High Yield: What the Market May Be Missing

A closer look at the dynamics shaping today’s high yield bond and loan markets reveals the potential for continued strong performance ahead.

Despite concerns about tight spreads and impending rate cuts, high yield bonds and senior secured loans generated strong performance in the first quarter. In our view, these concerns fail to account for the underlying strength of the fundamental and technical pictures supporting these markets and key market attributes that will likely shape performance.

Indeed, the backdrop for fixed income generally—but particularly for high yield bonds and loans—looks as supportive as it’s been in recent history. For one, expectations for a fast and furious pace of U.S. Federal Reserve rate cuts now look to have been extremely premature. While we may see rate cuts over the next 12 months, the current higher-for-longer rate period looks likely to persist. At the same time, high yield issuers remain fundamentally well-supported by underlying economic conditions—meaning they are continually able to generate cash and service debt, even as cost of capital has risen. Capital markets, too, remain open for business, minimizing the risks associated with refinancings and maturing debt.

This backdrop has proven to be a supportive environment for both high yield bonds and loans. For loans, it’s a coupon story—in fact, loan coupons have remained elevated at levels rarely, if ever, seen outside periods of significant economic stress. For bonds, it’s about duration and callability, and the impact those factors have on achievable returns. And for both segments of the market, the potential for strong total returns going forward remains significant.

Solid Fundamentals & Supportive Technicals

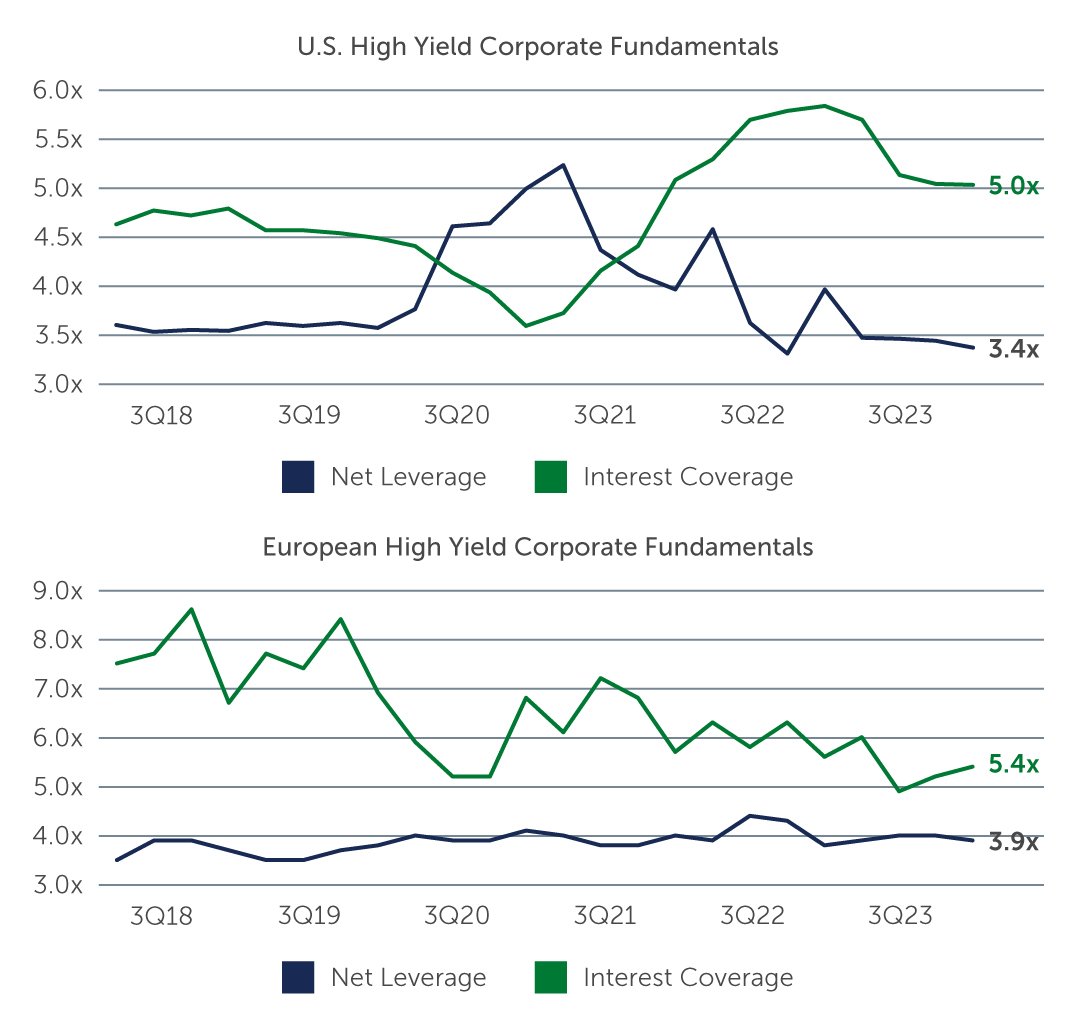

Corporate profitability may not be advancing at the pace many may prefer, but the flat-to-moderate revenue growth in the fourth quarter of 2023 came in line with expectations—with companies generating sufficient cash flow to cover debt and capital expenditures. While there is some bifurcation across sectors, and differentiation by geography, the prospects for improving earnings in 2024 look increasingly bright. In addition, many high yield issuers have been shoring up their financial positions over the last few years. Corporate net leverage, for instance, remains at low levels in both the U.S. and Europe, at roughly 3.4x and 3.9x, respectively.1

Figure 1: Continued Strength in Corporate Fundamentals Mitigates Refinancing Risk

Source: JP Morgan, Bloomberg. As of December 31, 2023.

Source: JP Morgan, Bloomberg. As of December 31, 2023.

Reflective of the healthy state of corporate fundamentals is the continued strength of credit quality as measured by rating agencies. The percentage of BB issuers in the Global High Yield Bond index remains near all-time highs at 52%, while the percentage of CCC issuers is around 10%—half of its roughly 20% market share a decade ago.2

The technical picture is also supportive for both high yield bonds and loans. Within bonds, inflows into the market have been chasing fewer opportunities, as the investible market has shrunk—from $1.8 trillion in the first quarter of 2022 to $1.5 trillion today.3 This is a function of more credits getting upgraded to investment grade and a relative dearth of new issuance on the back of slower M&A activity. While refinancings may start to tick higher, some of that activity is likely to move to the loan market, which should keep the technical backdrop in bonds supportive going forward.

On the loan side, the technical strength has largely been a function of the ongoing robust demand from significant CLO creation. One trend we are monitoring closely in this area is the recent move toward large issuers in the private debt space returning to the public loan market where they can fund their needs at a lower cost and with more flexible documentation.

A Golden Era for Fixed Income?

Against this solid fundamental and technical backdrop, attractive returns look achievable for investors without having to take excessive credit risk.

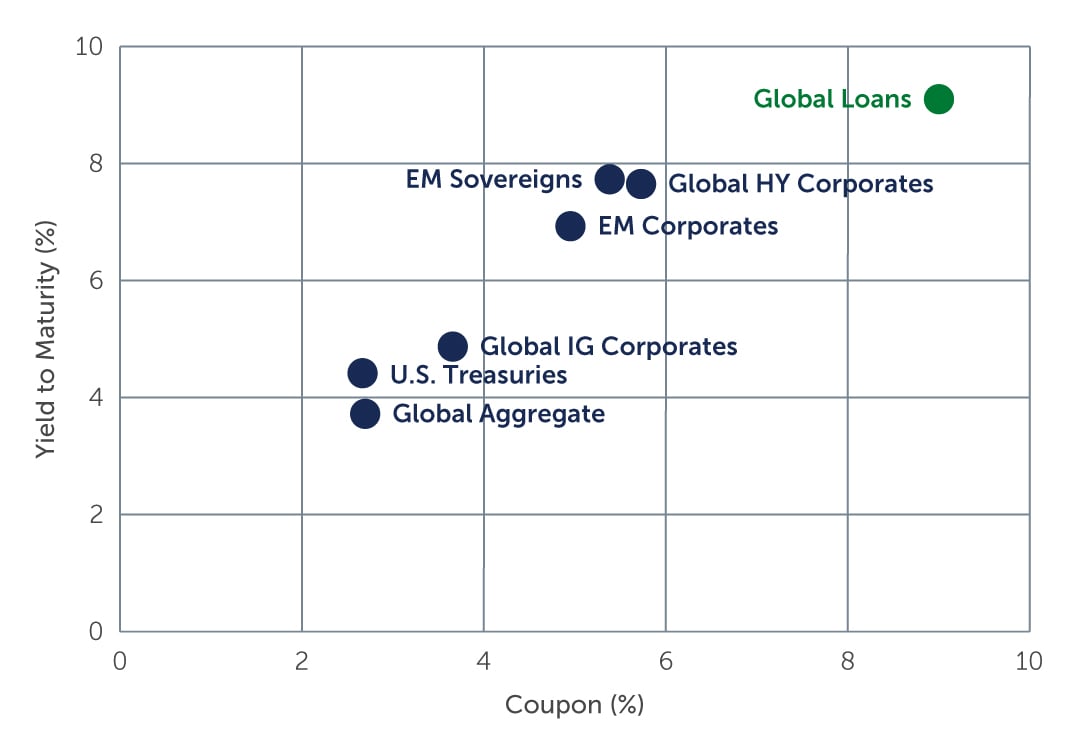

Loans look particularly interesting in today's environment. Amid still-elevated short-term rates—which make up the floating-rate portion of a loan’s coupon—the average coupon for loans today is around 9%, well above the long-term average of 5.6%.4 And while yields are high across most fixed income asset classes, loans stand out because the majority of the yield is coming from contractual income that is being paid today rather than awaiting price recovery. This income component has historically resulted in a much steadier return profile for loans relative to other fixed income asset classes—as evidenced most recently by the steady returns throughout 2023 versus markets like IG and EM bonds, which saw much “lumpier” return profiles.

While short-term rates will eventually decline from current levels, they are expected to remain high throughout 2024, which should keep coupons above historical levels and pave the way for healthy performance. Additionally, loans do not look expensive by conventional measures—indeed, valuations relative to history are hovering around levels that suggest investors may have been too quick to account for central bank rate cuts, which look increasing uncertain. As a result of these factors, we have adjusted allocations in our multi-strategy portfolios to heavily overweight loans based on this strong conviction.

Figure 2: Loans: Elevated Yields, Contractual Income

Sources: Credit Suisse; J.P. Morgan; Bloomberg. As of March 31, 2024.

Sources: Credit Suisse; J.P. Morgan; Bloomberg. As of March 31, 2024.

The potential for strong total returns persists in the bond market as well, where yields on BB/B bonds are currently around 7%.5 While the most common criticism of high yield bonds today is that spreads look tight relative to history, such an analysis may be overly simplistic and failing to account for key attributes of the market—most notably the lower duration and callability of the asset class.

Indeed, the duration of the high yield bond market today is 3.2 years versus an average of 3.9 years over the last 10 years, suggesting that the asset class is significantly more protected from interest rate swings than it has been historically.6 In addition, market convention is to calculate spreads and yields to worst, which for discounted bonds equates to their final legal maturity. But performing high yield companies will proactively look to refinance their debt at least 12–18 months ahead of the final legal maturity. This means the actual return profile of 2025 and 2026 final legal maturity bonds could likely be significantly higher than the calculated spread and yield.

In addition, high yield bonds become callable as you get closer to maturity, and indeed, do typically get called early. This feature can and does have a significant impact on returns—potentially to the tune of a 50-100 basis points positive impact when bonds are trading at a discount to par, which they currently are.

Looking Ahead

As investors digest the new reality of a relatively robust economic backdrop combined with less-dovish-than-expected central banks, we expect that floating-rate assets, most notably senior secured loans, will come back into favor for the reasons mentioned above. Even amidst uncertainties from continued geopolitical conflicts to a U.S. election later this year, we anticipate that the steady, reliable, and contractual income of loans should prove to be a bright spot for investor portfolios.

And, as discussed, on the bond side, we expect that investors who can look past the common narrative dominated by concerns of tight spreads, may be handsomely rewarded by digging deeper to understand the nuances of key attributes of the market like its lower duration and callability.

In aggregate, 2024 has the potential to be a very strong year for high yield. Is it a golden era? It may be too early to say. But the income opportunities available for investors and the underlying market dynamics are some of the most attractive we’ve seen in recent years.

1. Source: Bloomberg. As of December 31, 2023.

2. Source: ICE BofA. As of March 31, 2024.

3. Source: ICE BofA. As of March 31, 2024.

4. Source: Credit Suisse. As of March 31, 2024.

5. Source: ICE BofA. As of March 31, 2024.

6. Source: ICE BofA. As of March 31, 2024.