EM Debt: Bright Spots Exist, But Caution is Key

With growing uncertainty about the direction of the global economy, as well as the trajectories of rates, inflation, and currencies, caution and selectivity in EM debt are as important as ever.

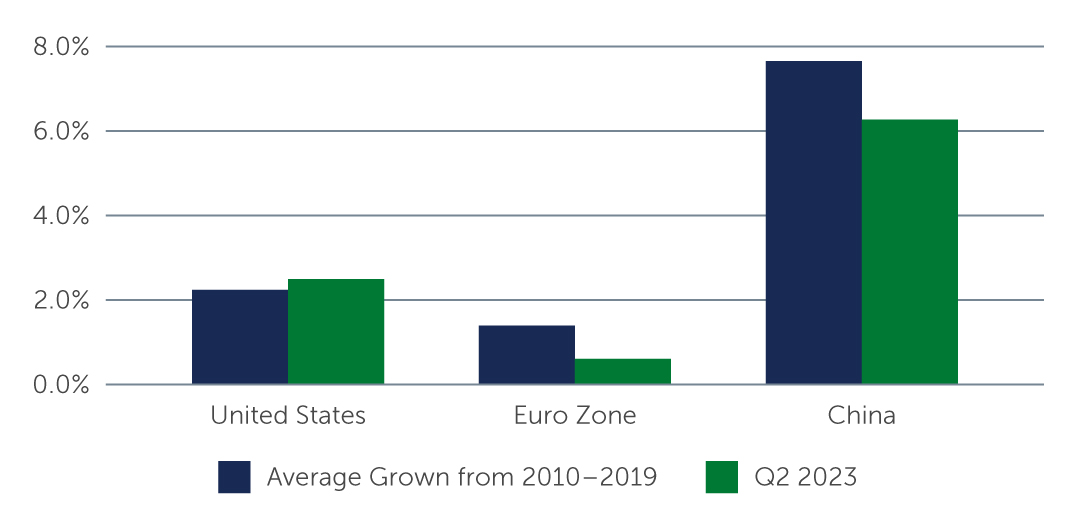

A number of economic developments have affected the performance of emerging markets (EM) thus far in 2023. On the positive side, the U.S. economy has been more resilient than anticipated. With an unexpected increase in the U.S. budget deficit, increase in investment across the country, and still-healthy corporate balance sheets and consumption levels, annual U.S. economic growth was higher than expected at 2.1% (Figure 1). Another surprising development has been a faster-than-expected moderation in global inflation, especially in many EM nations—falling below that of many developed nations.

However, uncertainties and headwinds remain on the horizon. In particular, we are closely monitoring developments in Israel and Gaza, and the potential impact they may have on EM countries and corporates, as well as commodity markets like oil. In addition to the obvious and tragic humanitarian impact, we expect these developments will drive further investor caution and a risk-off mentality toward EM assets in the short to medium term. In addition, if developed market inflation unexpectedly accelerates, there is potential for further tightening from the U.S. Federal Reserve (Fed). These factors are setting the stage for future challenges in EM sovereign, local, and corporate debt.

Figure 1: Above Average U.S. GDP Growth Surprises

Source: OECD. As of August 31, 2023.

Source: OECD. As of August 31, 2023.

Sovereign & Local Debt: An Unusual Rate Dynamic

Against this shifting backdrop, the picture for EM sovereigns remains nuanced. While EM inflation is indeed trending down, rising commodity prices, particularly for oil, food, and key industrial metals, could pose challenges for certain countries. In addition, continued strength in the U.S. economy and the U.S. dollar, along with a higher-for-longer interest rate environment, could raise financing costs—and therefore refinancing risks—for certain countries.

Interestingly, the local yield curve in many emerging markets—including the Czech Republic, Israel, Korea, Malaysia, and Thailand—now sits below that of the U.S. across the entire curve. This dynamic is highly unusual and highlights the fact that economic cycles and inflation dynamics are different in different countries. In particular, a number of EM countries are now experiencing declining inflation, which in some cases is allowing central banks to cut rates. This has led us to be more constructive on local interest rates, specifically in countries like Korea, Peru and the Czech Republic. However, if the U.S. economy remains strong, particularly in the face of weakness in China and Europe, EM currencies are likely to feel headwinds, which could in turn limit further rate cutting.

From a sovereign hard currency perspective, there are a number of idiosyncratic risks facing the market, from rising geopolitical risks, to political uncertainty in Mexico, to the impact of higher oil prices on oil-importing EM nations. Amid the heightened uncertainty, we believe a selective and cautious approach is crucial. Overall, investment grade sovereigns with strong fundamentals look better positioned in the space. More specifically, BBB sovereigns continue to have market access and can bear potentially higher borrowing costs. In the high yield space, there are select BB issuers that have been trending positively and will likely also be able to access the market to refinance, but issuers rated B and below are likely to find the going more difficult.

Corporate Debt: Healthy Fundamentals, Challenging Technicals

While there are reasons for caution going forward—from the impact of more expensive and tighter credit, to higher commodity costs and higher prices from a climate impact, to potentially slower growth—EM corporate balance sheets largely remain resilient, and most companies have been able to continue accessing the market. In the cases where they haven’t been able to, the private credit market has been stepping in as an alternative source of funding. These factors are playing a key role in maintaining the low default environment, suggesting the key drivers for the asset class currently are broader macroeconomic concerns and weak technicals.

In particular, as money market funds and short-term U.S. Treasuries offer attractive and virtually risk-free returns, EM corporate credit has struggled to attract flows. Sales of holdings by exchange-traded funds have put additional technical pressure on the asset class. In addition, ongoing concerns around China are weighing on the market. China’s economy continues to be dampened by ongoing problems in its real estate sector, which accounts for nearly 40% of all EM corporate high yield debt defaults this year.1 Various policy tweaks undertaken by the government so far have struggled to reignite consumer confidence sufficiently, making further downward spiraling more of a possibility.

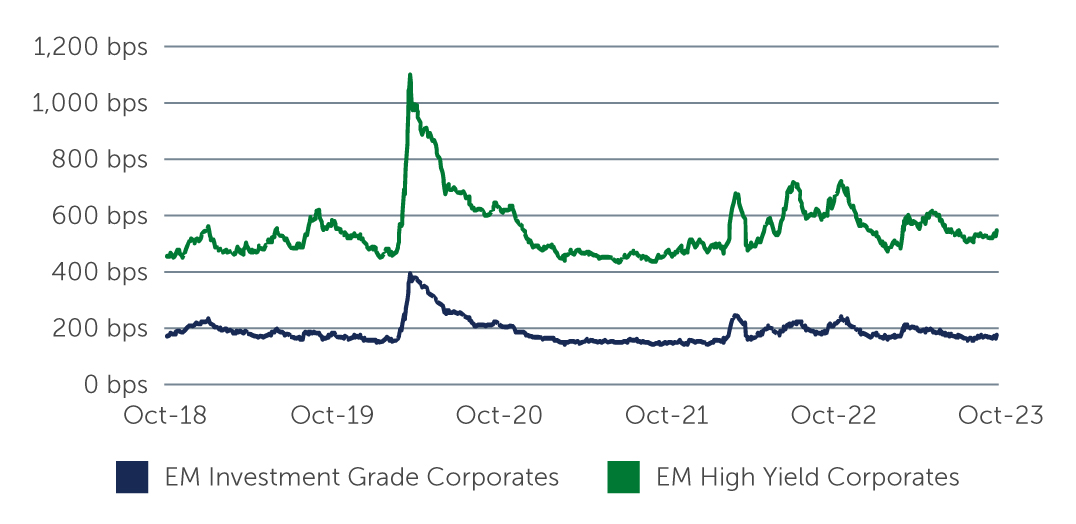

In the current environment, higher-quality investment grade debt looks better positioned due to inherent buffers in companies’ business models and balance sheets. In our view, shorter duration 1-3 year investment grade debt offers attractive carry at minimal duration and credit risk. Yield-based investors looking for duration may find current entry points appealing. However, we believe caution is warranted for lower-rated issuers. This is reflected in the spread basis between investment grade and high yield EM corporates, as the stronger demand for investment grade corporates and reduced appetite for high yield issuers has resulted in the spread differential widening to roughly 390 basis points (bps) during the summer (Figure 2). This compares to the five-year historical average of 363 bps.

Figure 2: EM Corporates IG vs. HY Spread Differential

Source: J.P. Morgan. As of October 5, 2023.

Source: J.P. Morgan. As of October 5, 2023.

Looking across the market, corporates in the Gulf Cooperation Council (GCC) region and in Brazil are in relatively good shape from a fundamental perspective. In the case of Brazil, geopolitical risk in the country is relatively low, however, companies in GCC countries may be vulnerable to contagion risk from the current geopolitical events in Israel and Gaza. In India, tailwinds from an economy that is expected to grow by more than 6% this year are creating favorable conditions for local companies. Meanwhile, Turkey’s long-struggling economy may be turning a corner if its new economics and finance team truly has the latitude to institute orthodox policies and reforms, which will be helpful for the nation’s many well-run companies.

In terms of sectors, we see attractive thematic opportunities in corporates with exposure to the energy transition and the renewable power sector, as well as low-cost, high-quality commodity producers that will benefit from elevated commodity prices. On the other hand, we are cautious on banks generally, especially given the Fed rhetoric around interest rates staying higher for longer and the potential impact of unrealized losses on banks’ investment holdings—similar to what we witnessed earlier in the year with U.S. banks. Within the financial sector, we remain cautious on Turkish banks—until the effects of rising rates in Turkey are more evident—while Mexican banks have demonstrated resilience with some of the strongest capital ratios in the asset class.

Risks Abound, But Bright Spots Ahead

Looking ahead, risks abound in the form of heightened geopolitical tensions, uncertainty over Fed policy, emerging drivers of inflation, and growing political uncertainty. But it is worth noting that these headwinds are mainly macro-driven, rather than credit risks or default concerns for EM sovereigns and corporates. In particular, EM credit continues to benefit from relatively healthy fundamentals, especially for higher-quality issuers.

For investors, this means the guiding principles of selectivity and staying nimble remain paramount. Active management and rigorous, bottom-up credit and country selection, as always, remain the path to managing risks and identifying issuers that are better-positioned to navigate an uncertain environment.

1. Source: J.P. Morgan. As of August 31, 2023.