Wait-and-See Characterizes Mood of CLO Market

As concerns about the banking sector add to continuing macroeconomic uncertainty, the CLO market finds itself largely becalmed as participants await clearer signs of the market’s future direction.

For the collateralized loan obligation (CLO) market, the prevailing economic uncertainty largely has encouraged waiting rather than selling. That said, the bifurcation that has characterized the market over the last six months has become more pronounced. Activity has continued at the highest-rated end of the capital structure, where there are few credit concerns and very little tail risk. At the same time, the volume of flows at the mezzanine and lower levels of the market has slowed to barely a trickle. In equity tranches, where before the recent banking turmoil emerged there were indications that a possible recovery was on the horizon, interest and activity have all but disappeared.

Fundamental & Technical Drivers

Fears continue that aggressive central bank tightening will push the U.S. and the U.K. into recession. For now, however, fundamentals remain relatively strong even if somewhat less robust than a few months ago. With signs of slowing beginning to emerge, leveraged loan defaults are slowly starting to tick higher. In February, the U.S. leveraged loan default rate rose above 1% for the first time in 20 months.1 If conditions worsen, defaults could rise to closer to 3%, or even 4%.2 However, defaults at those levels would not exceed the stress capacity that CLO structures were built to withstand.

A weaker economy and factors such as fewer covenants in loan documents are likely to result in loan market recoveries that in many cases will take longer to realize than in previous cycles. More loans that become troubled are likely to be reinstated at a fraction of their original amounts coming out of bankruptcy, and a significant portion of the ultimate recovery will be back-ended through monetization of equity holdings. For that equity to have value, however, several years of successful business performance probably will have to occur first.

This backdrop could present challenges for certain equity and junior mezzanine tranches in particular, namely older vintage deals that have taken some losses but still have larger exposures to tail-risk credits. Also concerning is that loan market weakness could lead to downgrades for single-B loans. A rating of CCC for those loans could potentially trigger cash flow diversions away from equity and lower-rated mezzanine tranches.

Technical factors also have contributed to the becalming. Banks have continued to step away from the market as buyers and have been replaced only in part by insurers and large financial firms, contributing to muted demand. Although CLOs have very little direct exposure to the banking sector—financials generally constitute only about 3% of the leveraged loan index—concerns over banking sector risks further contributed to inactivity. New issuance was also down during the quarter, reaching $33.5 billion in the U.S. and €6.3 billion in Europe at quarter-end and resulting in an overall lack of supply.3

A Case for Higher-Quality

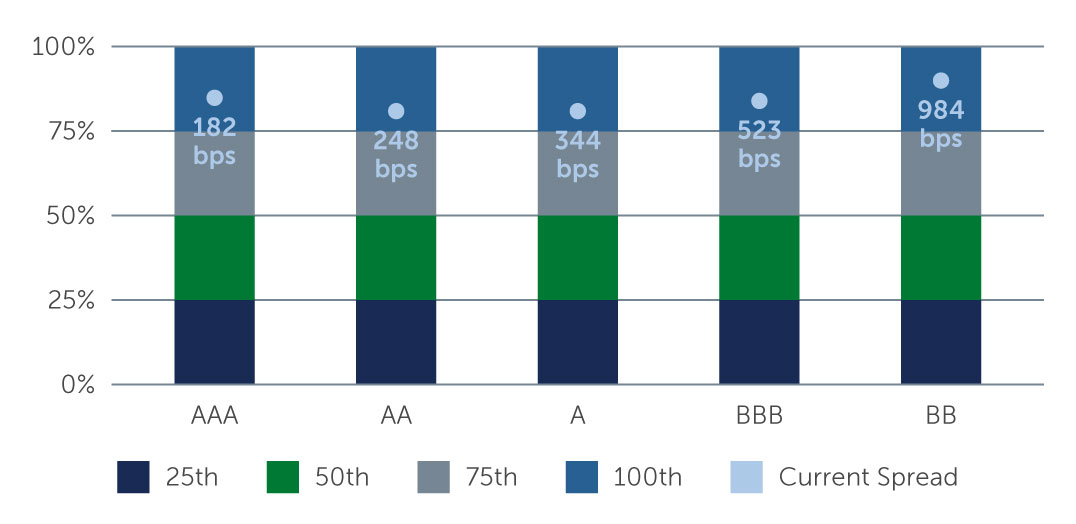

Across the current terrain, select opportunities continue to emerge. The top part of the capital structure continues to look particularly attractive. With base rates currently above 5%, the current coupon on a new issue AAA CLO is nearly 7%.4 Spreads also look attractive and remain wide relative to historical averages, and the credit risk component is minimal.

Figure 1: Spreads Remain Wide to Historical Averages

Source: JP Morgan. As of March 31, 2023.

Source: JP Morgan. As of March 31, 2023.

At the mezzanine level, opportunities are a greater function of a buyer’s particular requirements. For those seeking total return, for example, there is value to be found in high-quality, BB-rated tranches in the secondary market trading at a discount. Earlier in the year, they were trading in the high-$80s and recently have sold off to the mid-80s. For risk-based capital buyers like insurance companies, new issue mezzanine CLOs look attractive on a risk-adjusted return basis given the stronger structures with excess par subordination. While new issues will underperform secondaries on a total return basis if the market rebounds, we don’t expect that scenario to play out in the near to medium term given the risks on the horizon.

Since the timing of the market recovery in this cycle will be more macro-led than previous recoveries, caution is likely to persist in the coming months. Before the spate of banking problems emerged, there was a sense that improvement would be coming in the second half of the year. That now looks optimistic. Given that backdrop, we are likely to see more dispersion among deals and among managers going forward—making active management, and careful manager selection, critical to both minimizing potential risks and capitalizing on relative value as it emerges up and down the capital structure.

1. Source: Pitchbook. As of February 28, 2023.

2. Source: S&P.

3. Source: JP Morgan. As of March 31, 2023.

4. Source: Barings. As of March 31, 2023.

23-2840534