IG Credit: Finding Value in Less Conventional Places

While spreads have tightened, investment grade credit continues to offer compelling total return potential as well as many idiosyncratic opportunities.

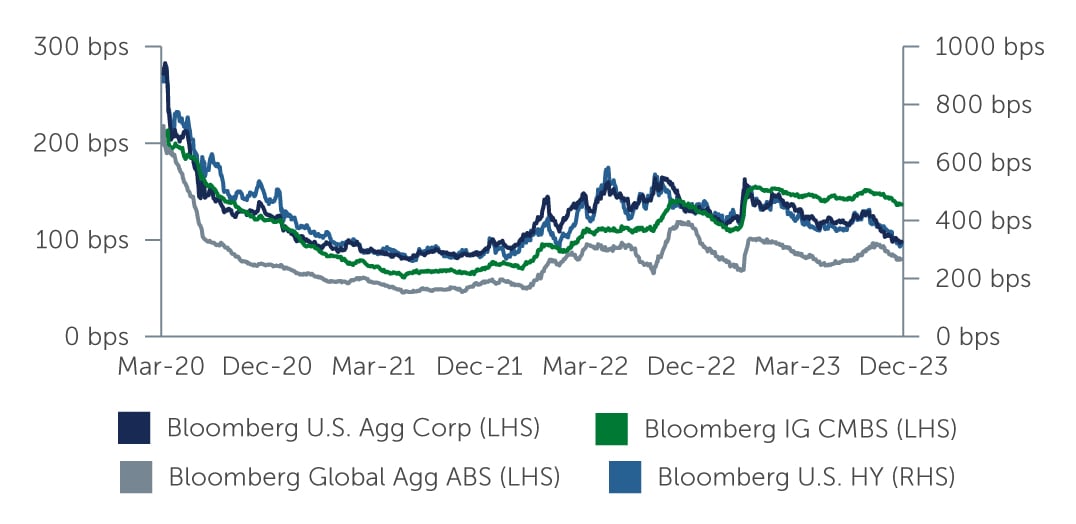

Investment grade (IG) credit looks poised to perform well this year due to a greater likelihood of interest rate cuts and issuers that have prepared for the possibility of a more challenging operating environment. Continuing the pattern seen since mid-2023, IG spreads tightened in the fourth quarter, from 121 basis points (bps) at the end of September to 99 bps as 2023 drew to a close. That is well below the 10-year average of 124 bps and significantly below the 20-year average of 149 bps—but, tight spreads don’t necessarily mean a lack of opportunity (Figure 1).

Figure 1: IG Spreads Continue to Grind Tighter

Source: Bloomberg Barclays. As of December 31, 2023.

Source: Bloomberg Barclays. As of December 31, 2023.

Softening Fundamentals, Strong Technicals

Corporate fundamentals remain positive overall, despite some recent softening. With warning flags of a recession flying for more than a year, many IG issuers have been preparing for tougher times through cuts in capex spending and by locking in long-term debt at the ultra-low rates that prevailed before the U.S. Federal Reserve began its tightening cycle. Nevertheless, interest coverage has started to decline as issuers coming to market recently have had to bear greater interest expense. While companies generally have found that customers are willing to absorb some inflation-driven higher prices, rising costs have become a headwind for margins—although recent margin declines largely represent a return to more normal profile levels following an unusual spike in margins during the Covid lockdowns. Revenue was down a slight 0.6% year-over-year, while EBITDA contracted by 6.6%, the largest year-over-year decline since the third quarter of 2016.1 Management teams seem to be reacting to slowing growth with more conservative management of balance sheets, as evidenced by the 11.1% year-over-year decline in shareholder returns.2

Going forward, favorable technical factors are likely to outweigh some of the fundamental weakening. The appeal of higher yields should result in inflows continuing to exceed outflows, as has been the case in recent months. In addition, the outlook for new supply in 2024 is a relatively flat $1.2 trillion. Should economic or policy shocks occur, the IG market’s greater liquidity relative to other credit asset classes should allow for portfolio repositioning that can help dampen volatility. Two technical indicators likely to be plateauing in coming quarters are the number of rising stars versus fallen angels and the number of credit-rating upgrades versus downgrades, each reflecting the greater difficulty issuers will face in improving credit quality from current high levels.

Idiosyncratic Opportunities

Although spread tightening in the IG asset class is a reality, so too is wide dispersion. As a result, we see current opportunities in particular industries and in certain situations. From a sector perspective, we are finding compelling opportunities in financials, especially insurance companies and large U.S. banks, as well as in Yankee bonds of large foreign banks, which are cheaply priced on an historical basis. In addition, select real estate investment trusts specializing in areas other than offices are offering value. We also are finding select opportunities in telecom and utilities, and remain positive on energy, where M&A activity has remained credit friendly. Our caution on pharma and tech continues.

“Many of the most interesting opportunities in the market today are of a more idiosyncratic or catalyst-driven nature.”

Many of the most interesting opportunities in the market today are of a more idiosyncratic or catalyst-driven nature. For instance, we have seen an uptick in equity-financed acquisitions, particularly in the insurance sector, in which a higher-rated company acquires a lower-rated issuer. Research into IG-rated sub securities and hybrid securities has led to investments in shorter-duration securities that we believe have a high probability of being called over the next two years, such as select AT1s and preferreds.

Looking Ahead

Given their still-strong financial condition and competitive advantages, IG companies tend to be fairly well-positioned to weather whatever economic difficulties may lie ahead. These fundamental advantages, as well as positive technical factors, point to continued opportunities for investors. That said, given the current phase of the economic and market cycle, those opportunities more often exist in idiosyncratic corners of the market—underscoring the importance of in-depth research capabilities, bottom-up credit selection, and long-term sector experience.

1. Source: J.P. Morgan. As of December 31, 2023.

2. Source: J.P. Morgan. As of December 31, 2023.