High Yield: A Compelling Risk-Reward Picture for Long-term Investors

Markets will likely remain on edge in anticipation of a central bank policy pivot, but high yield continues to present compelling total return opportunities for investors willing to ride out the volatility.

The elusive central bank policy pivot is the latest factor, in a long list, adding uncertainty to financial markets. Indeed, while markets rallied late last year in response to better-than-expected U.S. CPI data—suggesting moderating inflation could lead to a less hawkish policy pivot—the momentum quickly came to a halt as the U.S. Federal Reserve indicated further rate hikes are still very much in the cards. The European Central Bank, too, has maintained a more hawkish stance than expected.

While a policy pivot seems unlikely in the near term given that inflation remains near decade-high levels—even if it is moderating—the uncertainty will likely drive further volatility across markets going forward. That said, for investors willing to ride out the volatility and take a long-term approach, high yield bonds and loans continue to present compelling total return opportunities.

Earnings in Focus

If 2022 was the year of interest rate volatility, corporate earnings will likely take center stage in 2023. As inflation climbed last year, many companies maintained enough pricing power to pass higher costs through to their customers; earnings, as a result, remained more durable than some market participants were expecting. Looking across the high yield universe today, the picture seems to be darkening. For one, the lagging effect of 2022’s rate hikes has started to stress parts of the economy and is beginning to impact aggregate demand. Compounded by still-elevated labor costs, the ability of companies to pass through higher prices is starting to deteriorate, which will likely lead to some contraction in earnings going forward—and in some cases, potentially significant misses in headline earnings, which could drive volatility higher.

The technical picture has also remained challenging for high yield, particular loans, against a backdrop of more challenging liquidity and retail outflows in the U.S. Compounding this, there has been a continued lack of new collateralized loan obligation (CLO) issuance, which has historically accounted for a large portion of loan demand.

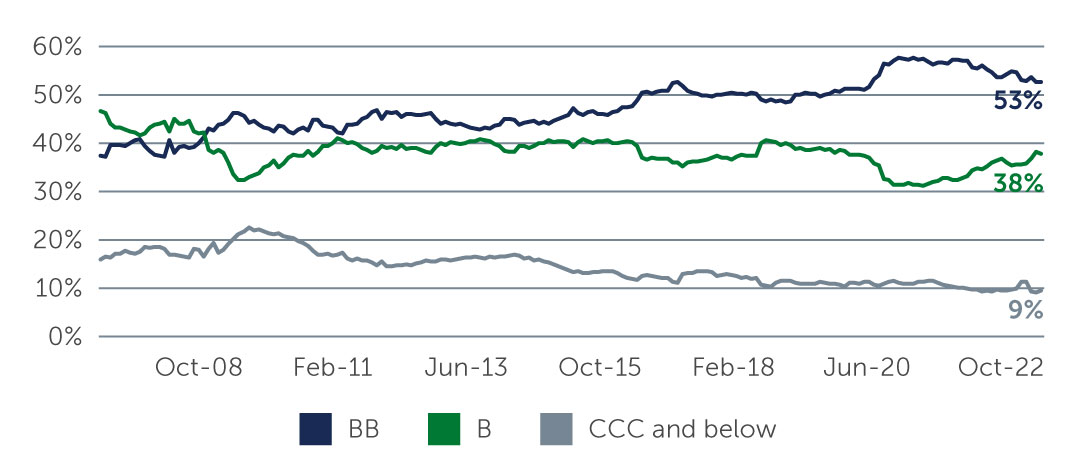

On the positive side, most high yield issuers still have the flexibility to continue to service their debt through a period of economic weakness, and remain in a stronger financial position today than they would have been before the pandemic. For instance, corporate leverage across U.S. high yield companies fell to 3.4x in the third quarter, which is the lowest level since the fourth quarter of 2019, while leverage across European companies fell to 5.2x in the second quarter.1 At the same time, the credit quality of the high yield market has improved considerably over the past 15 years—BB issuers comprise 53% of the market, while single-B companies make up 38% (Figure 1).

Figure 1: A Higher-quality High Yield Market

Source: Bank of America. As of December 31, 2022.

Source: Bank of America. As of December 31, 2022.

Attractive Total Return Potential

While the difficult macroeconomic environment is unlikely to fade anytime soon, it is also worth noting that mild recessions have not necessarily been bad environments for high yield markets in the past. Investors who stayed invested in high yield through periods of volatility, and even economic decline, have historically been rewarded with attractive, long-term returns. This is partly because high yield, unlike equities, does not require strong economic growth to perform well. Rather, what matters more in high yield is an issuer’s ability to continue to meet the interest payments on its outstanding debt obligations. Slow GDP growth, or even a short period of mildly negative growth, is unlikely to drive significant increase in defaults—particularly across a higher-quality market with solid underlying fundamentals.

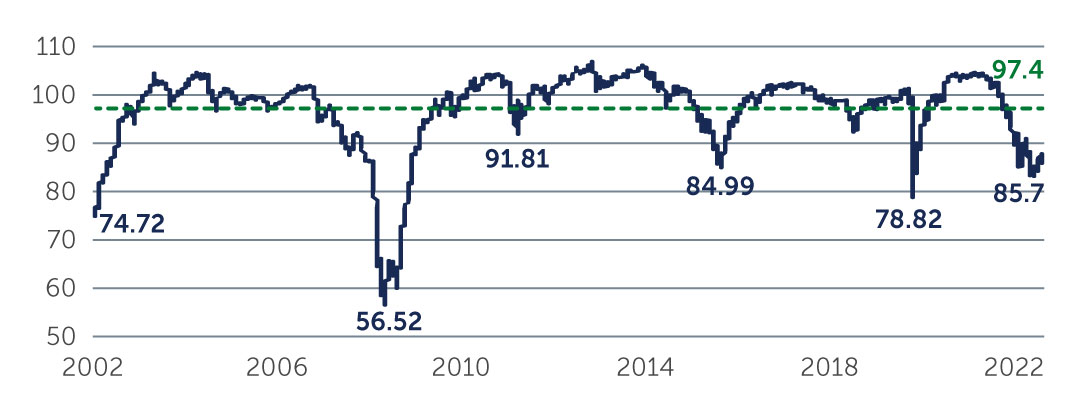

In the event of a recession, the potential downside in credit is also likely to be more limited given how challenging 2022 was for most financial markets. While spreads would likely experience some widening from current levels, we do not expect material widening to the extent that total returns would turn negative. This is partly a result of the combination of higher yields in response to rising rates, and materially discounted prices. For instance, high-quality BB bonds in the U.S. and Europe have traded at a discount to par, at roughly 89 and 87, respectively, with an average duration of slightly less than four years—and are currently yielding 6.5%–7.5%.2 At these levels, spreads would need to widen far beyond where they are today—to levels comparable to the sovereign debt crisis and Eurozone collapse—for total returns to turn negative. And again, given the higher quality of the market and solid fundamental backdrop, we believe such an extreme scenario is unlikely.

Figure 2: Average High Yield Index Price Versus History

Source: Bank of America. As of December 31, 2022.

Source: Bank of America. As of December 31, 2022.

We also hold a slight bias for credits in the U.S. market versus Europe. From the ongoing war in Ukraine to the softness in the housing market, risks are more elevated in Europe than in the U.S., which could result in a greater impact on consumer sentiment and spending and therefore a more severe or prolonged recession.

Focusing on the Long Term

Looking ahead, a potential recession, ongoing inflationary pressures, hawkish central banks policy and earnings volatility will certainly remain front and center. In this environment, and with markets likely to remain volatile in the coming months, investors do not need to take on excessive risk to earn potentially attractive returns. In higher-rated parts of the bond and loan universe, as well as in certain parts of the CLO market, the risk-reward picture remains compelling. However, a credit-intensive approach is crucial—to not only avoiding additional downside, but also identifying issuers that can withstand today’s headwinds.

1. Source: J.P. Morgan. U.S. data as of September 30, 2022; European data as of June 30, 2022.

2. Source: Bank of America. As of December 31, 2022.

23-2681051