—such as Israel, Korea, Thailand and Malaysia—look the most compelling, in our view.

Against the risks mentioned above, valuations in the sovereign hard currency space are looking much more fair, with spreads more than compensating for risks in many countries, particularly at the BB level. For instance, Brazil, Chile and Peru, though linked to China, look strong and flexible enough, from a default risk perspective, to withstand a major economic slowdown in the country. We also see select opportunities in single-B countries. That said, given the diversity and dispersion in performance across this space, country selection is critical. Above all, we seek to avoid countries where financing measures are deteriorating, and take positions only in countries where we have formed high conviction.

CORPORATE DEBT

Despite the headwinds and risks highlighted above, we continue to see opportunities in the corporate debt space. We find it encouraging that company fundamentals remain strong, with revenue and EBITDA back to pre-pandemic levels for many issuers. We also expect to see further improvement as the global economy continues to recover, and expect to see some bright spots in support of global economic activity coming from expected strong household spending, global restocking and resumption of corporate CAPEX. The commodity price outlook remains favorable as well, with most metals still at historically elevated price levels. Corporate issuers also expect to maintain the ability to either pass through cost increases or implement cost cutting measures, which will help absorb the input inflation. At the same time, the default rate for EM corporate high yield debt remains low, at roughly 1.2% excluding China.2 With record levels of gross funding of US$530 billion in 2021, many corporate issuers have also refinanced a significant portion of their U.S. dollar-denominated debt at lower funding costs ahead of the potential U.S. rate rises.3

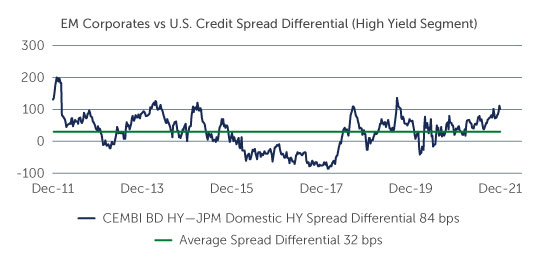

From a valuation perspective, we believe EM corporate debt continues to look attractive, given that spreads remain wide relative to developed markets and historical levels (Figure 2). In this environment, we continue to find opportunities in globally diversified EM companies where spreads are trading wider than fundamentals would suggest as a result of idiosyncratic country risks—such as we have seen recently in China, Ukraine and Turkey. Additionally, given the expectation around U.S. rate increases, we believe the high yield segment of the market looks particularly attractive for its shorter duration relative to investment grade and lower correlation with rate moves.

Discipline Is Key

While there are several factors that have the potential to create volatility going forward, we expect to see attractive opportunities emerge across the EM debt asset class as well. However, as always, credit and country selection matter, and will continue to be a big differentiator in performance. In our view, active managers that closely assess risk on a country-by-county and company-by-company basis, will be best positioned to identify the issuers that can withstand any forthcoming uncertainty and benefit the most through the ongoing recovery.

FIGURE 2: EM CORPORATE SPREADS REMAIN WIDE RELATIVE TO DEVELOPED MARKETS

Source: J.P. Morgan. As of December 31, 2021.

1. Source: J.P. Morgan. As of December 31, 2021.

2. Source: J.P. Morgan. As of December 31, 2021.

3. Source: J.P. Morgan. As of December 31, 2021.