Where is Mexico Headed a Year Out from a Critical Election?

As the single six-year term of leftist Mexican President Andres Manuel Lopez Obrador winds down, preparations for the June 2024 general election are heating up. What does this mean for EM debt investors?

The General Election Countdown Begins

With less than a year to go until the election that will replace the Mexican president familiarly known as AMLO, the nation’s political atmosphere is heating up. Under AMLO’s supervision, the ruling MORENA party announced a candidate selection process which via a set of polls will select the party’s nominee by early September, two months before the official deadline to submit presidential candidates. AMLO’s preferred candidate is Claudia Sheinbaum, who also seems to align with the more ideological faction of MORENA. Sheinbaum holds a PhD in physics, just resigned as mayor of Mexico City and may be a positive surprise in terms of energy matters. Not to be counted out, however, is Marcelo Ebrard, formerly Mexico’s Secretary of Foreign Affairs, who is widely viewed as more pragmatic and centrist than Sheinbaum.

A coalition of Mexico’s main opposition parties—PAN, PRI, and PRD, which have agreed to back a single candidate in the 2024 election—also has unveiled a candidate selection process and said it will announce the winner on September 3. While we are still very far from the election, early polling indicates that whichever MORENA candidate is nominated, the party is likely to win given approval ratings of about 60% for AMLO as well as the party’s active presence and its boosted social spending programs.1 However, all MORENA’s nominees are almost sure to be less charismatic than AMLO and will be promoting “continuity,” which is far less compelling than AMLO’s message of “change” back in 2018. A MORENA victory, therefore, should not be seen as a given, especially if we see indiscipline among its candidates.

What Does This Mean for Investors?

For investors, there is the prospect that a second MORENA administration would carry out AMLO’s promises of increased social and public works spending without necessarily having his fiscal discipline. AMLO did increase social expenditures during his term but remained fiscally responsible by, among other strategies, tapping into different reserve funds and shutting certain governmental programs. In practice, his operating philosophy might best be described as nationalist, which has provided a level of predictability that has been useful for our investment decisions. To be sure, over the past few years we have seen him attempt to undermine or degrade several public institutions, either by appointing political allies or simply shutting something down if it serves his interests. Fortunately, however, he has been unsuccessful in interfering with the INE, which is Mexico’s autonomous, public agency responsible for organizing federal elections. During this election cycle, AMLO is likely to turn up the rhetorical heat as he tries to excite the MORENA base and cement its support for the party’s eventual candidate—especially as Mexico will elect not only a new president but also, for three-year terms, all 500 members of its lower house, the Chamber of Deputies, as well as all 128 members of the Senate for six-year terms. The simultaneous election of the executive branch and entire legislative branch of Mexico’s government creates the potential for significant political change.

Contrary to campaign rhetoric, however, domestic governance structures as well as the geopolitical and global economic forces that have emerged during AMLO’s time in office could impel more centrist moves regardless of who wins the election. For example, Mexico’s upcoming competitive congressional races likely will lead to no coalition achieving the two-thirds qualified majority needed to pass constitutional reforms. That is a positive as it avoids unilateral decisions and forces parties to negotiate and moderate their positions. Also positive is the continued independence of Mexico’s Supreme Court, which can act as a counterbalance to elected leaders and representatives.

U.S. political interest in nearshoring coupled with Mexico’s competitive advantages in terms of wages, lead times, access to cheap U.S. natural gas and transportation costs give Mexico’s leaders a strong incentive to maintain economic and political stability while encouraging foreign investment—which will be necessary to help meet the challenges the next administration will face. These include investing in electricity generation, including clean sources, electricity transmission, and finding sustainable operational and financial solutions at state-owned oil company Pemex.

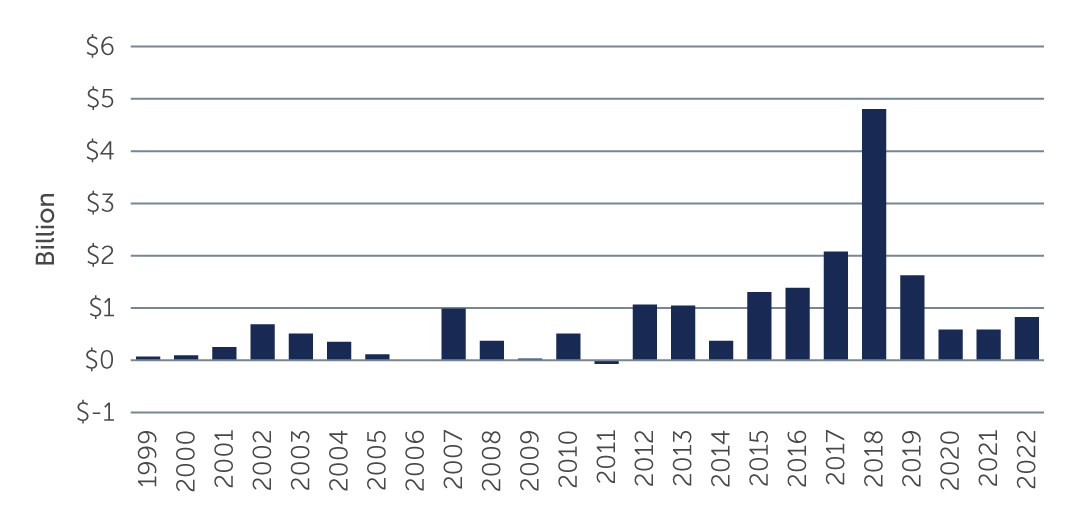

Figure 1: Mexico FDI in Electricity

Source: Gobierno de Mexico. As of December 31, 2022.

Source: Gobierno de Mexico. As of December 31, 2022.

In meeting these and other challenges that lie ahead for Mexico’s economy, there are good reasons for cautious optimism. Despite talk of higher government spending, the country is fiscally sound, with public debt at less than half of GDP—which is low by international standards.2 Its international reserves stand at about $200 billion, representing an important buffer against exchange rate volatility and balance-of-payments crises.3 Banxico, the nation’s respected central bank, has guided the nation’s monetary policy responsibly and efficiently. It began raising interest rates starting in the first half of 2021 and has kept them flat most recently. An easing cycle, in fact, may begin by the end of 2023, ahead of developed economies. Should the U.S. enter a recession, Mexico appears to be well-positioned to weather a downdraft.

Takeaway

While the 2024 election poses risks and political uncertainty for investors, it also presents opportunities—and we remain cautiously optimistic when it comes to the future of Mexico’s economy, politics, and companies. However, we continue to believe that rigorous, bottom-up credit selection remains crucial to navigating the risks at hand, while also to identifying the issuers that are well-positioned to withstand a challenging environment.

1. Source: AS/COA. As of June 28, 2023.

2. Source: CEIC Data. As of March 31, 2023.

3. Source: CEIC Data. As of March 31, 2023.