Surge of the Secondaries: Financing Growth in an Undercapitalized Industry

With the secondary market growing in leaps and bounds, raising capital remains top of mind for managers. It also underscores the importance of being able to access alternative sources of financing—a key, and sometimes overlooked, variable in the capital overhang equation.

“Staggering” is the word that comes to mind when looking back at the growth of the private equity (PE) secondary market since its inception. One can only imagine whether Jeremy Coller—the founder of Coller Capital and known by market participants as the ‘godfather of secondaries’—could have fathomed how this industry would grow over the next three decades.

Back then, investing in the secondary market—where investors can buy and sell pre-existing commitments to funds—may have resulted in the investment manager being hailed a visionary. Today, however, secondaries have become an integral part of many investors’ private market allocations.

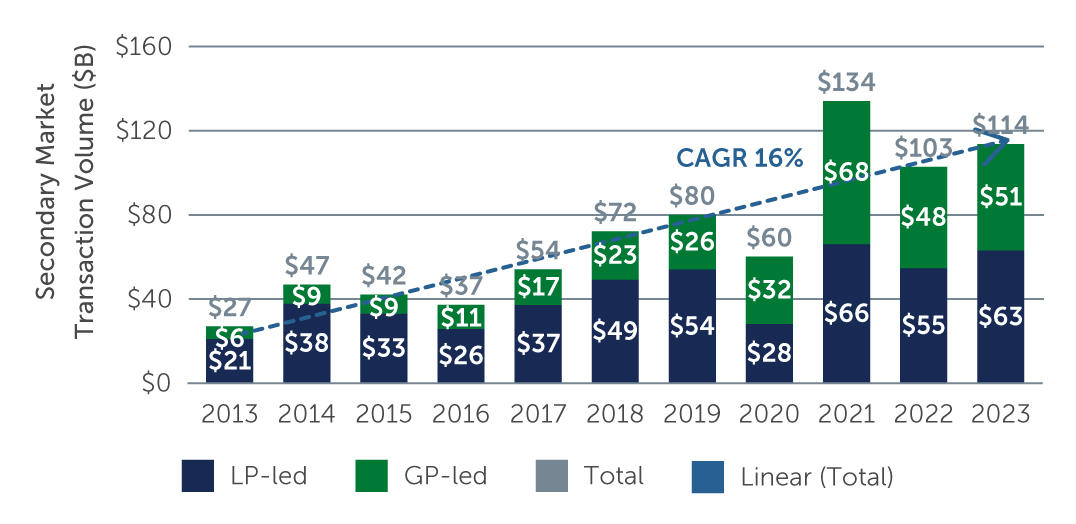

Figure 1: Robust Secondary Volume Growth Over the Years

Source: Evercore. As of July 2024.

Source: Evercore. As of July 2024.