Emerging European Equities: Key Areas of Opportunity

From a more constructive outlook, to structural growth trends, to attractive valuations, there are a number of factors converging to create compelling opportunities in Emerging European equities.

Emerging European markets have faced a myriad of challenges recently—from Russia’s invasion of Ukraine, to the broader global headwinds of inflation and rising interest rates. This resulted in heightened volatility and, at times, lead to significant selloffs across the region’s equity markets.

Despite the broader challenges, it appears that a number of factors are converging across Emerging Europe to create unique investment opportunities today. For instance, the economic outlook in Europe is more constructive than was feared 18 months ago, helped by the significant easing of energy prices, while growth rates for Emerging European countries look attractive relative to the broader Euro area. At the same time, there are several long-term structural growth trends providing support to the region. This backdrop, in combination with attractive current valuations, is presenting a compelling opportunity in Emerging European equities.

Country-specific Factors Provide Long-Term Support

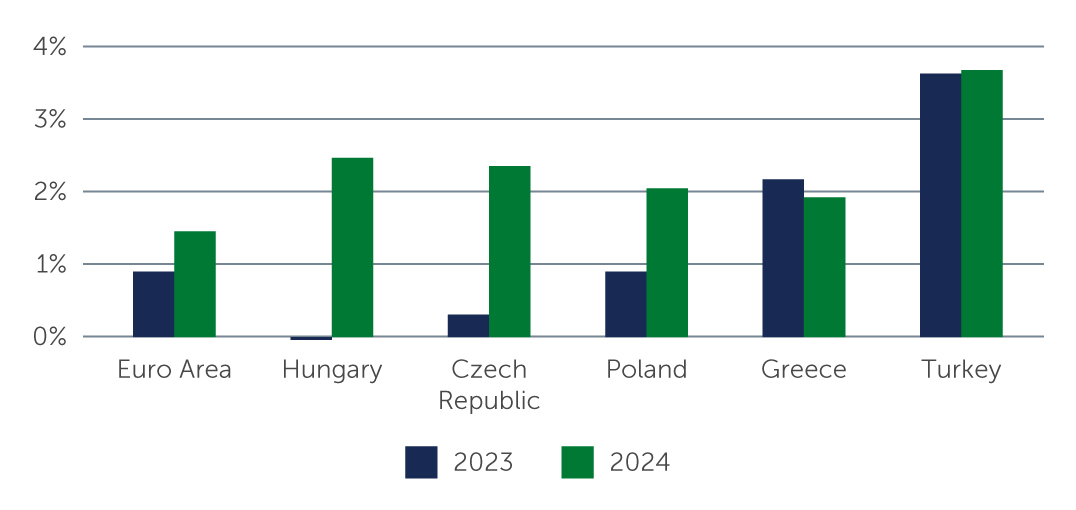

Emerging European countries are forecast to grow between 2%–4% in 2024, outpacing that of the broader Euro area (Figure 1). These robust economic growth forecasts should be underpinned by rising incomes and consumption trends, which in turn are likely to be reflected in improving corporate earnings—and subsequently an increase in investor confidence in the region. These encouraging macroeconomic trends are supported by a number of compelling country-specific factors that we believe contribute to the long-term appeal of the region.

Figure 1: Emerging Europe Growth Likely to Outpace Euro Area

Source: OECD. As of June 2023.

Source: OECD. As of June 2023.