Investment Grade Credit: Higher Rates Aren’t All Bad

The Russia-Ukraine conflict and rising interest rates have affected all bond markets, but opportunities remain among the investment grade universe.

Russia’s invasion of Ukraine, higher inflation and rising rates were the major developments affecting financial markets in the first quarter. Investment grade (IG) corporates were down as a result, returning -7.69% for the quarter, although performance varied by sector.1 Aircraft lessors, for instance, have been directly affected by the Russia-Ukraine war, given that many companies that leased planes to Russian firms, as a result of sanctions put in place, can no longer accept payments from those firms. Financials also underperformed, partly because of the negative impact of the war on Yankee banks, or foreign (typically European) banks that do most of their business in the U.S. On the positive side, higher commodity prices have provided a boost to energy companies, helping accelerate their efforts to reduce their debt levels.

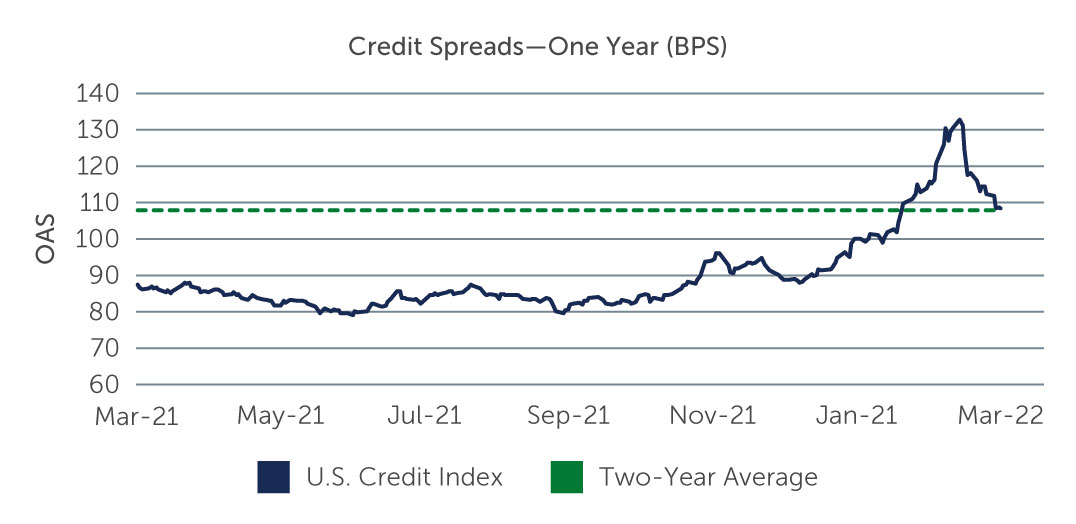

In terms of credit spreads, there has been significant movement in a very short period. At the end of the second quarter of 2021, spreads on investment grade bonds had reached 77 basis points (bps), which are historically tight levels particularly when adjusted for credit quality and duration profile. By the end of March, spreads had widened to 108 bps, having peaked at 135 bps. Spreads ended the quarter more in line with historical averages (Figure 1).

Figure 1: Credit Spreads Return to More Normal Levels

Source: Barings. As of March 31, 2022.

Return of Overseas Buyers

From a fundamental perspective investment grade companies entered this challenging period from a position of financial strength. Revenues and EBITDA, for many companies, have returned to or exceeded pre-COVID levels. Leverage has continued to decline as issuers across the board take steps to pay down debt. After peaking at 3.3x in the third quarter of 2020, gross leverage had returned to 2.9x by the end of 2021—comparable to 2019 levels.2 At the same time, company margins continue to improve. While higher inflation certainly poses a risk, companies have generally been able to pass higher costs through to their customer.

From a technical standpoint, following two very strong years of new issuance, expectations were for a return to more normal levels. While issuance has moderated to some extent, it remains elevated relative to history, reaching $458.7 billion as of quarter-end.3 Overall, the supply in the market has been absorbed well. Although fund flows have turned negative after being positive through almost all of last year, higher rates have led to stronger demand from overseas buyers, particularly at the longer end of the curve. As rates continue to move higher—and with the widening of spreads to more normal levels—this push back in to the asset class should continue as investors like insurers and pension funds seek to capitalize on the resulting incremental yield.

Areas of Opportunity

We are currently finding opportunities in short-duration bonds. These bonds have lower duration risk, which means the price of the bond is fundamentally less sensitive to changes in interest rates compared to longer-dated bonds. Immediately following the U.S. Federal Reserve’s plan to raise its benchmark fed-funds rate, there was some inversion of the yield curve as shorter-duration bonds became more expensive. Prices came down in subsequent weeks, however, and we are currently finding attractive pricing with some of the new issuance of short-duration bonds in particular.

We also think one-off opportunities can be found in areas where the market may have overreacted to the impact of the Russia-Ukraine war. For example, while aircraft lessors have lost business, many of these firms, such as AerCap, have very strong business models and were able to get through the pandemic successfully, which arguably had a greater impact on their business. Certain short-duration bonds from Yankee banks also look attractive, particularly those with little direct exposure to Russia or Ukraine. In some cases, these banks have been unfairly lumped together with other European banks that are more directly exposed to the conflict, and prices look attractive as a result.

Rising stars, or companies that look poised to migrate from high yield to investment grade, continue to present interesting opportunities as well. Much of this opportunity stems from the large number of companies that were downgraded from investment grade as the pandemic took hold. While we have already seen a handful of companies make the return trip to IG, there are many more that appear to be on the verge of an upgrade. Energy companies in particular stand out. In addition to benefitting from higher oil and gas prices, many have taken material steps to lower leverage in recent years.

Risks We’re Monitoring

The Russia-Ukraine war is clearly a major risk to monitor in the months ahead. Fed policy is another factor to watch. If the Fed gets too aggressive in its efforts to address inflation, it could end up tightening monetary policy to a degree that slows down the economy and potentially triggers a recession. There also appears to be an increased risk that we could see stagflation—an inflationary environment paired with weak economic growth. While companies up until now have been able to pass higher costs on to consumers, there are questions around how much longer that can continue—particularly if higher costs for food and fuel begin to chip away at demand. In this environment, flexibility is key, and there can be benefits to considering multi credit strategies that can invest across the entire IG universe. Because they are benchmark agnostic, multi credit strategies position managers to pursue the best global relative value opportunities as they arise and potentially deliver more attractive risk-adjusted returns over time.

1. Source: Bloomberg Barclays. As of March 31, 2022.

2. Source: J.P. Morgan. As of December 31, 2021.

3. Source: Bloomberg Barclays. As of March 31, 2022.