A Sweet Spot for IG Credit?

Attractive current yields and the potential for solid total returns present a compelling case in IG credit—but uncertainties remain on the horizon.

With generally strong balance sheet management, investment grade (IG) companies have been subject to few downgrades this year. Even if business conditions deteriorate, IG companies are likely to remain on solid financial footing given that they are starting from a position of better balance sheet strength. Moreover, the asset class offers the potential for attractive total return opportunities once the Federal Reserve stops tightening and, in the event of a slowdown that quenches inflation, perhaps moves to trim rates.

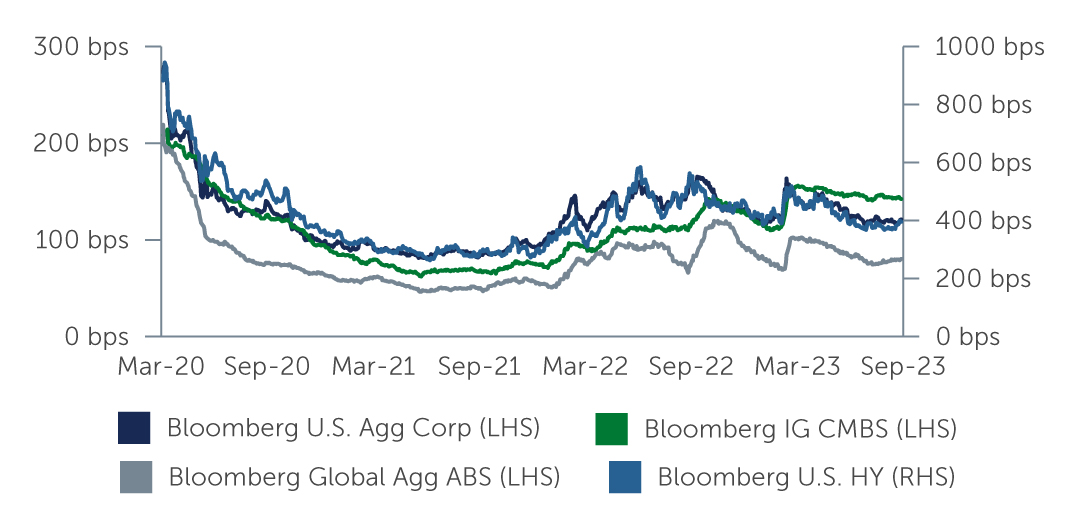

The compelling risk-reward profiles across IG credit have also led to steadily tightening spreads, and they may have room to move even tighter given the increasing interest in the asset class. At the end of the third quarter, IG credit spreads tightened to 121 basis points (bps), slightly below the 10-year average of 124 bps and well below the 20-year average of about 148 bps (Figure 1). Yields on IG corporates have climbed almost steadily since early in the year, reaching just over 6% today—a rarity for IG credit over the last decade.1 In an environment characterized by uncertainty around global growth and inflation, and the potential for an end in the rate hiking cycle in the U.S., IG credit, given the combination of attractive valuations and a higher-rated market, looks fairly well-positioned.

Figure 1: IG Spreads Continue to Grind Tighter

Source: Bloomberg Barclays. As of September 30, 2023.

Source: Bloomberg Barclays. As of September 30, 2023.

Strong Technicals, Weaker Fundamentals

IG credit continues to benefit from a very strong technical backdrop, which is largely supported by robust investor demand. Insurance companies and yield-oriented investors, in particular, are turning to the market this year, while demand is also coming from investors that are more conservative and looking to shift away from higher-risk assets. In particular, around $160 billion has entered IG credit year-to-date, which has essentially reversed the consistent outflows of last year.2 Meanwhile, net new issuance remains relatively modest, with $995 billion of supply coming into the market year-to-date.3

Another theme continuing to provide solid technical support is the number of credit rating upgrades relative to downgrades. In the first half of this year, 6.6% of issuers have been upgraded from high yield to IG versus 1.5% that have been downgraded from IG to below investment grade.4 Compared to the historical record, the current market exhibits extremely low “fallen angel” risk. In particular, the lower-rated part of the market largely comprises energy issuers with solid balance sheets and strong fundamentals, which have recently been upgraded into IG—such as Occidental Petroleum.

From a corporate fundamentals standpoint, the picture has deteriorated somewhat—but it is worth noting that fundamentals are weakening from very strong levels. IG corporate revenue growth stands at 3.4% year-over-year, but revenue was 1.6% lower than in the second quarter. EBITDA growth was negative 1.9% year-over-year, but down 4.5% on a sequential basis.5 The numbers are certainly starting to indicate weakness, but for the remainder of the year fundamentals and technicals appear to be balanced. It’s also worth noting that additional weakness in corporate earnings, more broadly, could end up being a positive for IG markets as investors shy away from riskier parts of the market and allocate more to the asset class.

Compelling Opportunities Remain

Looking across the market, we continue to see attractive opportunities emerging. From a sector perspective, we remain constructive on energy issuers. Most energy issuers have significantly improved their credit metrics over the last several years, and we believe they are likely to continue generating meaningful cash flows even if oil prices fall from currently elevated levels. We also see compelling opportunities in financials, especially in less liquid insurance companies, while select real estate investment trusts specializing in areas other than offices are also offering value.

In the bank sector more specifically, we see good value in the largest U.S. and Yankee banks across various parts of the capital structure. Our extensive credit research also continues to unearth idiosyncratic opportunities. One such area involves identifying specific callable bank bonds with the highest likelihood of being called at the first call date for reasons such as changes in regulation. A related area of research entails identifying bonds with higher-than-expected coupon resets at the first call date. Many of these opportunities are related to the transition from Libor to SOFR and require understanding the transition language in individual bond indentures, and it also increases the likelihood of being called. In our view, these opportunities offer compelling yields for short duration bonds.

We remain slightly more cautious on the technology sector due to less attractive valuations and M&A risk, as well as the health care and pharmaceuticals sectors given the regulatory risks.

Looking Ahead

While not immune to weaker demand or a potential slowdown in growth, IG companies largely remain healthy and they tend to have strong competitive advantages in their sectors. At the same time, there are a number of tailwinds supporting IG credit—from the potential end to the Fed’s rate hiking cycle, to the attractiveness of higher-rated credits in an uncertain environment. However, thorough research and bottom-up credit selection will remain essential to managing any challenges that lie ahead.

1. Source: Bloomberg U.S. Corporate Index. As of September 30, 2023.

2. Source: J.P. Morgan, Bloomberg. As of September 30, 2023.

3. Source: Barclays. As of September 30, 2023.

4. Source: J.P. Morgan. As of June 30, 2023.

5. Source: J.P. Morgan. As of June 30, 2023.