Emerging Markets Debt: Cautiously Optimistic

Buoyed by a drop in 10-year Treasury yields, moderating inflation, and an economy that continues to chug along, emerging markets debt has entered 2024 on an upbeat note.

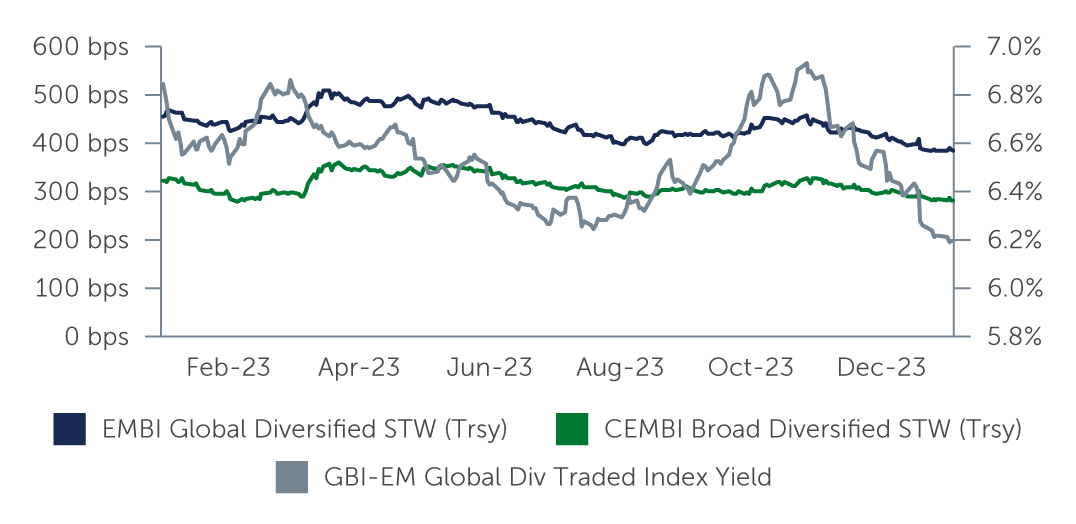

In contrast to ongoing weakness in China and Europe, the surprising strength of the U.S. economy—as well as indications that the U.S. Federal Reserve has halted its rate-hiking cycle and may start cutting soon—has served as solid support for emerging markets (EM) debt. While the optimism with which the asset class greeted the Fed’s December pivot may have been somewhat excessive in terms of the level of spread tightening, the combination of resilient growth and lower rates should provide a supportive backdrop going forward. Potential challenges lie ahead, to be sure, but overall, we believe there are reasons for cautious optimism.

Figure 1: EM Spreads Are Tighter Across the Board

Source: J.P. Morgan. As of December 31, 2023.

Source: J.P. Morgan. As of December 31, 2023.

Sovereign & Local Debt: A Better Technical Backdrop

While uncertainty and headwinds remain on the horizon, the overall picture for sovereign hard currency debt looks promising. There is growing confidence that inflation is coming down, which—combined with the sharp decrease in what looks likely to be a less volatile riskless rate—brings confidence to the market. The probability of a severe recession also remains low, which should provide further support to credit even if growth turns out to be less vibrant than hoped. Also on the positive side, earlier concerns over refinancings against a backdrop of higher rates at this point seem overwrought. The debt that was repriced in 2023 at more costly levels represented just a small fraction of the total market, which will likely be the case again in 2024, even if refinancings rise. The total amount of new sovereign issuance has also decreased. In 2022 and 2023, new issuance reached roughly $238 billion, compared to $418 billion in the two years prior.1 Further, many sovereigns continue to finance themselves domestically, and since domestic rates and inflation are coming down, the risk of default is likely to decrease as well.

From an opportunity standpoint, we see value in a few distinct areas. One is in investment grade sovereigns with strong fundamentals, particularly BBB countries, which continue to look well-positioned. In the high yield space, there are select opportunities in BB issuers that have been trending positively and should be able to access the market to refinance—and where we continue to see a healthy overcompensation for default risk. Serbia, Oman and Morocco are examples. Issuers rated single-B and below warrant a more cautious, case-by-case approach, although we remain positive on Sri Lanka as the country is still trending in the right direction while in the process of restructuring its debt.

From a local debt perspective, we are slightly less constructive on local interest rates versus a few months ago given that inflation has come down in many countries, limiting the potential for further central bank rate cuts. That said, we continue to see value in countries like Korea, Peru and the Czech Republic. Local currencies look slightly better positioned given the prospect of lower interest rates in the U.S. and a potentially weakening dollar. While currency reserves tend to be volatile, they have held up well according to recent data, with the Australian Dollar, Brazilian Real, Mexican Peso and Hungarian Forint looking particularly attractive, in our view.

Corporate Debt: Compelling Value in IG

With spreads having tightened substantially throughout the fourth quarter, the path of least resistance in 2024 is for spreads to go slightly wider, which is good reason to stay somewhat defensive. That said, if fund flows and cash return to the asset class, EM corporates may return to favor and spreads could remain more rangebound.

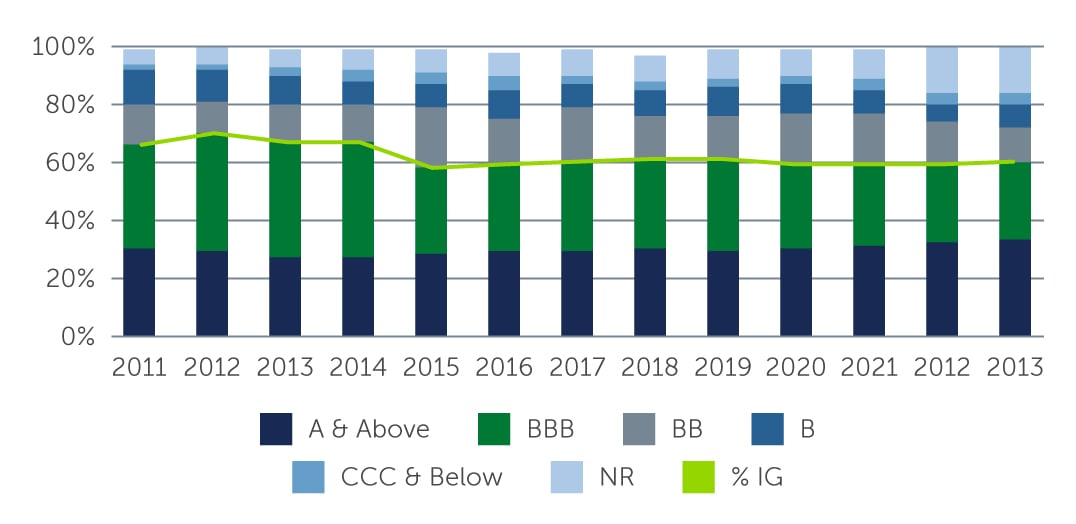

Looking at the market today, we see particular value in investment grade (IG) corporate debt. Roughly 60% of EM corporate issuers are rated investment grade (IG), which is counter to the widespread and incorrect assumption that the asset class is composed primarily of small companies in esoteric countries. IG-rated companies in the EM universe constitute a $1.5 trillion opportunity, and about 62% of them are quasi-sovereigns that are either directly or indirectly controlled by governments.2 These issuers often fulfill policy functions and are concentrated in financials, oil and gas, utilities and infrastructure. Many predominately sell into or operate in developed market (DM) economies.

Figure 2: EM Corporate Bond Stock by Rating Bucket

Source: J.P Morgan; Bloomberg Finance LP; Bond Radar. As of November 2023.

Source: J.P Morgan; Bloomberg Finance LP; Bond Radar. As of November 2023.

These companies are also fundamentally sound, with the average EM IG company operating with just one turn of leverage, which is relatively conservative even compared to similarly rated DM peers.3 Also on the positive side, corporate profits, in the form of EBITDA, moderated in the third quarter of 2023 after declining for the prior three quarters. While leverage increased modestly in 2023, it remains in good shape for the most part and is well-below prior peaks.

These solid fundamental trends are translating into global EM corporate default rate expectations of a normalized 4% rate.4 Looking at the year ahead, larger IG-rated companies with strong market share, scale, healthy balance sheets, and pricing power look particularly well-positioned.

Political Risk at the Forefront

While the backdrop for EM debt looks promising, there are a number of risks on the horizon that could introduce volatility going forward—and with more than half of the world headed to the polls in 2024, politics is chief among them. Somewhat ironically, the election that could cause the biggest disruption in emerging markets is the U.S. presidential election. Aside from the potential volatility in the lead-up to November, a scenario in which former President Donald Trump returns to office, for instance, could call into question a number of major international policies.

Aside from elections, there are continued unknowns around China, where the government’s seeming move to more of an inward focus in addressing its economic stresses has changed the calculus for many EM countries. Escalating tensions in the Middle East and climate changes with the potential to upend global food supplies are further factors to watch. Against this backdrop, extensive credit-by-credit analysis and rigorous, bottom-up credit and country selection are critical to not only to managing risks, but also identifying issuers that are better-positioned to navigate the coming months.

1. Source: Bank of America. As of December 31, 2023.

2. Source: J.P Morgan; Bloomberg Finance LP; Bond Radar. As of November 2023.

3. Source: J.P. Morgan. As of November 2023.

4. Source: J.P. Morgan. As of November 2023.