European CLOs: 101

European CLOs offer resilient, floating-rate credit exposure backed by strong protections and a rapidly maturing market.

Summary

European CLOs package hundreds of senior secured corporate loans into a single, actively managed vehicle.

Investors have access to:

- Floating‑rate income that adjusts as interest rates move

- Diversified exposure across borrowers, sectors and geographies

- Access to multiple tranches spanning the risk‑return spectrum

- Structural protections designed to absorb stress and preserve senior capital

They look similar to U.S. CLOs—but Europe’s market behaves differently.

U.S. Versus Europe

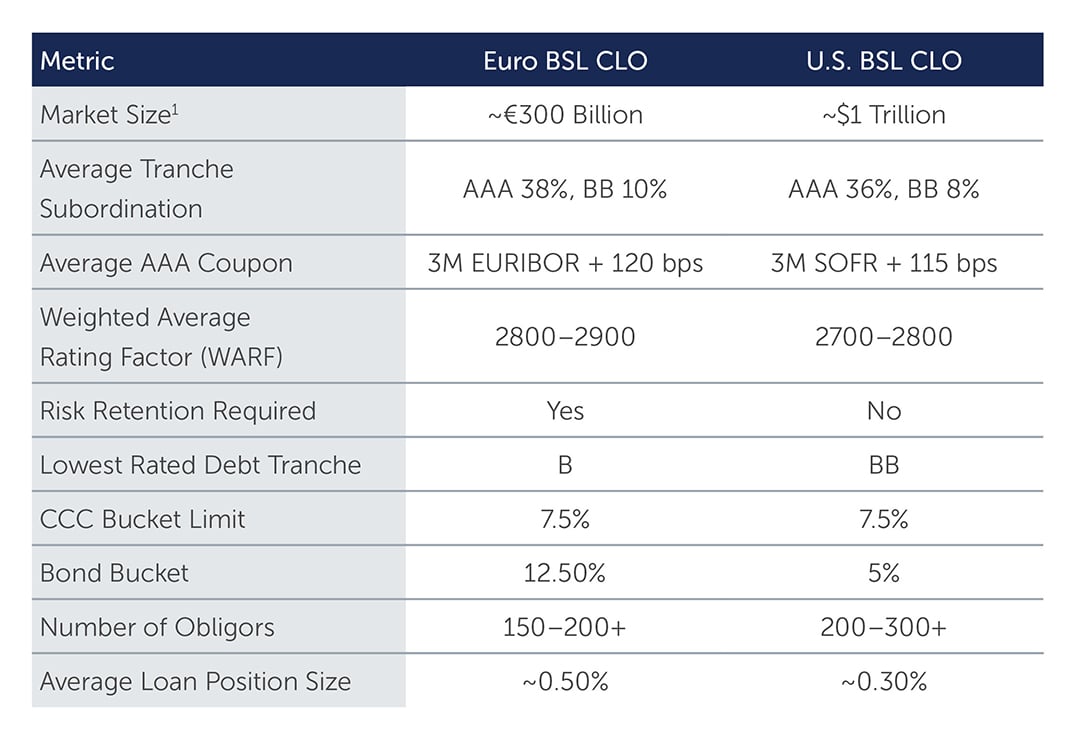

While European CLOs share a common framework with U.S. transactions, they are shaped by a smaller, more geographically diverse loan market and a distinct regulatory environment.

These differences influence portfolio construction, liquidity dynamics and how European CLOs behave across credit cycles—making them a complementary allocation rather than a substitute for U.S. exposure.

Performance That Stands Out

European CLOs have demonstrated resilience through the Global Financial Crisis, Brexit, COVID and the 2022–23 rate and inflation shocks.

Notably, no European CLO 2.0 (a CLO issued after the Global Financial Crisis) has ever defaulted.² Structural protections and self‑healing tests have consistently supported tranche stability.

1. Source: BofA. As of February 13, 2026.

2. Source S&P Global Ratings. As of March 31, 2024.

26-5211884