IG Credit: Supportive Backdrop but Risks Remain

While there are risks to monitor, higher yields, supportive technicals, and a still-solid fundamentals picture suggest that IG corporate credit continues to look attractive.

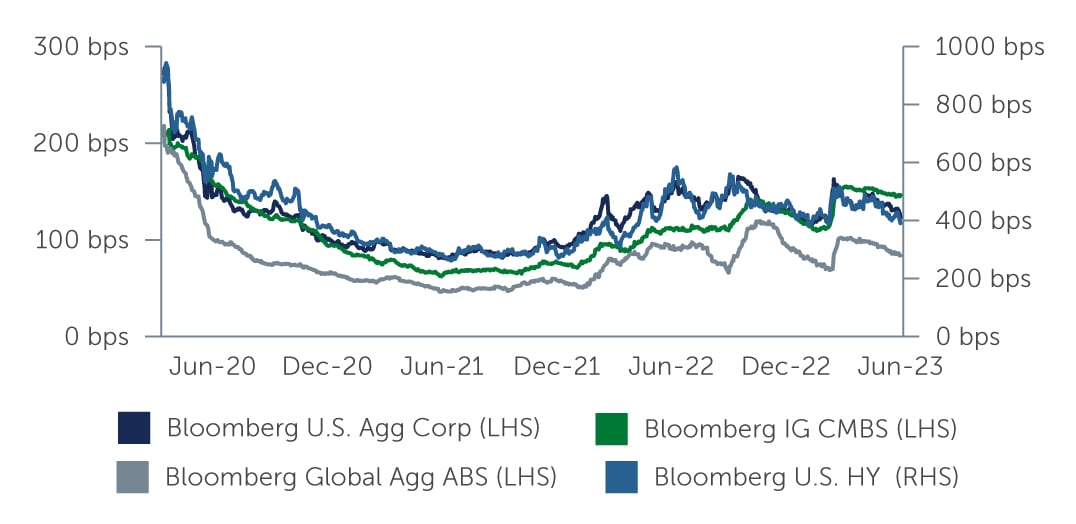

While recession concerns remain on investors’ minds, there has been a gradual shift to a belief that any coming downturn likely will be fairly mild. This change in outlook is one of the reasons—along with the relatively limited exposure that investment grade (IG) credit has to the more troubled areas of the economy including regional banks and commercial real estate—that spreads on IG corporates have held up fairly well. For instance, U.S. corporate credit spreads ended the second quarter at 123 basis points (bps), near the 10-year average of 125 bps and a bit richer than the 20-year average of about 148 bps (Figure 1).

At the same time, the metric that remains important is yields on IG corporates, which are currently in the mid-5% range—and only 4% of the time over the past decade have yields been higher.1 This attractive valuation, combined with the still solid fundamental picture for IG corporates, presents a compelling opportunity in the asset class.

Figure 1: IG Spreads Held up Relatively Well

Source: Bloomberg Barclays. As of June 30, 2023.

Source: Bloomberg Barclays. As of June 30, 2023.

Strong Technical Support

After large outflows in 2022, IG has continued to experience inflows this year, with more than $110 billion entering the asset class year-to-date.2 That reverses about two-thirds of last year’s outflows and continues to provide strong positive technical support for the IG market. Demand is mainly coming from insurance companies and pension funds, which are largely becoming more conservative and shifting away from equities and higher risk assets and moving into fixed income. European and Asian investors also are returning to U.S. IG credit as hedging costs have come down on the heels of the U.S. Federal Reserve’s pause in hiking interest rates and increasingly higher rates in Europe.

The IG new issue market has seen around $897 billion of supply coming in year-to-date.3 That is slightly lower than the level seen in 2022 and in line with expectations, and has been somewhat neutral in terms of providing technical support to the asset class. For the remainder of 2023 and into 2024, we expect new issue volume to continue near current levels—however, we could see supply rise if regional banks return to the market.

Providing further support from a technical standpoint is the positive momentum of credit rating upgrades relative to downgrades. Year-to-date, in the U.S. corporate market, 6.6% of issuers have been upgraded from high yield to IG versus 1.5% that have been downgraded from IG to below investment grade.4 This is a continuation of a trend that this year has thus far produced $41 billion of rising stars and just $11 billion of fallen angels.5

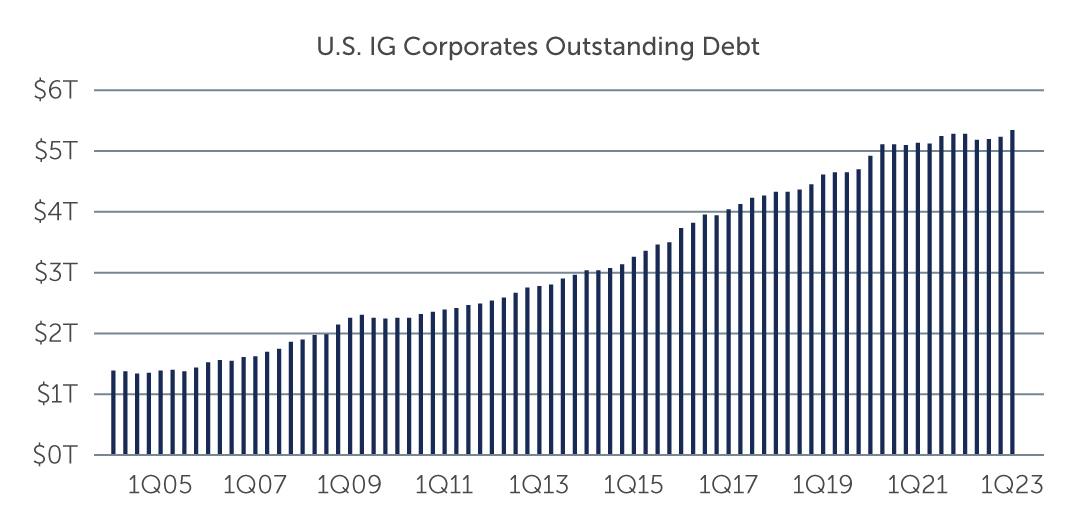

Meanwhile, from a corporate fundamentals perspective, the second quarter saw a slight deterioration with leverage ticking up and interest coverage declining slightly. However, companies remain in good financial shape overall. For instance, debt growth has been modest and shareholder returns have declined, indicating that companies are still being conservative and conserving cash in preparation for a recession.

Figure 2: Corporate Debt Growth Remains Modest

Source: J.P. Morgan. As of March 31, 2023.

Source: J.P. Morgan. As of March 31, 2023.

Areas of Opportunity

Given the supportive technical backdrop and largely solid fundamental picture, we expect to continue seeing select opportunities emerge going forward. From a sector perspective, we continue to find value in energy and financials. In particular, in the financials sector, we see value in life insurance companies and select REIT sub-sectors—but given the risks facing the office sector, issuers with exposure to commercial real estate are likely to remain challenged. While regional banks look riskier going forward, potential consolidations across the sector could create attractive opportunities. In the meantime. we continue to see value in well-diversified large U.S. and global banks. Across the market, more defensive sectors such as utilities also look well-positioned. Meanwhile, we believe the risk-reward picture for a number of sectors including tech, health care and pharmaceuticals looks less attractive today.

Outside of traditional IG corporate credit, in the securitized space, IG-rated government-sponsored mortgage-backed securities valuations have become more attractive—but again, given the concerns about the commercial real estate market, we are more cautious. We do see opportunities in IG collateralized loan obligations (CLOs), especially those with higher ratings, which offer the potential for a spread pick-up, with the added benefit of robust structures that have helped the asset class weather past periods of volatility well.

In addition, one unusual and time-sensitive area of opportunity involves the transition from the Libor interest rate benchmark to its principal replacement, the Secured Overnight Financing Rate, or SOFR. Several callable securities within IG corporates have fixed coupons that become floating coupons based on Libor upon reaching the call date. Since future conversions of this type will result in floating rate coupons based on SOFR rates, which usually are higher than Libor rates, the transition has provided some unique opportunities.

Key Takeaway

Looking ahead, there are still headwinds on the horizon. For example, while we believe the worst of the banking crisis has passed, there remain smaller regional banks that could be subject to stress, especially given their exposure to commercial real estate. In addition, there continues to be uncertainty around inflation, rates, and a potential recession. In this environment, bottom-up credit selection remains key to navigating the risks at hand—as well as to identifying the issuers that are well-positioned to withstand the challenges ahead.

1. Source: Bloomberg U.S. Corporate Index. As of June 30, 2023.

2. Source: J.P. Morgan, Bloomberg. As of June 30, 2023.

3. Source: Barclays. As of June 30, 2023.

4. Source: J.P. Morgan. As of June 30, 2023.

5. Source: J.P. Morgan. As of June 30, 2023.