The Fluidity of Liquidity

To meet policyholder demands and terms of their financing arrangements, life insurers must maintain adequate levels of liquidity. Here are some reasons why today’s environment makes liquidity management so critical.

As seen by the recent events in the banking industry, rising interest rates can also pose a challenge for life insurance companies, potentially threatening their financial health. Along with inadequately priced products, poor expense management, investment defaults and fraud, rising rates can be a factor contributing to insurer insolvency by impairing liquidity, or the ability to raise sufficient cash, when needed, to meet payment demands. In the past, insurer liquidity crises largely were the result of poor product management (for example, writing policies that allowed for large-scale, immediate policyholder cash-outs), inadequate liquidity in investment portfolios to fund redemptions, or poor anticipation of disintermediation risk due to changing economic conditions. In hindsight, proper planning and stress testing could have saved most, if not all, insurers facing insolvency in the past. Given today’s environment, attention to liquidity needs is more important than ever.

Reasons for an Increased Focus on Liquidity

IMR WOES

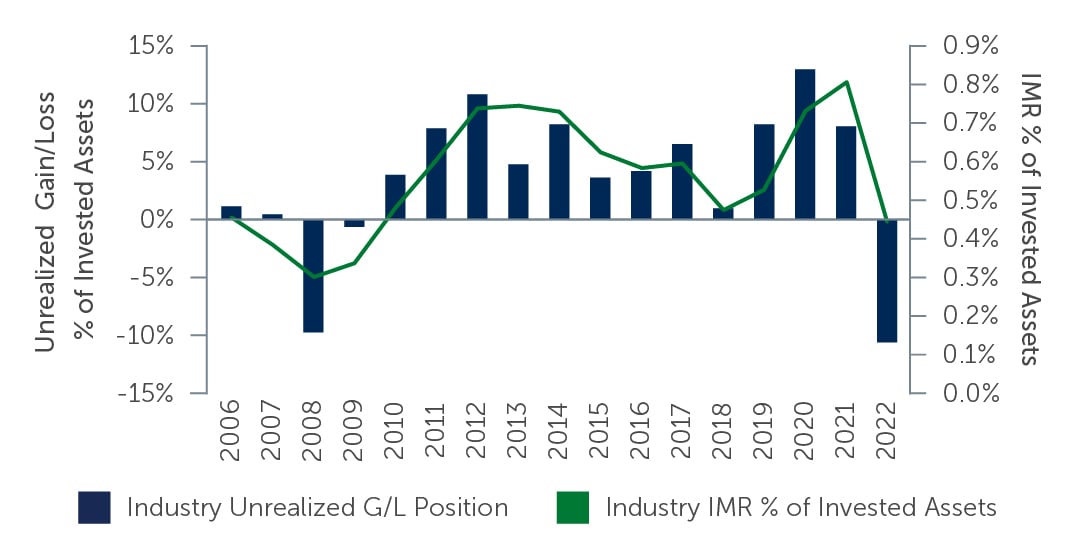

The turbulent economic environment of 2022 was characterized by high and unanticipated inflation, a sharp spike in interest rates, and steep declines in the prices of equity and fixed income securities. These extreme events caused a significant decline in asset values for all insurers, leading to grievous unrealized losses in their investment portfolios.

Figure 1: Life Industry Unrealized Gain/Loss and IMR

Source: S&P. As of December 31, 2022

Source: S&P. As of December 31, 2022

Thanks to the statutory book-value accounting used by insurance companies, large declines in a portfolio’s market value are rendered harmless until they are realized. But since accounting for realized gains and losses runs through the Interest Maintenance Reserve (IMR), which due to a legacy ruling must be positive to act as a buffer, large amounts of realized losses will eventually begin to degrade surplus positions, regardless of how well assets are managed against liability needs. The unnatural effect of this makes insurers reluctant to trade their portfolio, either for repositioning to improve credit risk management or to accommodate policyholders demanding cash for their policies. These forces create additional liquidity strains for insurers, where a record 26% of life insurers were in a negative IMR position as of year-end 2022.1

1. Source: S&P. As of December 31, 2022.