Globale und internationale Aktien

Regional und Specialist

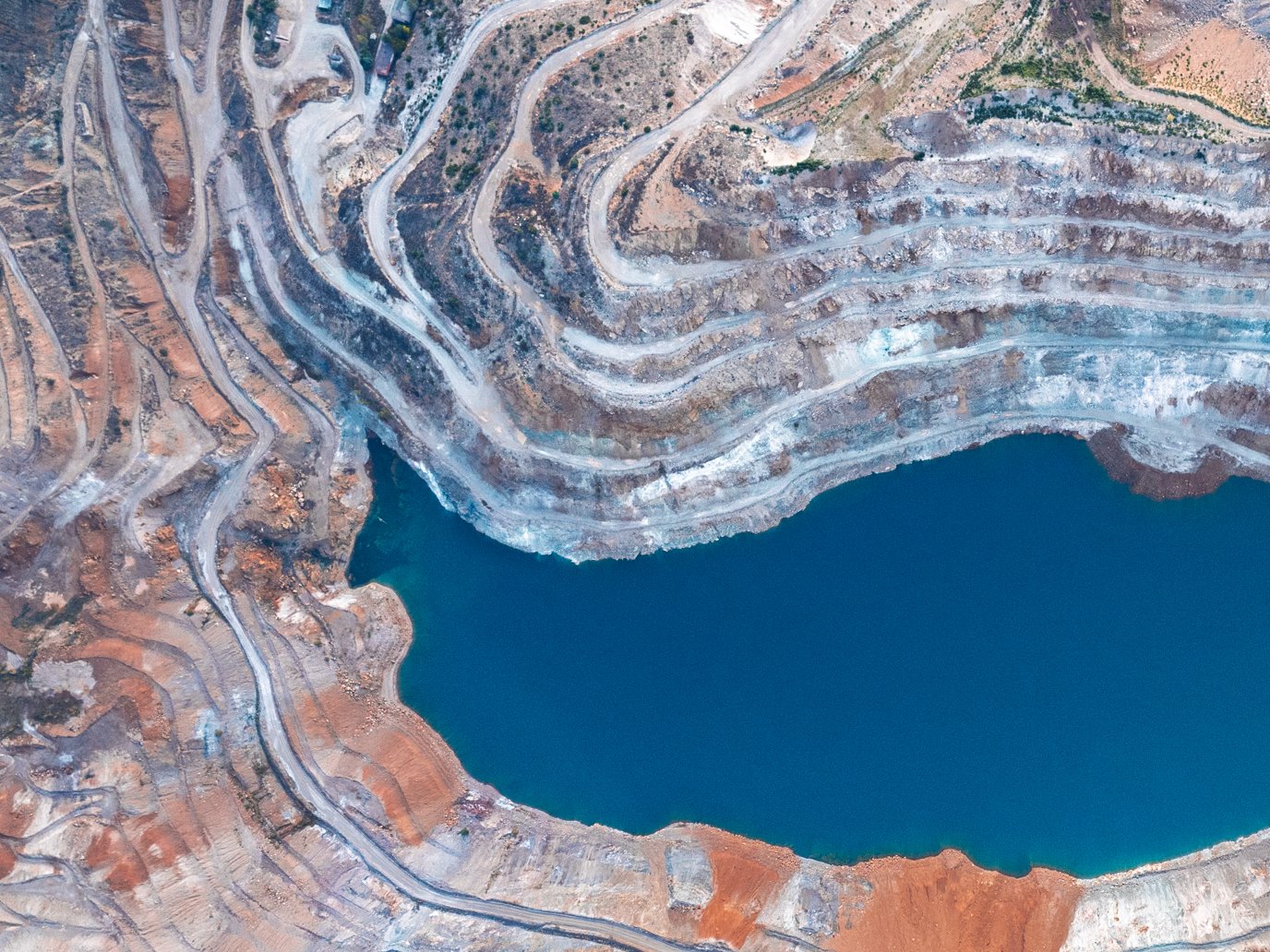

Our capabilities extend to an array of high conviction regional and country funds in developed markets including Germany, Europe and Japan, in addition to specialist global resources funds.

Verwaltetes Vermögen

Datum des Inkrafttretens

Vehikel

Separate Account

Investitionsphilosophie

Our investment philosophy reflects our understanding that equity markets are inefficient and risky, and we believe that over the long term, stock selection can add value.

- Our Growth at a Reasonable Price (GARP) approach seeks to identify companies that we believe are mispriced on a longer-term basis

- We seek to achieve attractive risk-adjusted returns through a disciplined, bottom-up approach and a risk-aware portfolio construction process

- We utilize proprietary valuation models that incorporate ESG analysis and macro considerations

Unser Mehrwert

- Our diversified global team of 45+ investment professionals produces proprietary company research that drives our stock selection

- We focus on a five-year research horizon, as we believe market inefficiency is more pronounced over this period

- Our Cost of Equity (COE) captures and quantifies systematic and idiosyncratic risk and incorporates these into our valuation and setting of price targets

- ESG analysis is fully embedded into our investment process, which means it influences both our qualitative assessment and final COE of a company

- Proprietary portfolio construction tools support our stock selection and risk management, enabling us to potentially deliver high risk-adjusted returns

Verwaltetes Vermögen

Datum des Inkrafttretens

Vehikel

Separate Account

Investitionsphilosophie

Our investment philosophy reflects our understanding that equity markets are inefficient and risky, and we believe that over the long term, stock selection can add value

- Our Growth at a Reasonable Price (GARP) approach seeks to identify companies that we believe are mispriced on a longer-term basis

- We seek to achieve attractive risk-adjusted returns through a disciplined, bottom-up investment process and risk-aware portfolio construction

- We utilize proprietary models to incorporate ESG analysis and macro considerations and value companies on a long-term basis

Unser Mehrwert

- Our diversified global team of 50+ investment professionals produces proprietary company research that drives our stock selection

- We focus on a five-year research horizon, as we believe market inefficiency is more pronounced over this period

- Our Cost of Equity (COE) captures and quantifies systematic and idiosyncratic risk and incorporates these into our valuation and setting of price targets

- ESG analysis is fully embedded into our investment process, which means it influences both our qualitative assessment and final COE of a company

- Proprietary portfolio construction tools support our stock selection and risk management, enabling us to potentially deliver high risk-adjusted returns

Verwaltetes Vermögen

Datum des Inkrafttretens

Vehikel

Separate Account

Investitionsphilosophie

Our investment philosophy reflects our understanding that equity markets are inefficient and risky, and we believe that over the long term, stock selection can add value

- Our Growth at a Reasonable Price (GARP) approach seeks to identify companies that we believe are mispriced on a longer-term basis

- We seek to achieve attractive risk-adjusted returns through a disciplined, bottom-up investment process and risk-aware portfolio construction

- We utilize proprietary models to incorporate ESG analysis and macro considerations and value companies on a long-term basis

Unser Mehrwert

- Our diversified global team of 50+ investment professionals produces proprietary company research that drives our stock selection

- We focus on a five-year research horizon, as we believe market inefficiency is more pronounced over this period

- Our Cost of Equity (COE) captures and quantifies systematic and idiosyncratic risk and incorporates these into our valuation and setting of price targets

- ESG analysis is fully embedded into our investment process, which means it influences both our qualitative assessment and final COE of a company

- Proprietary portfolio construction tools support our stock selection and risk management, enabling us to potentially deliver high risk-adjusted returns

Verwaltetes Vermögen

Datum des Inkrafttretens

Vehikel

Separate Account

Investitionsphilosophie

Our investment philosophy reflects our understanding that equity markets are inefficient and risky, and we believe that over the long term, stock selection can add value

- Our Growth at a Reasonable Price (GARP) approach seeks to identify companies that we believe are mispriced on a longer-term basis

- We seek to achieve attractive risk-adjusted returns through a disciplined, bottom-up investment process and risk-aware portfolio construction

- We utilize proprietary models to incorporate ESG analysis and macro considerations and value companies on a long-term basis

Unser Mehrwert

- Our diversified global team of 50+ investment professionals produces proprietary company research that drives our stock selection

- We focus on a five-year research horizon, as we believe market inefficiency is more pronounced over this period

- Our Cost of Equity (COE) captures and quantifies systematic and idiosyncratic risk and incorporates these into our valuation and setting of price targets

- ESG analysis is fully embedded into our investment process, which means it influences both our qualitative assessment and final COE of a company

- Proprietary portfolio construction tools support our stock selection and risk management, enabling us to potentially deliver high risk-adjusted returns

Verwaltetes Vermögen

Datum des Inkrafttretens

Vehikel

Separate Account

Investitionsphilosophie

Our investment philosophy reflects our understanding that equity markets are inefficient and risky, and we believe that over the long term, stock selection can add value

- Our Growth at a Reasonable Price (GARP) approach seeks to identify companies that we believe are mispriced on a longer-term basis

- We seek to achieve attractive risk-adjusted returns through a disciplined, bottom-up investment process and risk-aware portfolio construction

- We utilize proprietary models to incorporate ESG analysis and macro considerations and value companies on a long-term basis

Unser Mehrwert

- Our diversified global team of 50+ investment professionals produces proprietary company research that drives our stock selection

- We focus on a five-year research horizon, as we believe market inefficiency is more pronounced over this period

- Our Cost of Equity (COE) captures and quantifies systematic and idiosyncratic risk and incorporates these into our valuation and setting of price targets

- ESG analysis is fully embedded into our investment process, which means it influences both our qualitative assessment and final COE of a company

- Proprietary portfolio construction tools support our stock selection and risk management, enabling us to potentially deliver high risk-adjusted returns

Unserer Erfahrung nach ist die Zeit, die in Beziehungen investiert wird, gut investierte Zeit.

Die in Beziehungen investierte Zeit ist unserer Erfahrung nach gut investierte Zeit. Wir möchten uns jeden Tag verbessern, innovativ sein, uns anpassen und uns gemeinsam mit unseren Kunden weiterentwickeln—und stets die realen Auswirkungen jeder unserer Anlageentscheidungen berücksichtigen.