CLOs: Navigating a Bifurcated Market

The CLO market remains well-supported, but caution is warranted as the path forward will likely be shaped by both macroeconomic forces and deal-specific characteristics.

The complex interplay between macroeconomic uncertainty, evolving monetary policy, and geopolitical tensions continues to shape risk sentiment and capital flows in the collateralized loan obligation (CLO) market. In the U.S., economic data has remained resilient, but signs of slowing momentum are emerging. Meanwhile, policy developments, particularly around tariffs, have introduced new layers of risk, contributing to episodic volatility across credit markets. Despite these challenges, investor appetite for yield has persisted, supporting demand for structured credit more broadly.

CLOs are faring relatively well against this backdrop. Performance has been positive across the capital structure, with year-to-date returns ranging from 2.7% for AAAs to 4.4% for BBs.1 The drivers of performance, however, are distinct—with technical factors heavily influencing the top of the capital structure and credit driving performance at the bottom.

Fundamentals: Resilient but Facing Pressure

The fundamental backdrop for CLOs remains relatively stable, supported by broadly healthy credit conditions in the leveraged loan market. Many issuers have taken advantage of prior market strength to extend maturities and shore up balance sheets, leaving portfolios in a generally sound position. While margin compression is expected to emerge as a theme, especially in light of ongoing tariff-related uncertainty, most companies appear to be entering this phase from a position of strength.

That said, the outlook is not without risks, and headline-driven volatility has the potential to both disrupt sentiment and challenge credit performance going forward. While second-quarter earnings will provide a clearer picture, early indicators suggest that credit deterioration remains contained for now. In terms of second-order concerns around the proportion of CCC issuers in CLO portfolios, most CLO managers have taken proactive steps to mitigate risk, including reducing exposure to lower-rated credits and maintaining conservative CCC buckets, especially in newer vintages. For context, the average exposure to CCCs across portfolios sits at approximately 3%, providing adequate cushion should additional downgrades materialize. Newer-vintage CLOs are being constructed even more conservatively, with CCC exposure often below 1%.2

Technicals Drive the Top, Credit Shapes the Bottom

The CLO market is currently characterized by a divergence in how different parts of the capital structure are trading. At the top, AAA tranches are being largely driven by technical factors, with demand from Japanese and U.S. banks, insurance companies, and ETFs shaping pricing dynamics amid still-strong supply. AAA spreads have remained “sticky” or range-bound this year as a result, and meaningful tightening beyond current levels seems unlikely. Nonetheless, the top of the capital structure continues to offer the potential for stable, if modest, returns and attractive carry—and given the likelihood of further volatility, risk-remote AA and AAA tranches can serve as a reliable anchor for investors prioritizing capital preservation and liquidity.

Further down the capital structure, mezzanine tranches are trading largely on credit fundamentals and perceived volatility. BB resets, in particular, are seeing wider spreads due to increased tail risk. The basis between new issue and reset BBs has also widened significantly, reflecting investor preference for cleaner new issues ramped with full knowledge and consideration of the companies and industries that could be adversely affected by tariffs. And we expect this bifurcation to persist, especially as a heavy reset calendar unfolds in the second half of the year. That said, as resets face wider spreads and reduced liquidity, attractive entry points could also emerge in “cleaner” reset deals on the back of broader market volatility—particularly for investors with higher risk tolerance and longer time horizons.

For CLO equity, which is highly sensitive to liability pricing, the opportunity has become more challenging. With AAA spreads remaining sticky and loan prices hovering near par, managers must walk a finer line to make the arbitrage work—though a healthy pace of deal activity suggests it remains achievable.

A Broadening Mandate

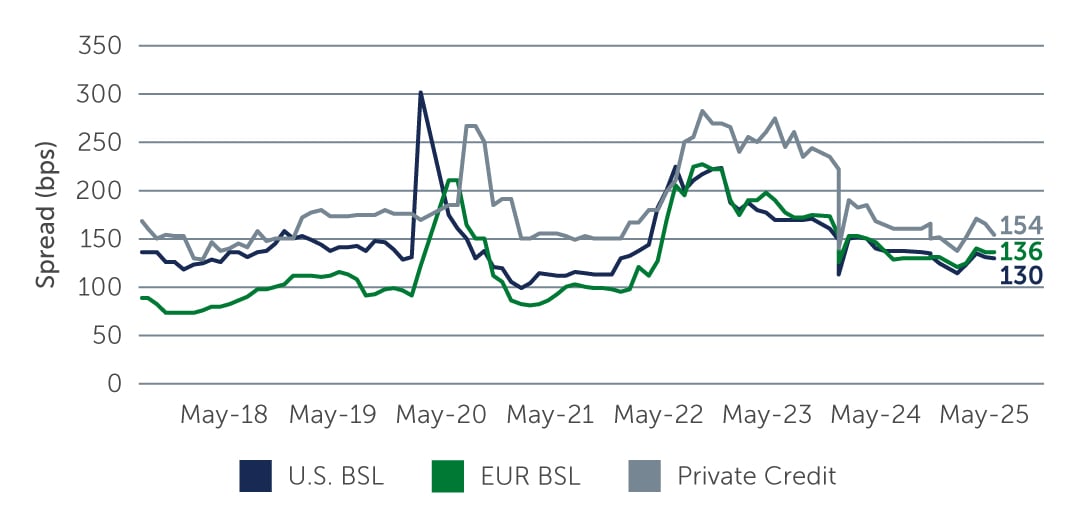

The opportunity beyond traditional broadly syndicated loan CLOs is also expanding. Across the CLO market, private credit CLOs have continued to gain traction, driven by the asset class’s compelling risk-return profile and structural advantages—and mirroring the expansion of the direct lending market more broadly. Interestingly, the basis between middle market and broadly syndicated CLOs has begun to compress more recently, suggesting growing investor comfort with less liquid CLOs (Figure 1). In our view, this trend also reflects investors’ broader understanding of CLOs and how they can be used to gain exposure to a number of different asset classes—from broadly syndicated leveraged loans to middle market loans, infrastructure debt, and commercial real estate loans.

Figure 1: The Basis Between Middle Market and BSL CLOs Has Begun To Compress

Source: BofA Global Research (U.S. spreads); J.P. Morgan (European spreads). As of May 31, 2025. Represents new issue spreads.

Source: BofA Global Research (U.S. spreads); J.P. Morgan (European spreads). As of May 31, 2025. Represents new issue spreads.

What’s Next?

Looking to the second half of 2025, investors are navigating a landscape marked by both opportunity and complexity. While resilient fundamentals and steady demand provide a solid foundation, macroeconomic uncertainty and technical bifurcation require a more nuanced approach. The relative stability of AAA tranches offers a potential safe harbor, while the mezzanine space may present compelling value opportunities for those equipped with the expertise to identify and manage risk. In this environment, timing, credit and manager selection, and structural discipline are not just advantageous—they are essential. And for investors seeking to harness the potential of the CLO market while managing risk, partnering with seasoned managers who understand the full breadth of the asset class is as important than ever.

1. Source: J.P. Morgan CLOIE. As of June 30, 2025.

2. Source: S&P LLI; S&P ELLI. As of June 30, 2025.