European High Yield: A Compelling Case in an Uncertain World

European high yield has been resilient during periods of lower growth. And, looking forward, we believe there are several key reasons why the asset class remains well-positioned, despite the unknowns on the horizon.

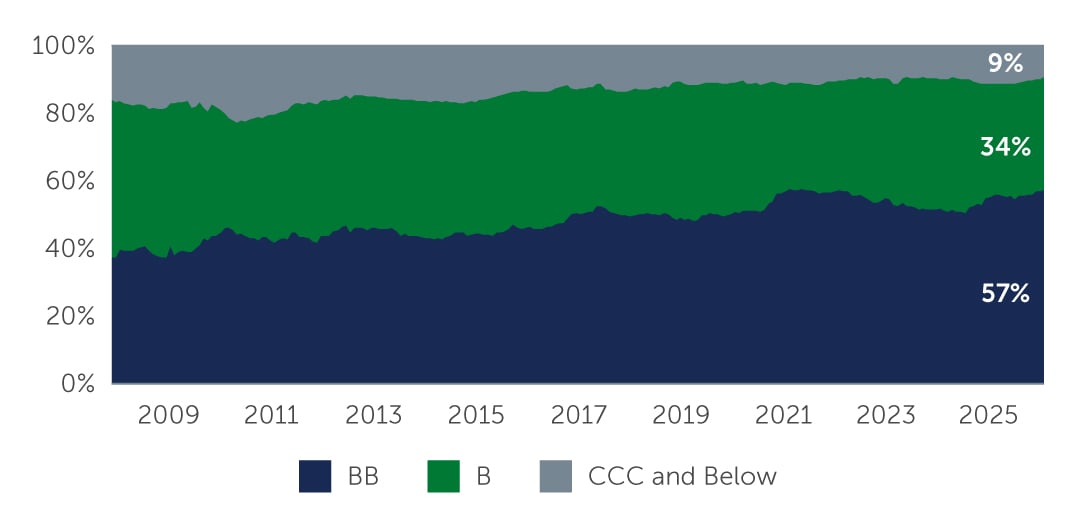

1. The Market Has Shifted Up in Credit Quality

There is a common misconception that high yield means high risk, but that is not necessarily the case. Over the last several years, high yield companies have been bolstering their financial positions, resulting in a healthy picture for corporate fundamentals today. While uncertainty around the longer-term effects of tariffs continues to cloud visibility, issuers have largely maintained discipline, with leverage and interest coverage metrics holding steady.1

Reflecting the resilient fundamental backdrop is the upward shift in credit quality of the market, which is much higher today than it has been historically. In fact, 57% of the global high yield bond market is rated BB, while the lowest-rated CCC and below issuers account for around 9% (Figure 1). Looking back to the beginning of 2010, BB issuers made up a much smaller 43%, while CCC issuers accounted for a much higher 21%.

Figure 1: Global High Yield Bonds: A Historical Shift Toward Higher Quality

Source: ICE BofA. As of August 31, 2025.

Source: ICE BofA. As of August 31, 2025.

1. Source: CreditSights. As of June 30, 2025.