Global Fixed Income: Resilience amid Shifting Economic Landscape

Resilient fundamentals and easing rate expectations support a constructive view on credit markets, with active management key amid rising market dispersion.

The global economic landscape remains in flux as investors navigate a complex mix of resilient data, policy uncertainty, and geopolitical tension. There is limited visibility around global trade/tariff policy, which has the potential to disrupt various sectors and lead to near-term inflationary pressures. That being said, expectations of central bank rate cuts—particularly out of the U.S.—are increasing, which should provide a more supportive backdrop for fixed income markets, especially if those rate cuts occur in a slowing (as opposed to recessionary) growth environment. Despite the uncertain macroeconomic environment, corporate fundamentals remain in good health and Q2 second-quarter company earnings to date remain resilient. Overall, this environment makes us constructive on credit markets, where elevated coupon/income levels should help total return outcomes. We also anticipate heightened market dispersion underscoring the importance of skilled active management and security selection.

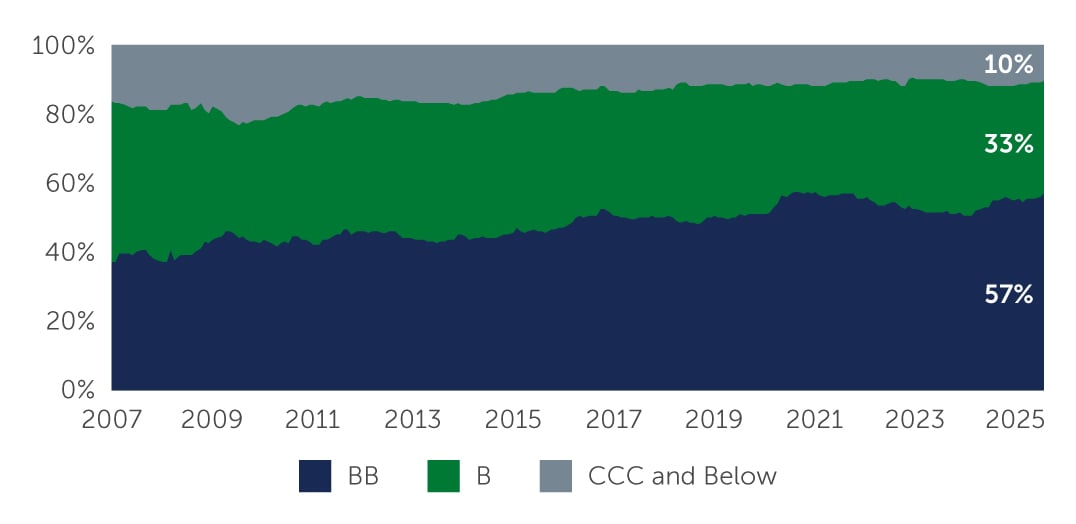

High Yield Bonds Market

The credit quality profile of the high yield bond market is among the highest we’ve observed over the past several years (Figure 1). In the BB segment of the market, for instance, the majority of issuers are large, publicly listed firms.

Figure 1: Global High Yield Index Ratings Composition Over Time

Source: ICE BofA Developed Markets Non-Financial High Yield Constrained Index (HNDC). As of June 30, 2025; Barings internal market views.

High yield companies have managed their balance sheets conservatively, with most new debt issuance directed toward creditor-friendly refinancing rather than equity-focused activities like M&A or dividends. Supported by a strong fundamental backdrop, high yield bond defaults remain below historical averages, with no signs of a broad-based acceleration.1

While the initial impact of tariffs appears less severe than feared, uncertainty around their longer-term effects continues to cloud visibility. Companies are beginning to reassess capital expenditure plans, and signs of demand softening are emerging, particularly in sectors sensitive to consumer and geopolitical trends. We are less constructive on the more cyclical and consumer-oriented sectors and prefer sectors such as telecommunications (more domestically oriented) and healthcare (less cyclical).

Investment Grade Bonds Market

Similar to the high yield market, investment grade companies are benefitting from resilient fundamentals. In addition, demand-supply market technicals remain highly favorable, with net inflows outpacing new supply. With significant client allocations still parked in cash/liquidity related investments, anticipated interest rate cuts are likely to drive continued inflows into longer duration (more interest rate sensitive) markets such as investment grade bonds, with higher yields on offer. We continue to favor financials (banks and insurance) over industrials, given the better relative valuations, stronger fundamentals, and lower risks from tariffs.

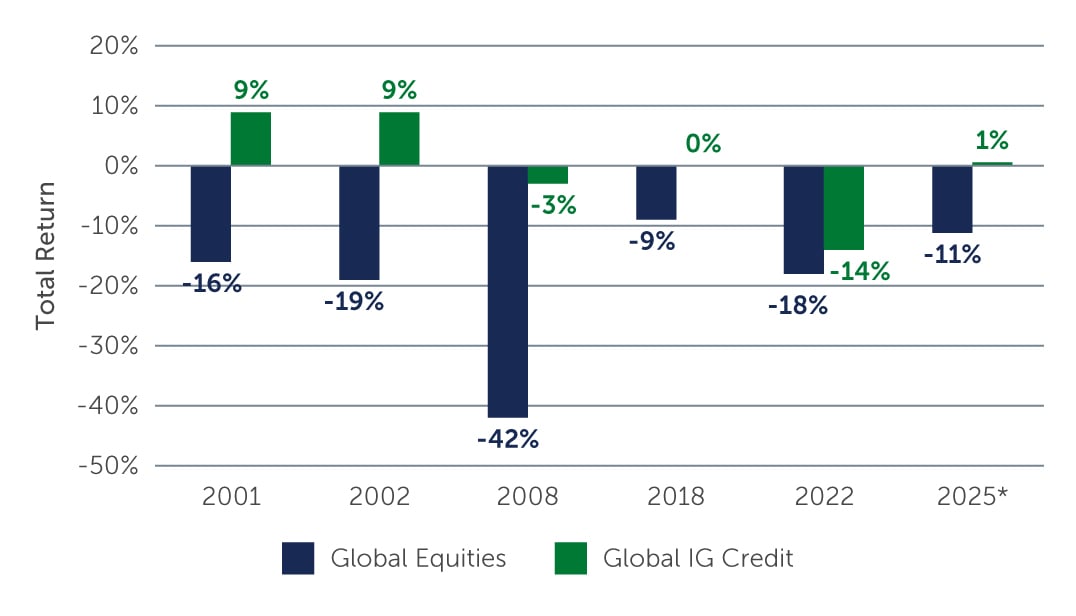

More broadly, investment grade (IG) credit markets offer the potential for diversification in a broader portfolio of higher risk assets such as equities, particularly in a risk-averse market environment (Chart 2). In particular, the greater interest rate sensitivity of IG credit provides capital appreciation potential in a falling rate environment.

Figure 2: Largest Global Equity Annual Drawdown Periods and Corresponding Returns for Global IG Credits

Source: Barings and Bloomberg. As of June 30, 2025. Global Equities represented by MSCI ACWI Index. Global Investment Grade Credit represented by Bloomberg Global Aggregate Credit index (USD Hedged). Analysis shown covers the period from 2001 to April 8, 2025. *2025 analysis covers period from January 1, 2025 to April 8, 2025, the period of the largest drawdown year-to-date.

1. Source: UBS Global Strategy research (formerly Credit Suisse Strategy research prior to 2023). As of July 31, 2025.

25-4757774