High Yield: Reasons for Cautious Optimism

As investors braced for higher rates and an impending recession, second-quarter markets performed with surprising resilience. Together with a higher-quality market and attractive yields, the case for high yield looks compelling.

As fears of a wave of regional-bank failures abated at the start of the second quarter, option-adjusted global high yield spreads started to narrow—but only to jump to the 496 basis points (bps) level again in early May as worries about a U.S. debt-ceiling crisis mounted.1 But with first-quarter earnings less dire than initially expected and a labor market continuing to show strength—combined with hopes that a debt-ceiling agreement eventually would be reached—market sentiment largely improved. As a result, spreads declined to end the quarter at 417 bps.2 Against a more-resilient-than-expected backdrop, and with fixed income yields rising to attractive levels, the case for high yield looks compelling today.

A More Resilient Picture

The long-anticipated worst-case scenarios triggered by the U.S. Federal Reserve’s (Fed) steady hiking of interest rates—recession, higher unemployment, sharply lower earnings, greater defaults—did not materialize in the past few months. Instead, a mixed but relatively positive picture has emerged. Earnings are generally somewhat lower, but companies in services and leisure-related areas held up well, as did companies benefitting from infrastructure spending. Earnings softness in cyclical industries such as chemicals seemed in part due to customers waiting for the lower costs of key commodity inputs to filter down into prices. Meanwhile, despite some notable workforce cutbacks, labor shortages continue in many industries, keeping the unemployment rate low and consumer spending steady.

With the macroeconomic backdrop more constructive than feared, lower-quality credit continued to outperform, surprising many who anticipated investment grade securities to do so. In fact, a ‘fear of missing out’ on the part of market participants who had previously steered clear of risk assets may have contributed to the persistence and strength of the rally.

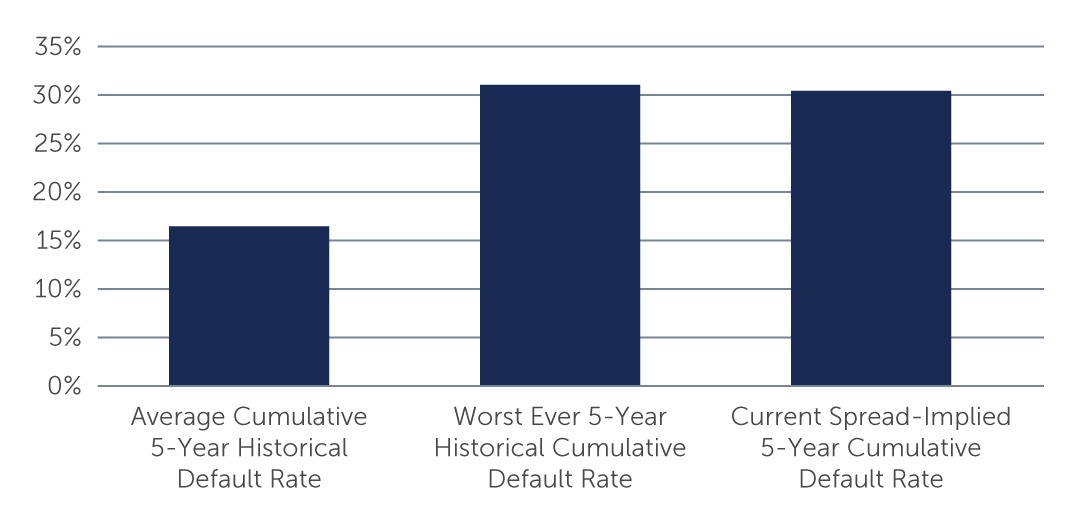

Underlying the market’s resilience is the strong financial condition of most issuers, which generally have lower leverage and higher interest coverage than they did before the pandemic. The credit quality of the high yield market remains at historically high levels with BB and single-B issuers making up 52% and 39% of developed markets high yield today, respectively, while CCC and below issuers comprise 9%.3 Default rates, although inching up due to some idiosyncratic cases, are expected to be around 3%.4 Even if a recession arrives later this year or in 2024, a sharp increase in defaults looks less likely, especially given the ample cash cushions and financial discipline evident at many issuers. In our opinion, at current and anticipated default rates, likely credit losses can be readily absorbed by the high yield market. Specifically, high yield spreads are currently compensating investors for defaults worse than 2x historical averages, and close to the worst ever cumulative 5-year default rate, including the Global Financial Crisis (Figure 1).

Figure 1: Current Spreads Offer Compensation to Offset GFC-Type Default Rates

Source: Barings, Deutsche Bank. As of May 18, 2023. Spread implied default rates assume 40% recovery.

Opportunities Across the Market

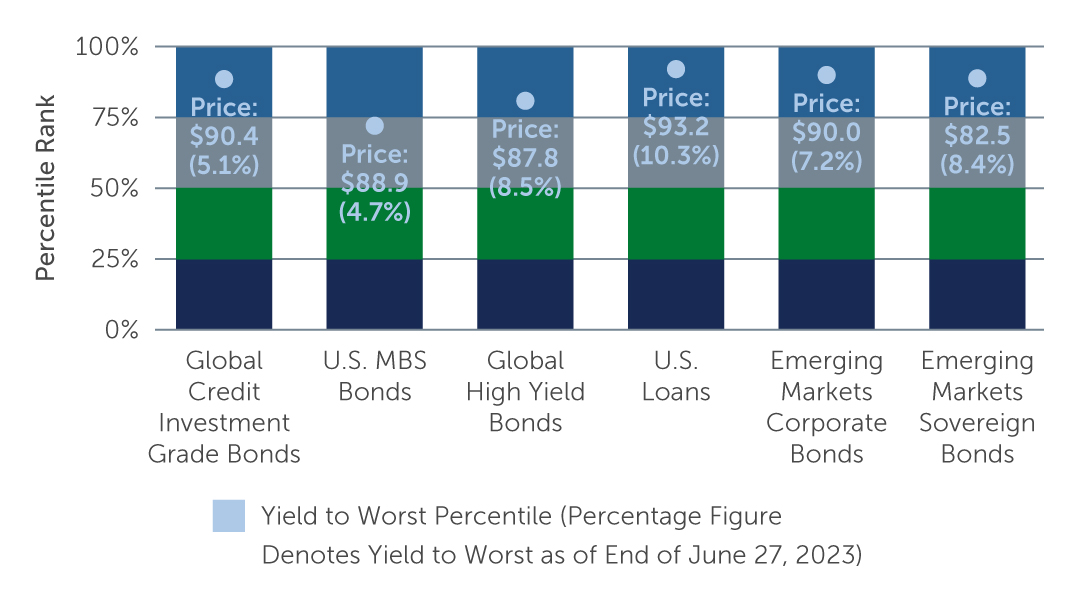

As much as there are reasons to be concerned about the economy later in the year and into 2024, current credit market conditions are attractive across the board due to higher yields that are offering a cushion against potential downside scenarios. In particular, yields across most fixed income asset classes are in the 80th-90th percentile versus the last 20 years, with yields on global high yield bonds and global loans reaching 8.5% and 10.1%, respectively, at the end of the quarter.5

Figure 2: Most Fixed Income Yields Are in the 80th-90th Percentile vs. The Last 20 Years

Source: Bank of America Merrill Lynch, Bloomberg and JP Morgan. As of June 27, 2023.

Source: Bank of America Merrill Lynch, Bloomberg and JP Morgan. As of June 27, 2023.

Meanwhile, given the potential for the Fed to continue its program of interest rate hikes, we see more value in loans in the short term, relative to high yield bonds. Coupons on floating-rate debt remain very attractive today, but in the longer term, when the end of the rate hike cycle becomes more apparent, fixed-rate debt will likely be more compelling. There are also a number of potential headwinds on the horizon for floating-rate debt. For one, there could be a possible slowdown in the formation of collateralized loan obligations (CLOs) due to the decreased attractiveness of CLO arbitrage. There is also an increasing level of older vintage CLOs passing their reinvestment periods, which could result in lower demand for loans. These headwinds, however, may be self-correcting in that as loan demand from CLOs goes down, loan yields will rise and likely lead to higher demand from other investor types.

For investors determining where to invest now, the fixed income market offers a range of attractive opportunities—but the real question concerns the liability set that is being managed. For instance, a corporation deploying cash may consider high yield bonds, while for an insurance company looking to match long-term liabilities, longer duration assets may be more attractive. Similarly, a pension fund may make regular income from a separately managed account a priority to match predictable outflows, and therefore consider the attractive coupon on offer in loans.

Reasons for Optimism

With inflation remaining stickier than expected, a deteriorating earnings outlook, and a likely recession on the cards, there are indeed a number of risks to watch for going forward—and we don’t believe that now is the time to take on excessive risk to earn higher returns. However, the potential downturn is unlikely to have as negative an impact on the high yield market as some anticipate, especially since, from a starting position of relative strength, many issuers have responded to the weaker growth outlook by adopting more creditor-friendly actions. Examples include stopping debt growth (0% change year-over-year) and making reductions in capital expenditures (-8% quarter-over-quarter) in order to help preserve balance sheet quality.6

In addition, from a macro standpoint, consumer savings and government spending could potentially help make any recession relatively manageable. This supportive backdrop, combined with the attractive level of yields, suggest that fixed income looks compelling today. However, a credit-intensive approach is crucial to both avoiding additional downside, and identifying issuers that can withstand the challenges ahead.

1. Source: Bank of America. As of May 4, 2023.

2. Source: Bank of America. As of June 30, 2023.

3. Source: Bank of America. As of June 30, 2023.

4. Source: JP Morgan. As of June 23, 2023.

5. Source: Bank of America Merrill Lynch, Bloomberg and JP Morgan. As of June 28, 2023.

6. Source: J.P. Morgan. As of March 31, 2023. Data based on U.S. high yield issuers.