ESG in Equities: Engaging for Progress in Corporate Governance

When it comes to ESG, engagement can not only bring about meaningful change, but also pave the way for value creation—as evidenced by the recent improvements in governance among Japanese corporates.

When it comes to driving progress in environmental, social and governance (ESG) practices, engagement can be a powerful tool. In particular, by directly engaging with companies to improve their practices—such as requesting greater transparency in carbon disclosures or encouraging board diversity—asset managers can help create positive, long-term change and pave the way for value creation over time.

We have recently seen this through our engagement efforts with companies in Japan.

An Opportunity in Japan, With Wider Implications

Japanese corporates have a significant presence in the global market. They constitute over 20% of the MSCI EAFE index, and around 30% of the MSCI World Small Cap index.1 Japan is also home to household names like Toyota and Nintendo, as well as the world’s largest producer of wafers—an important component in manufacturing semiconductors, which are essentially the foundation of the entire electronics industry.

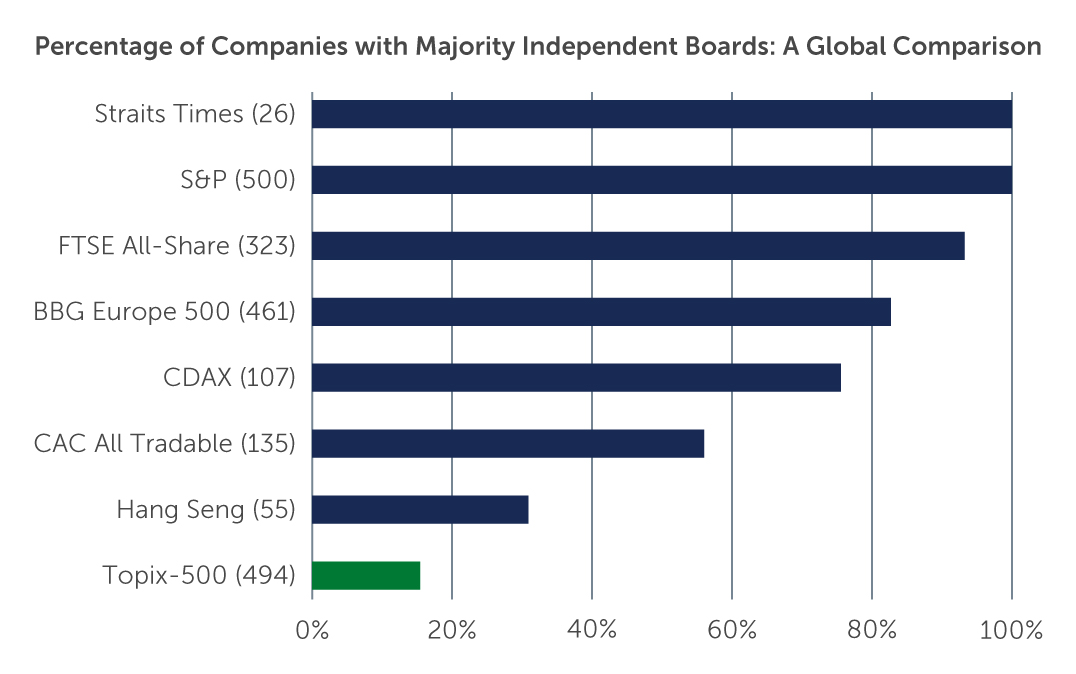

Despite Japan’s significant presence in the market—as well as continued efforts to advance the country’s Corporate Governance Code—many Japanese companies remain behind their global peers across a number of governance factors. For instance, there is significant scope to bring greater independence to company boards (Figure 1), and to improve female representation in management positions.

Figure 1: Scope for Improvement

Source: CLSA. As of March 2021.

Source: CLSA. As of March 2021.

More broadly, limited corporate governance can be harmful to a company’s growth and lead to negative issues such as lack of accountability, or even fraud—which can ultimately impact a company’s share price. Good or improving governance, on the other hand, can lead to better accountability, transparency, fairness and responsibility at a company, which can translate into stronger performance over the long term. With this in mind, and given the positive trajectory of ESG efforts in Japan, we believe there is a compelling opportunity to engage with these companies to drive positive change, and ultimately create value for investors.

Progress Over Perfection

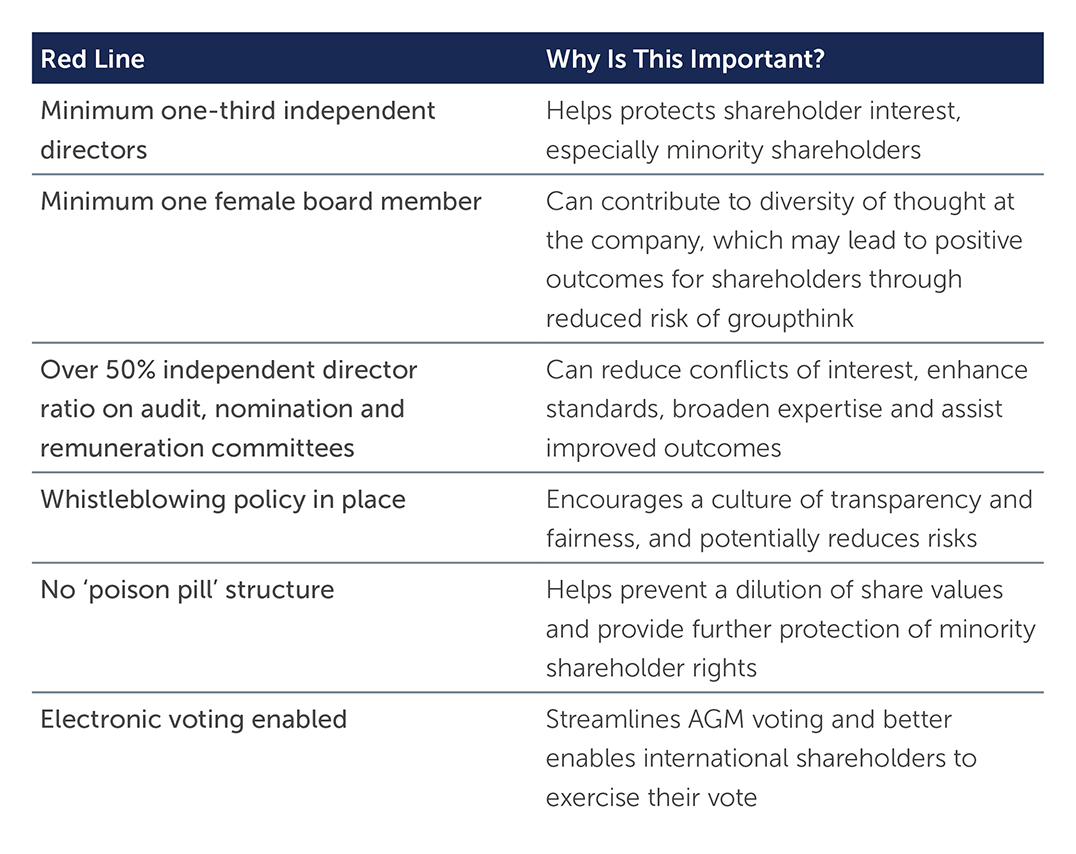

While engagement is a key principal across all of our equities strategies, we have taken our approach to Japanese companies a step further given the broad-based potential for improvement. The intention behind our approach is to provide the companies we invest in with a reasonable and realistic starting point for improving their governance efforts. To do this, we have created six so-called “red lines,” which set minimum requirements for companies across a range of governance measures. Where companies fall below these red lines, we notify management that we will vote against them at the next Annual General Meeting (AGM) unless the thresholds are achieved by then. We also notify companies of what it would take for us to vote in favor of the board or chairman. Given that voting records are made public, this can be an effective way to drive change.

As part of our engagement efforts, we often maintain an open dialogue with company management and discuss the changes we hope to see. The red lines outlined above are only a starting point to targeted and meaningful engagements with companies, rather than a substitute to our active ownership approach. As companies in Japan make progress with regard to their governance structures, we will review and strengthen the minimum thresholds to ensure further improvements are delivered—which we believe will benefit investors. For example, in 2021 we raised the threshold on the whistle blower policy by adding the requirement that this should include an external channel, by which employees could report concerns directly to independent parties. We also added a new requirement that a company should have a formal equal opportunities policy.

Engagement in Action: Positive Outcome

One of the companies we invest in is a provider of on-site and online corporate training in Japan. In November 2021, the company was failing to meet two of our red line measures: they had an independent director ratio below 33%, and they had not yet enabled electronic voting at their AGM. Since then, we have regularly engaged with senior management to address these concerns—and, encouragingly, have seen the company take positive steps toward improvement. Specifically, in addition to conducting an extensive search for an additional independent director and making an appropriate selection prior to the AGM, they enabled electronic voting. These positive outcomes are a part of a wider progression, with additional efforts being made in areas such as improving female management representation. We believe that over the long term, this should improve the likelihood that the company will deliver on its strategy successfully, to the benefit of all stakeholders, including investors.

That said, we also believe that the direction of travel of a company is extremely important, and may have a more pronounced impact on the outlook of a company than its current state. For this reason, if our initial efforts prove unsuccessful, we often opt to maintain an open dialogue with companies on how they can improve their ESG practices over time, and frequently engage with management to ensure progress is being made toward the engagement objectives that we set. In some cases, when a company has failed to improve over a designated period of time, or if there is a clear lack of commitment from management on resolving an issue, our qualitative assessment and intrinsic valuation of the company may deteriorate—and as a result, we may divest from or not invest in the company from the outset.

Engagement in Action: Working Toward Change

A global leading manufacturer of silicon wafers and PVC, which also has strong operations in a range of additional electronic and industrial materials, lacked female presence on its board. We engaged with this company, requesting that they add at least one female board member, which is one of our red lines. Despite repeated discussions on the topic, the company, unfortunately, has yet to make progress toward change. As a result, we voted against the Chairman’s reappointment at the AGM. That said, we remain optimistic in the potential for change at this company given management’s responsiveness to our concerns, and will continue to engage—via voting action and ongoing dialogue—to try and drive positive improvements in this area.

Driving Positive Change2

19

NEW ENGAGEMENTS

15

FOLLOW-UP ENGAGEMENTS3

5

SUCCESSFUL ENGAGEMENTS4

Key Takeaway

Japanese equities, given their notable presence in global equity indexes, offer a prime opportunity for engagement today. While we are encouraged by the progress many companies are already making, there is still scope for improvement—not only on governance issues, but also when it comes to environmental and social factors. Ultimately, we believe that by actively engaging with these companies we can help bring about positive change, potentially unlocking opportunities and improving risk-adjusted returns for investors in the process.

1. Source: MSCI. As of June 30, 2022.

2. Source: Barings. In the 12 month period as of May 2022.

3. Follow-up engagements refers to those where we have followed-up on an issue which we have previously engaged upon, but as yet no resolution has emerged.

4. Successful engagements refers to those where the company has taken actions to address the issue raised, and we therefore see that issue as having been successfully resolved.

22-2276169