IG Credit: Well-positioned in a Challenging Environment

In a potential recessionary environment, robust company balance sheets and normalizing yield levels are creating a compelling case for IG corporate credit.

Despite fears of a looming recession remaining front and center for investors, and against a backdrop of elevated inflation and rising rates, investment grade (IG) corporate bonds are starting to look increasingly attractive, for a number of reasons. For one, language from the U.S. Federal Reserve (Fed) in the fourth quarter pivoted toward a potential slowing pace of rate hikes, while U.S. inflation in November rose less than expected—resulting in a sentiment shift toward risk-on. Second, higher interest rates have not eroded the overall fundamental backdrop for IG corporates—and in fact many companies have stronger credit profiles today than before the pandemic. At the same time, given the upward move in yields, the return potential for fixed income is much more appealing than it has been for the last several years, suggesting there may be a cyclical rotation back into public fixed income. Against this backdrop, now may be a good time to consider IG credit.

Strong Fundamentals, Supportive Technicals

From a fundamental standpoint, the picture for IG corporates remains solid. Revenues and EBITDA look healthy after rising 18.1% and 19.8% year-over-year, respectively.1 Leverage levels have also continued to decline, and are currently at the lowest levels since 2016, while interest coverage has improved on both a quarterly and an annual basis. These factors reflect the fact that companies are being fairly conservative in managing their balance sheets and suggest that IG corporates are heading into a particularly challenging period from a position of strength. That said, profit margins may decline slightly going forward, given the ongoing impact of higher labor and energy costs, as well as the effect of currency changes amid a stronger U.S. dollar.

Figure 1: IG Corporate Fundamentals Remain Strong

Source: J.P. Morgan. As of September 30, 2022.

Source: J.P. Morgan. As of September 30, 2022.

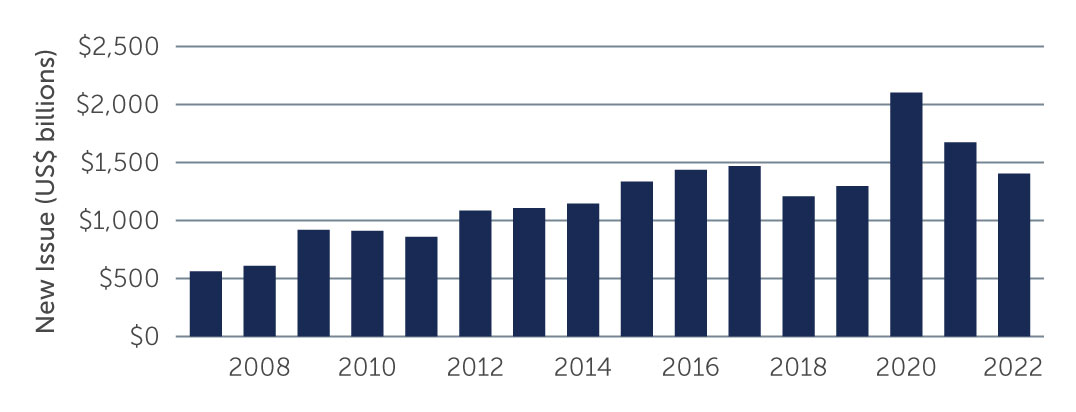

In terms of technicals, given the negative total returns during the year, around $150 million of flows exited the asset class in 2022.2 However, on a positive note, higher rates kept new issue levels lower-than-expected at around $1.4 trillion—down from $1.7 trillion in 2021 and $2.1 trillion in 2020. Lower supply has indeed provided technical support to the IG asset class, and with forecasts calling for roughly $1.2 trillion in new issuance in 2023, this positive technical is likely to continue to support the asset class.3

Figure 2: Low Issuance Providing Technical Support

Source: Barclays. As of December 31, 2022.

Source: Barclays. As of December 31, 2022.

Upgrades May (Counterintuitively) Outpace Downgrades

Given the strong fundamental backdrop and potentially supportive technicals, we expect to continue seeing select opportunities emerge going forward. One area in particular is in sectors where spreads have widened beyond what fundamentals would suggest, such as financials. More specifically, spreads on banks widened significantly in 2022, largely driven by technical factors, and they remain wide relative to recent history. From a liquidity and leverage standpoint, banks look particularly well-positioned heading into a slowdown. We also see value in select, less-liquid companies in the financial sector such as life insurers and REITs—these companies underperformed amid last year’s volatility, but their strong credit profiles should support performance going forward.

We also see value in companies that look poised to see an upward migration in credit ratings, particularly those transitioning from high yield to IG, or so-called “rising stars.” Last year, there was around $50 billion of rising stars versus under $10 billion of fallen angels (IG companies that are downgraded to high yield).4 Despite the recessionary headwinds on the horizon, we expect—somewhat counterintuitively—to see more rising stars than fallen angels in the year ahead. This is largely due to the fact that many companies, after being downgraded during the pandemic, took material steps to lower their leverage. As a result, these companies have stronger credit profiles today and look poised to make a transition back to IG—including some larger companies like Occidental and Ford.

Public Fixed Income Back in Favor

As we look ahead to the coming months, recessionary concerns and the impact of higher prices on corporate earnings remain top of mind. We continue to monitor which sectors are seeing ongoing margin deterioration and pressures on P&L accounts. Against this backdrop, and if we do enter a recession, we expect spreads may experience some widening, though it’s unlikely to be substantial. Part of this is due to IG corporates’ strong balance sheets and healthy fundamentals, putting them in a good position to face economic headwinds.

At the same time, the yield environment today is radically different compared to the past decade, when accommodative central bank policy and low rates drove yields on IG corporates down—below 2%, in some cases.5 As large investors struggled to meet their target returns, there was a shift away from fixed income and into asset classes such as equities and private credit in search of higher yields. Today, however, sentiment seems to be shifting once again. With current yields on IG corporates ranging between 5-6%,6 the total return potential for IG corporates is much more attractive than it has been over the last several years—making a strong case for a cyclical shift back into the asset class going forward. Of course, given the headwinds on the horizon, a bottom-up approach to credit selection remains crucial to navigating the risks at hand and identifying the issuers that are well-positioned in this environment.

1. Source: J.P. Morgan. As of September 30, 2022.

2. Source: J.P. Morgan, Bloomberg.

3. Source: J.P. Morgan, Bloomberg. As of December 31, 2022.

4. Source: J.P. Morgan, Bloomberg.

5. Source: J.P. Morgan, Bloomberg.

6. Source: Bloomberg U.S. Corporate Index. As of December 31, 2022.

23-2662397